Question: PE 16-4A Cash flows from operating activities-indirect method OBJ. 2 Demers Inc. reported the following data: Net income $490,000 Depreciation expense 52,000 Gain on disposal

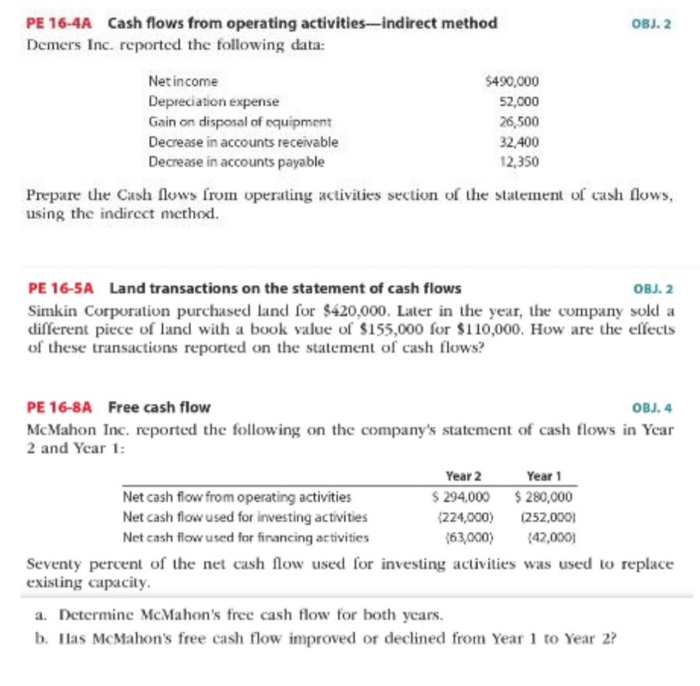

PE 16-4A Cash flows from operating activities-indirect method OBJ. 2 Demers Inc. reported the following data: Net income $490,000 Depreciation expense 52,000 Gain on disposal of equipment 26,500 Decrease in accounts receivable 32,400 Decrease in accounts payable 12,350 Prepare the cash flows from operating activities section of the statement of cash flows, using the indirect method. PE 16-5A Land transactions on the statement of cash flows OBJ. 2 Simkin Corporation purchased land for $420,000. Later in the year, the company sok a different piece of land with a book value of $155,000 for $110,000. How are the effects of these transactions reported on the statement of cash flows? PE 16-8A Free cash flow OBJ. 4 McMahon Inc. reported the following on the company's statement of cash flows in Year 2 and Year 1: Year 2 Year 1 Net cash flow from operating activities $ 294,000 $ 280,000 Net cash flow used for investing activities (224,000) (252,000) Net cash flow used for financing activities (63000) (42,000) Seventy percent of the net cash flow used for investing activities was used to replace existing capacity 1. Determine McMahon's free cash flow for both years. b. llas McMahon's free cash flow improved or declined from Year 1 to Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts