Question: Pear Orchards is evaluating a new project that will require equipment of $229,000. The equipment will be depreciated on a 5-year MACRS schedule. The annual

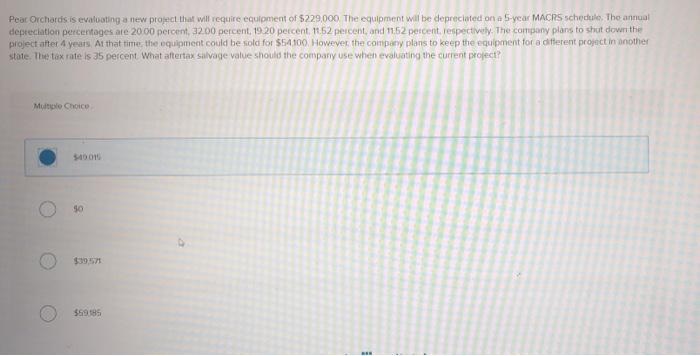

Pear Orchards is evaluating a new project that will require equipment of $229,000. The equipment will be depreciated on a 5-year MACRS schedule. The annual depreciation percentages ate 2000 percent, 3200 percent. 19.20 percent. 11.52 percent, and 1162 percent. Iespectively. The company plans to shut down the project after 4 yearsAt that time, the equipment could be sold for $54100 However the company plans to keep the equipment for a diterent project in another state. The tax rate is 35 percent What aftertax salvage value should the company use when evaluating the current project? Multiple Choice $10010 90 $59.185

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts