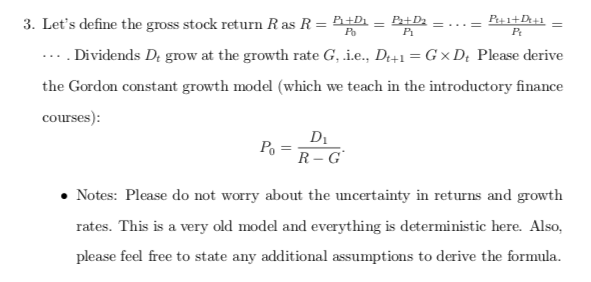

Question: PE 1+1 P: P. 3. Let's define the gross stock return Ras R = + = BED2 ... Dividends Du grow at the growth rate

PE 1+1 P: P. 3. Let's define the gross stock return Ras R = + = BED2 ... Dividends Du grow at the growth rate G, i.e., De+1 = GXDPlease derive the Gordon constant growth model (which we teach in the introductory finance courses): P. R-G D Notes: Please do not worry about the uncertainty in returns and growth rates. This is a very old model and everything is deterministic here. Also, please feel free to state any additional assumptions to derive the formula

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock