Question: n TOYTEK Inc. is a toy manufacturing and distribution company for children of all ages. Searching for a viable business opportunity, the company is currently

n

n

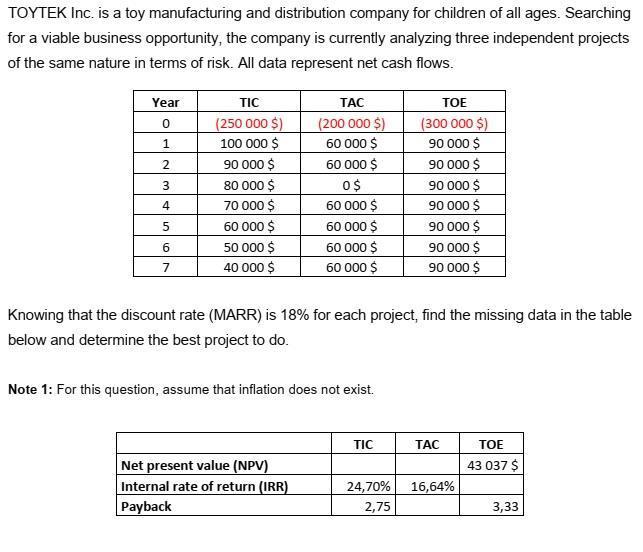

TOYTEK Inc. is a toy manufacturing and distribution company for children of all ages. Searching for a viable business opportunity, the company is currently analyzing three independent projects of the same nature in terms of risk. All data represent net cash flows. Year 0 1 2 3 4 5 6 7 TIC (250 000 $) 100 000 $ 90 000 $ 80 000 $ 70 000 $ 60 000 $ 50 000 $ 40 000 $ TAC (200 000 $) 60 000 $ 60 000 $ 0$ 60 000 $ Net present value (NPV) Internal rate of return (IRR) Payback 60 000 $ 60 000 $ 60 000 $ Note 1: For this question, assume that inflation does not exist. Knowing that the discount rate (MARR) is 18% for each project, find the missing data in the table below and determine the best project to do. TIC TOE (300 000 $) 90 000 $ 90 000 $ 90 000 $ 90 000 $ 24,70% 2,75 90 000 $ 90 000 $ 90 000 $ TAC 16,64% TOE 43 037 $ 3,33

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

TIC Year Cash flow Discount Factor 18 Present Value 0 200000 1000 200000 1 60000 08475 50850 2 60000 ... View full answer

Get step-by-step solutions from verified subject matter experts