Question: Peaton Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $26,000 per year and have

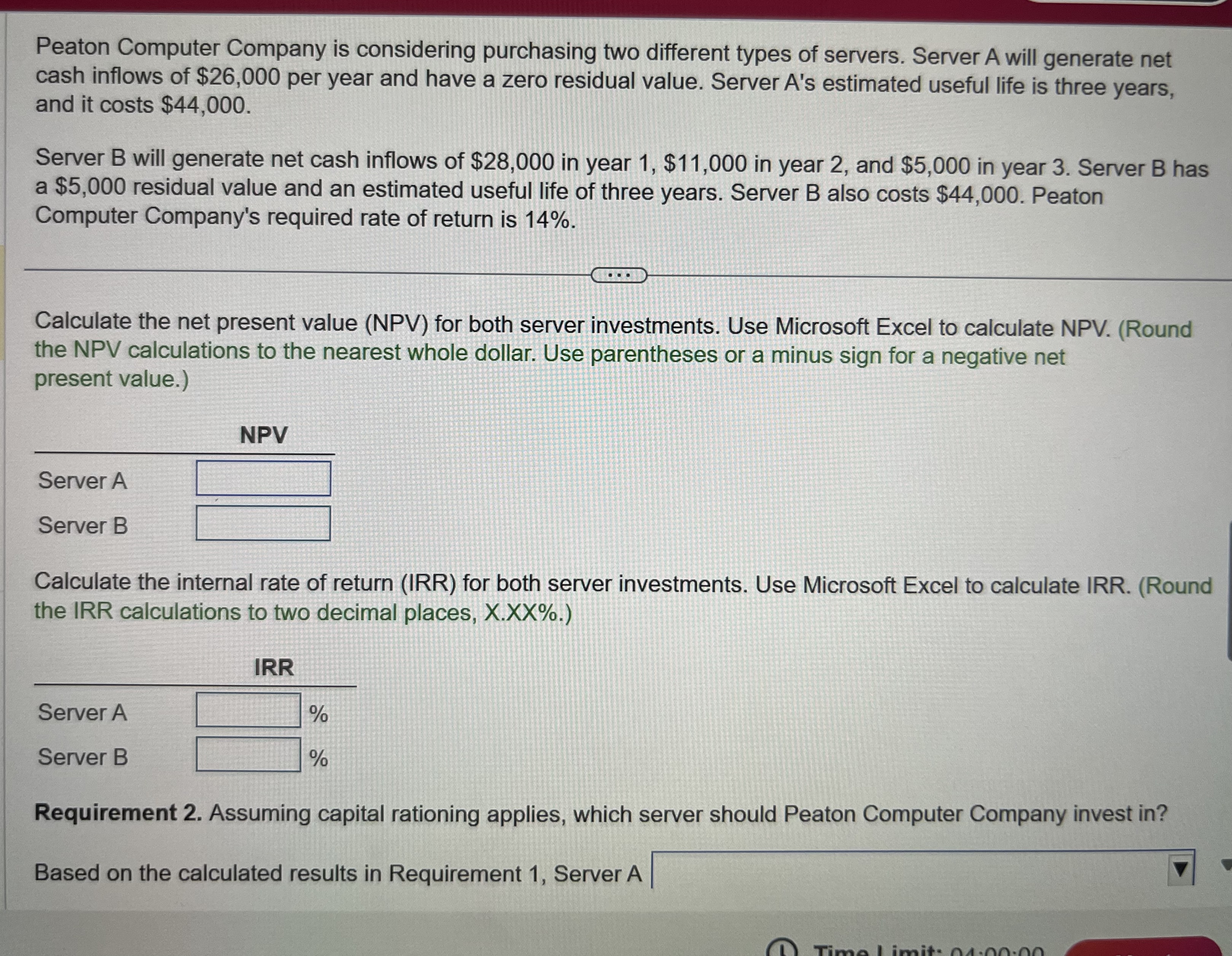

Peaton Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $26,000 per year and have a zero residual value. Server A's estimated useful life is three years, and it costs $44,000. Server B will generate net cash inflows of $28,000 in year 1, $11,000 in year 2, and $5,000 in year 3. Server B has a $5,000 residual value and an estimated useful life of three years. Server B also costs $44,000. Peaton Computer Company's required rate of return is 14%. Calculate the net present value (NPV) for both server investments. Use Microsoft Excel to calculate NPV. (Round the NPV calculations to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Server A Server B NPV Calculate the internal rate of return (IRR) for both server investments. Use Microsoft Excel to calculate IRR. (Round the IRR calculations to two decimal places, X.XX%.) Server A Server B IRR % % Requirement 2. Assuming capital rationing applies, which server should Peaton Computer Company invest in? Based on the calculated results in Requirement 1, Server A Time Limit: 04:00:00

Step by Step Solution

There are 3 Steps involved in it

Here are the calculations in Excel Server A NPV1444000260002600026000 NPV 12332 Server B NPV14440002... View full answer

Get step-by-step solutions from verified subject matter experts