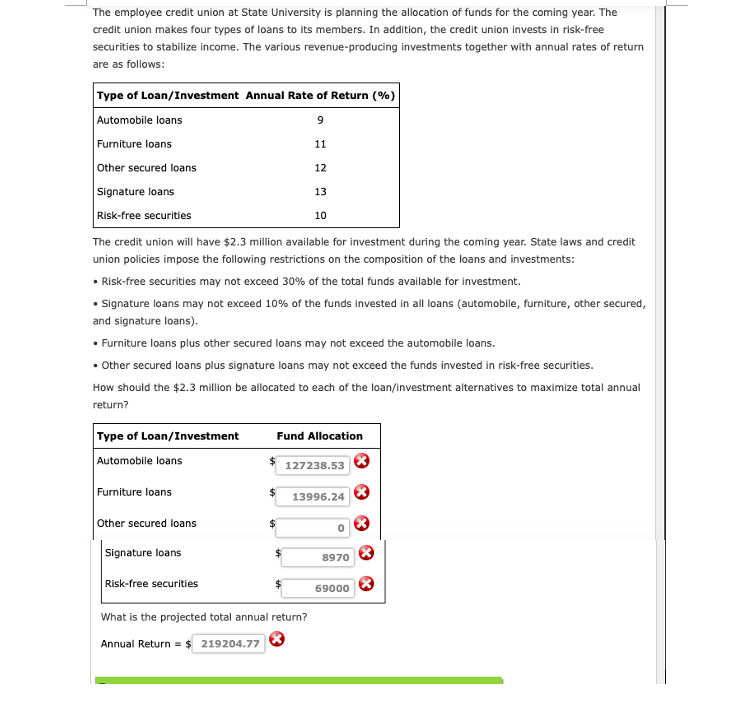

Question: Pease Provide excel formulas for the linear programming problem below for the solution. Thank you! The employee credit union at State University is planning the

Pease Provide excel formulas for the linear programming problem below for the solution. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts