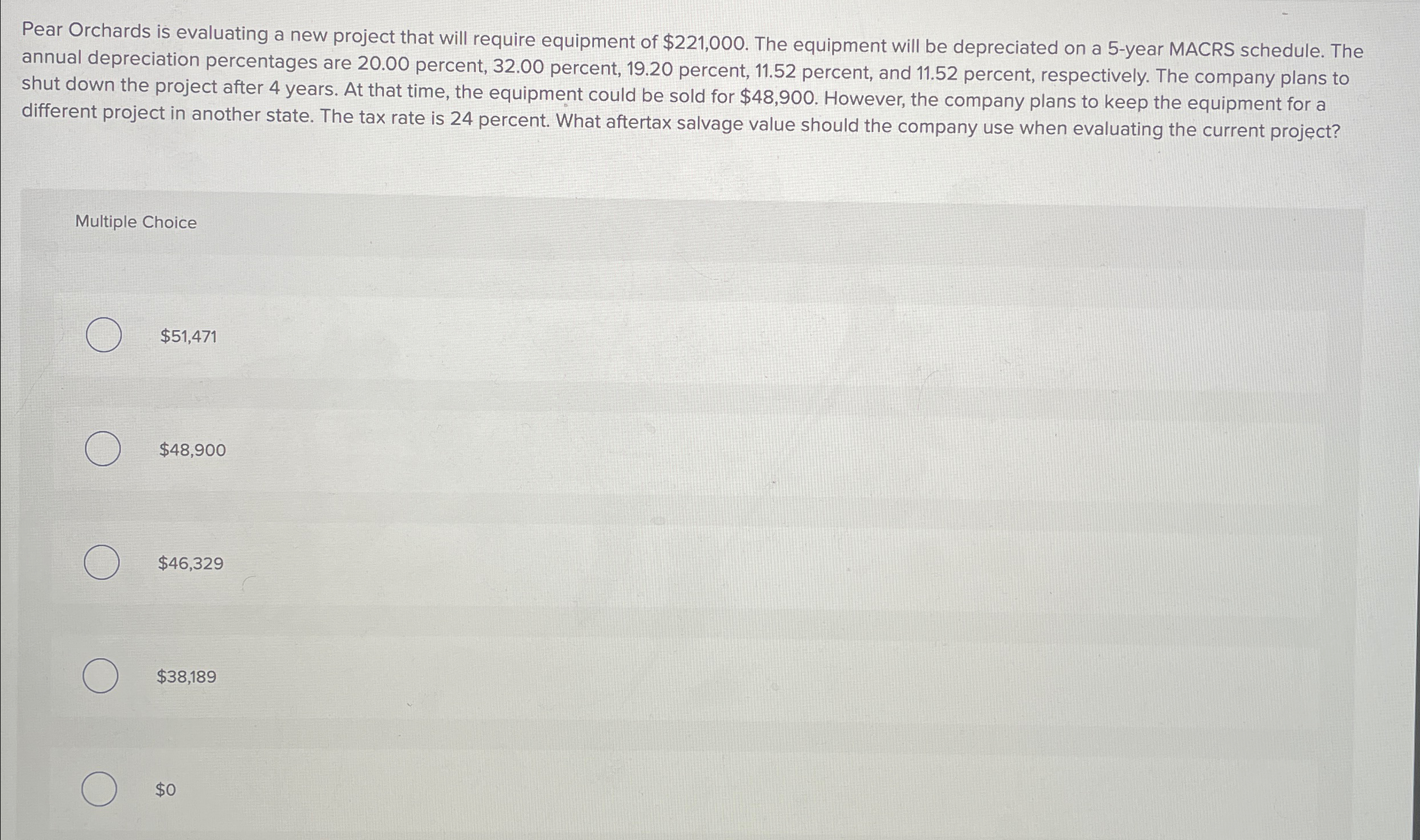

Question: Pear Orchards is evaluating a new project that will require equipment of $ 2 2 1 , 0 0 0 . The equipment will be

Pear Orchards is evaluating a new project that will require equipment of $ The equipment will be depreciated on a year MACRS schedule. The annual depreciation percentages are percent, percent, percent, percent, and percent, respectively. The company plans to shut down the project after years. At that time, the equipment could be sold for $ However, the company plans to keep the equipment for a different project in another state. The tax rate is percent. What aftertax salvage value should the company use when evaluating the current project?

Multiple Choice

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock