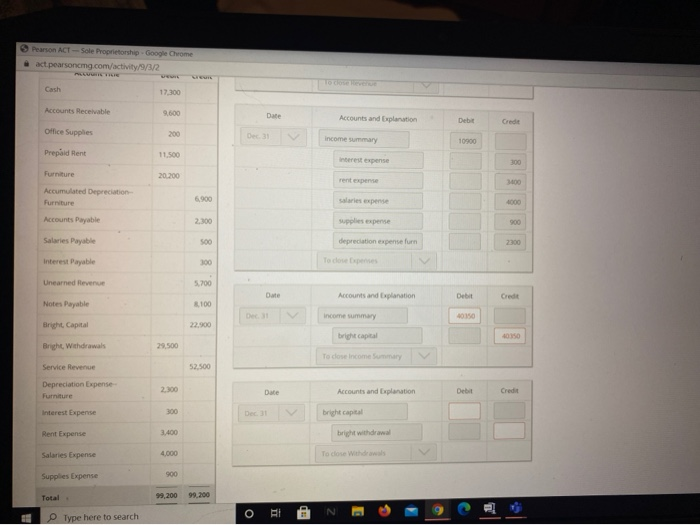

Question: Pearson ACT - Sole Proprietorship - Google Chrome act pearsoncmg.com/activity/9/3/2 PLUS Cash 17,300 Accounts Receivable 9.600 Date Accounts and Explanation Debe Crede Office Supplies 200

Pearson ACT - Sole Proprietorship - Google Chrome act pearsoncmg.com/activity/9/3/2 PLUS Cash 17,300 Accounts Receivable 9.600 Date Accounts and Explanation Debe Crede Office Supplies 200 income Summary 10900 Prepaid Rent 11.500 rest expense 300 Furniture 20.200 rent expense 3400 6.900 4000 Accumulated Depreciation Furniture Accounts Payable 2.300 supplies expense 900 Salaries Payable depreciation expense furn 2300 Interest Payable 300 Ta close Expenses Unearned Revenue 5.700 Date Accounts and Explanation Debat Crede Notes Payable 100 income summary 40150 Bright Capital 22.900 bright capital 40150 Bright Withdrawals 29.500 To dose Income Summary Service Revenue 52.500 Depreciation Expense- Furniture 2.300 Date Accounts and Explanation Debat Credit Interest Expense 300 bright capital Rent Expense 3.400 bright withdrawal Salaries Expense 4,000 To close Waldeawals. Supplies Expense 900 Total 99,200 99,200 Type here to search O RI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts