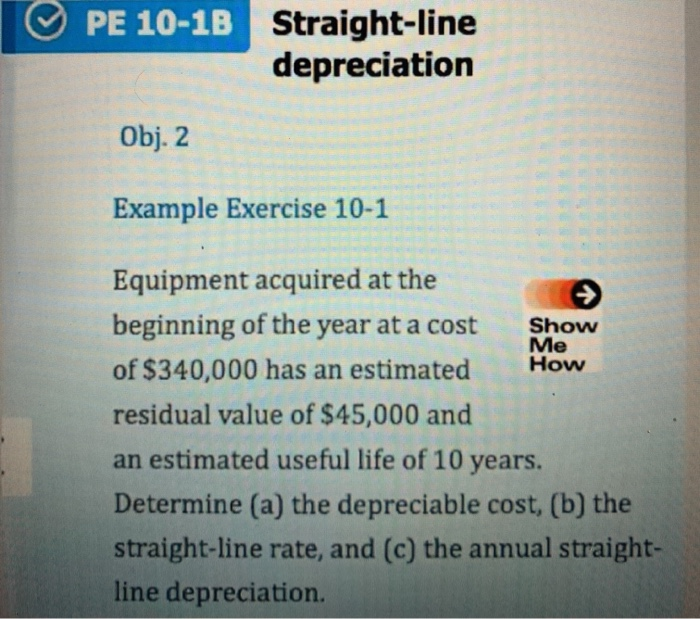

Question: PE 10-1B Straight-line depreciation Obj. 2 Example Exercise 10-1 Show Me How Equipment acquired at the beginning of the year at a cost of $340,000

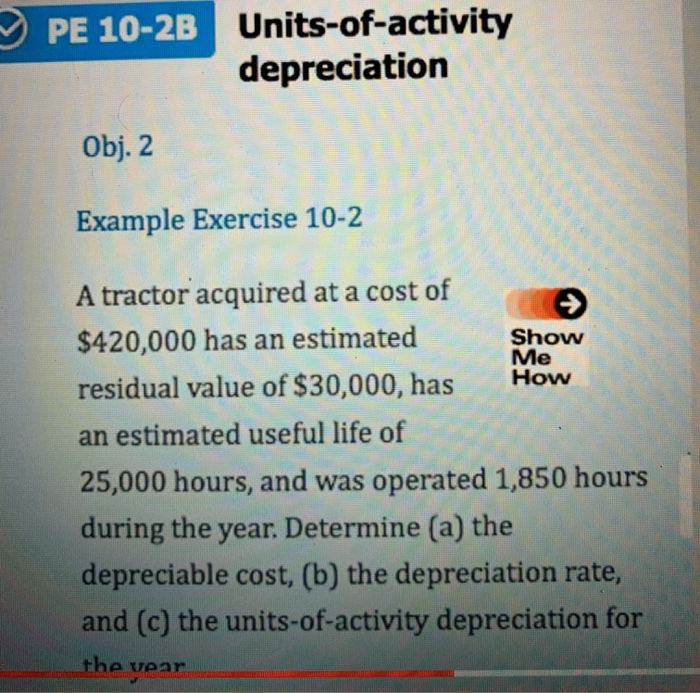

PE 10-1B Straight-line depreciation Obj. 2 Example Exercise 10-1 Show Me How Equipment acquired at the beginning of the year at a cost of $340,000 has an estimated residual value of $45,000 and an estimated useful life of 10 years. Determine (a) the depreciable cost, (b) the straight-line rate, and (c) the annual straight- line depreciation. PE 10-2B Units-of-activity depreciation Obj. 2 Example Exercise 10-2 Me A tractor acquired at a cost of $420,000 has an estimated Show residual value of $30,000, has How an estimated useful life of 25,000 hours, and was operated 1,850 hours during the year. Determine (a) the depreciable cost, (b) the depreciation rate, and (c) the units-of-activity depreciation for the vear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts