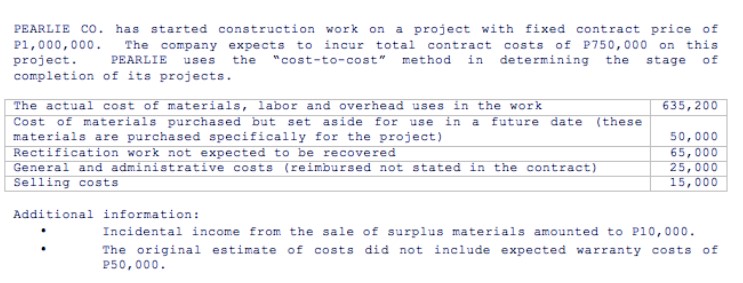

Question: PEARLIE CO. has started construction work on a project with fixed contract price of P1,000,000. The company expects to incur total contract costs of

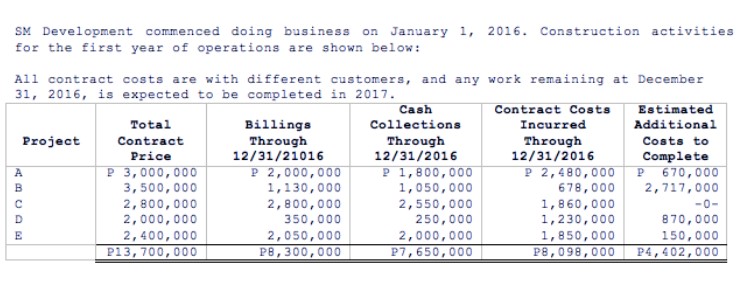

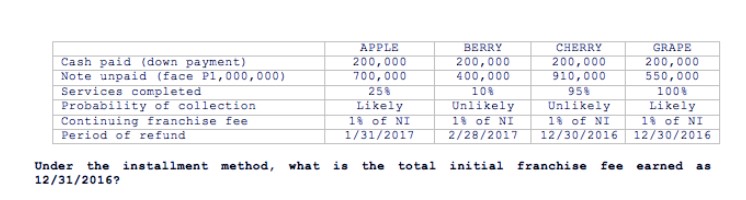

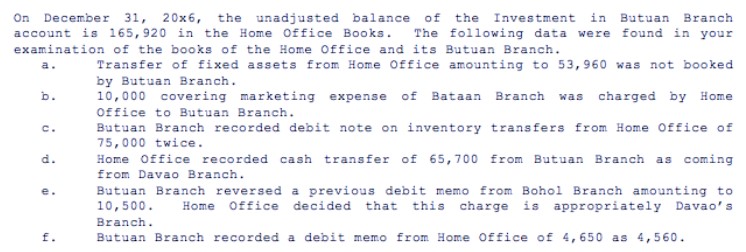

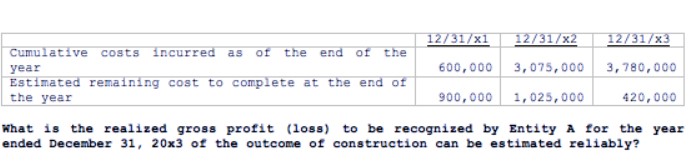

PEARLIE CO. has started construction work on a project with fixed contract price of P1,000,000. The company expects to incur total contract costs of P750,000 on this project. PEARLIE uses the "cost-to-cost" method in determining the stage of completion of its projects. The actual cost of materials, labor and overhead uses in the work 635,200 Cost of materials purchased but set aside for use in a future date (these materials are purchased specifically for the project) Rectification work not expected to be recovered 50,000 65,000 General and administrative costs (reimbursed not stated in the contract) Selling costs 25,000 15,000 Additional information: Incidental income from the sale of surplus materials amounted to P10,000. The original estimate of costs did not include expected warranty costs of P50,000. SM Development commenced doing business on January 1, 2016. Construction activities for the first year of operations are shown below: All contract costs are with different customers, and any work remaining at December 31, 2016, is expected to be completed in 2017. ABCD E Project Total Contract Price P 3,000,000 3,500,000 2,800,000 2,000,000 Billings Through 12/31/21016 P 2,000,000 1,130,000 2,800,000 350,000 2,050,000 2,400,000 P13,700,000 P8,300,000 Cash Collections Through 12/31/2016 P 1,800,000 1,050,000 2,550,000 250,000 2,000,000 P7,650,000 Contract Costs Incurred Through 12/31/2016 P 2,480,000 678,000 1,860,000 1,230,000 Estimated Additional Costs to Complete P 670,000 2,717,000 -0- 870,000 1,850,000 150,000 P8,098,000 P4,402,000 Cash paid (down payment) Note unpaid (face P1,000,000) Services completed Probability of collection APPLE 200,000 BERRY 200,000 CHERRY GRAPE 200,000 700,000 400,000 910,000 200,000 550,000 258 Likely 108 Unlikely 958 Unlikely Continuing franchise fee Period of refund 1% of NI 1/31/2017 18 of NI 2/28/2017 18 of NI 12/30/2016 Under 12/31/2016? the installment method, what is the total initial 100% Likely 1% of NI 12/30/2016 franchise fee earned as On December 31, 20x6, the unadjusted balance of the Investment in Butuan Branch account is 165,920 in the Home Office Books. The following data were found in your examination of the books of the Home Office and its Butuan Branch. a. b. C. d. e. f. Transfer of fixed assets from Home Office amounting to 53,960 was not booked by Butuan Branch. 10,000 covering marketing expense of Bataan Branch was charged by Home Office to Butuan Branch. Butuan Branch recorded debit note on inventory transfers from Home Office of 75,000 twice. Home Office recorded cash transfer of 65,700 from Butuan Branch as coming from Davao Branch. Butuan Branch reversed a previous debit memo from Bohol Branch amounting to 10,500. Home Office decided that this charge is appropriately Davao's Branch. Butuan Branch recorded a debit memo from Home Office of 4,650 as 4,560. 12/31/x1 12/31/x2 12/31/x3 Cumulative costs incurred as of the end of the year 600,000 3,075,000 3,780,000 Estimated remaining cost to complete at the end of the year 900,000 1,025,000 420,000 What is the realized gross profit (loss) to be recognized by Entity A for the year ended December 31, 20x3 of the outcome of construction can be estimated reliably?

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

To determine the stage of completion and the profit recognized for the project we need to calculate ... View full answer

Get step-by-step solutions from verified subject matter experts