Question: Peltech Limited (Peltech) is a technology company that develops, sells, repairs, and supports computers and related products and services. The board of directors unanimously

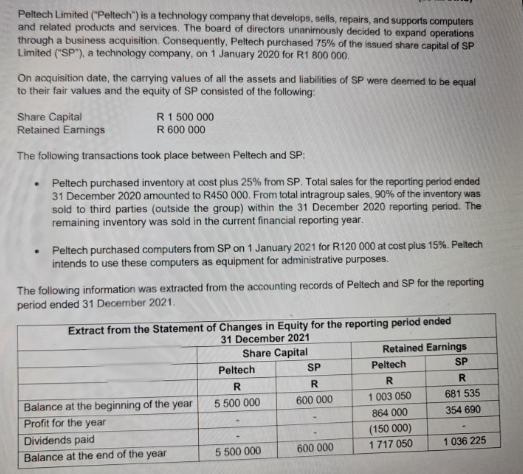

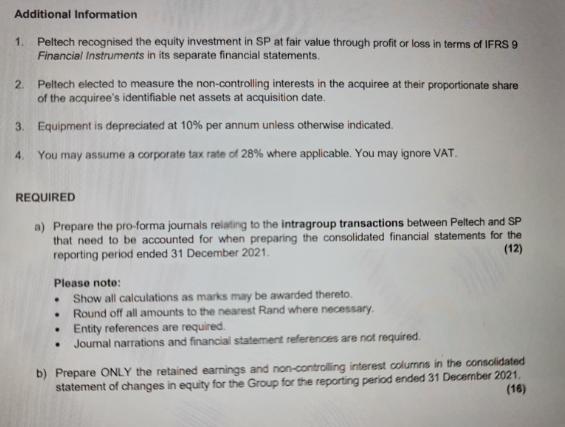

Peltech Limited ("Peltech") is a technology company that develops, sells, repairs, and supports computers and related products and services. The board of directors unanimously decided to expand operations through a business acquisition. Consequently, Peltech purchased 75% of the issued share capital of SP Limited ("SP"), a technology company, on 1 January 2020 for R1 800 000. On acquisition date, the carrying values of all the assets and liabilities of SP were deemed to be equal to their fair values and the equity of SP consisted of the following: R 1 500 000 R 600 000 The following transactions took place between Peltech and SP: Share Capital Retained Earnings Peltech purchased inventory at cost plus 25% from SP. Total sales for the reporting period ended 31 December 2020 amounted to R450 000. From total intragroup sales, 90% of the inventory was sold to third parties (outside the group) within the 31 December 2020 reporting period. The remaining inventory was sold in the current financial reporting year. Peltech purchased computers from SP on 1 January 2021 for R120 000 at cost plus 15%. Pellech intends to use these computers as equipment for administrative purposes. The following information was extracted from the accounting records of Peltech and SP for the reporting period ended 31 December 2021. Extract from the Statement of Changes in Equity for the reporting period ended 31 December 2021 Share Capital Balance at the beginning of the year Profit for the year Dividends paid Balance at the end of the year Peltech R 5 500 000 5 500 000 SP R 600 000 600 000 Retained Earnings SP R Peltech R 1 003 050 864 000 (150 000) 1717 050 681 535 354 690 1036 225 Additional Information 1. Peltech recognised the equity investment in SP at fair value through profit or loss in terms of IFRS 9 Financial Instruments in its separate financial statements. Peltech elected to measure the non-controlling interests in the acquiree at their proportionate share of the acquiree's identifiable net assets at acquisition date. 3. Equipment is depreciated at 10% per annum unless otherwise indicated. You may assume a corporate tax rate of 28% where applicable. You may ignore VAT. 2 4 REQUIRED a) Prepare the pro-forma journals relating to the intragroup transactions between Peltech and SP that need to be accounted for when preparing the consolidated financial statements for the reporting period ended 31 December 2021. (12) Please note: Show all calculations as marks may be awarded thereto. Round off all amounts to the nearest Rand where necessary. Entity references are required. Journal narrations and financial statement references are not required. . . . . b) Prepare ONLY the retained earnings and non-controlling interest columns in the consolidated statement of changes in equity for the Group for the reporting period ended 31 December 2021. (16)

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

To proceed with the task lets first analyze the information provided and determine the intergroup transactions that need to be accounted for in the consolidated financial statements for the reporting ... View full answer

Get step-by-step solutions from verified subject matter experts