Question: Peanut's (PNT) key R&D faculty was destroyed in a Marvel Superhero rescue mission. As a result, its free cash flow (FCF) is expected to go

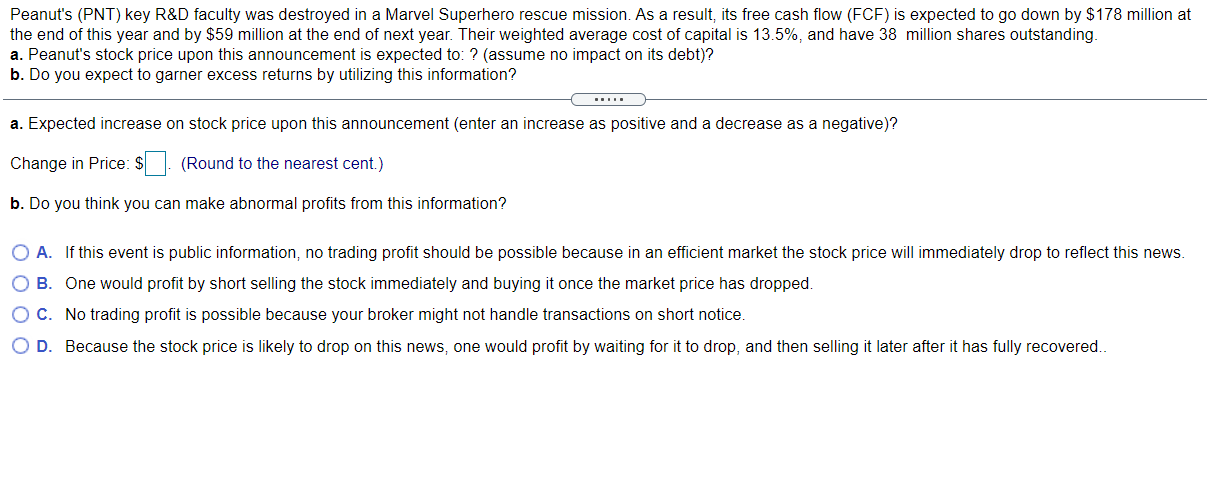

Peanut's (PNT) key R&D faculty was destroyed in a Marvel Superhero rescue mission. As a result, its free cash flow (FCF) is expected to go down by $178 million at the end of this year and by $59 million at the end of next year. Their weighted average cost of capital is 13.5%, and have 38 million shares outstanding. a. Peanut's stock price upon this announcement is expected to: ? (assume no impact on its debt)? b. Do you expect to garner excess returns by utilizing this information? a. Expected increase on stock price upon this announcement (enter an increase as positive and a decrease as a negative)? Change in Price: $. (Round to the nearest cent.) b. Do you think you can make abnormal profits from this information? O A. If this event is public information, no trading profit should be possible because in an efficient market the stock price will immediately drop to reflect this news OB. One would profit by short selling the stock immediately and buying it once the market price has dropped. O C. No trading profit is possible because your broker might not handle transactions on short notice. OD. Because the stock price is likely to drop on this news, one would profit by waiting for it to drop, and then selling it later after it has fully recovered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts