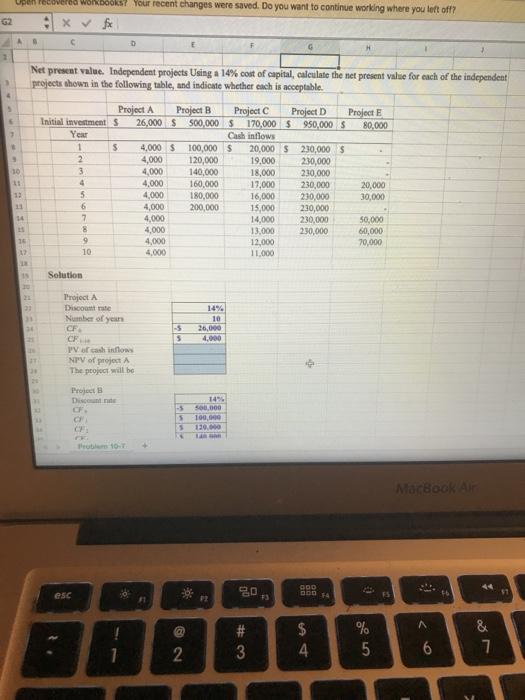

Question: pen recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? : * fx A. 0 Net present

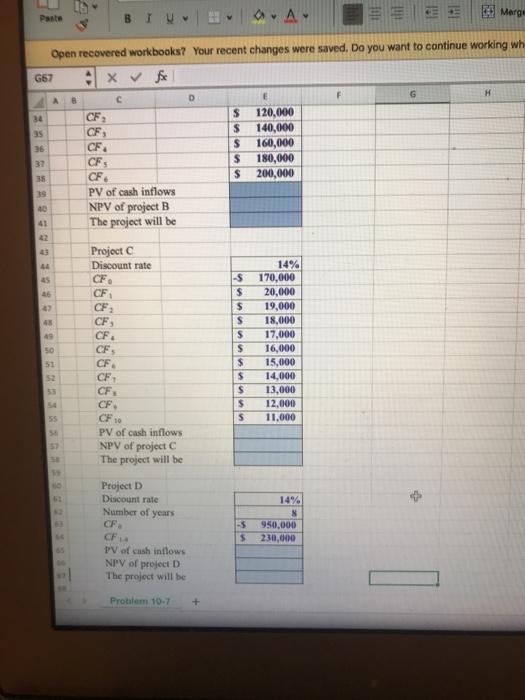

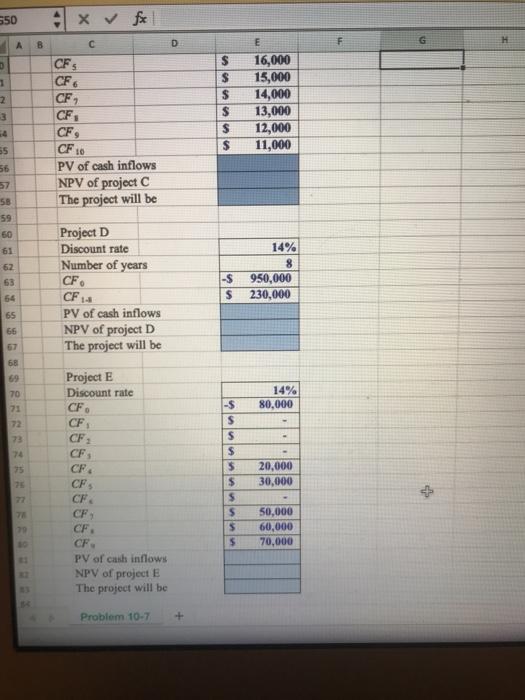

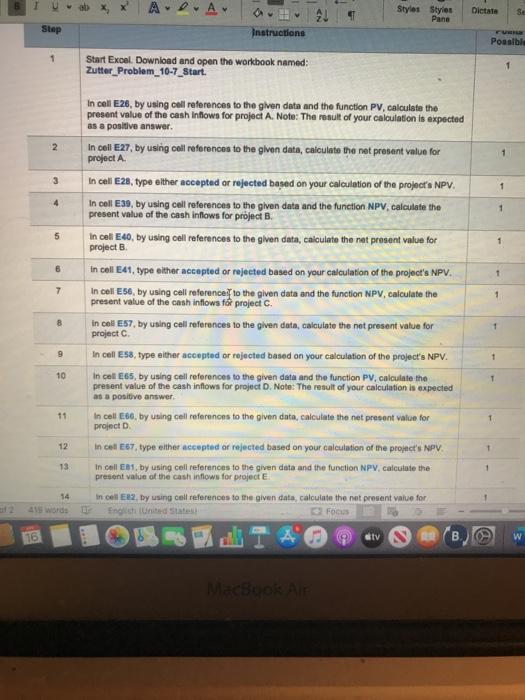

pen recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? : * fx A. 0 Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. 4 5 7 Project A Project B Project C Project D Initial investments Project E 26,000 $500,000 $170,000 $950,000 $ 80,000 Year Cash inflows 1 $ 4,000 $ 100,000 $ 20,000 $ 230,000 $ 2 4,000 120,000 19,000 230,000 3 4,000 140,000 18,000 230,000 4,000 160,000 17,000 230,000 20,000 5 4,000 180,000 16,000 230,000 30,000 6 4,000 200,000 15,000 230,000 7 4,000 14,000 230,000 50,000 8 4,000 13,000 230,000 60,000 9 4,000 12,000 70,000 10 11.000 4 12 12 Solution 21 Project A Discote Number of year CF 14% 10 26.000 4.000 24 CF 5 PV of cash now NPV of project The project will be Project Disc -5 5 5 CH 14% 500.000 100,000 130.000 LLLL Protherm 101 MacBook Air esc 30 OOD 4 ti + # 3 A 4 % 5 & 7 2 6 HOA E! Merge Paste IM H D 35 CF Open recovered workbooks? Your recent changes were saved. Do you want to continue working wh G67 x fe C F G 34 CF, $ 120,000 $ 140,000 36 CE S 160,000 S 180,000 35 $ 200,000 PV of cash inflows NPV of project B The project will be CFS CF 40 41 Project C Discount rate CF 45 16 CF -$ $ $ S CF: CF) CF CF 5 CF CF CF CF. 50 14% 170,000 20,000 19,000 18,000 17,000 16,000 15,000 14,000 13,000 12.000 11,000 lulululu 52 55 $ $ $ 5 55 CF 57 PV of cash inflows NPV of project The project will be Project D Discount rate Number of years + CF CF -5 $ N 950,000 230,000 PV of cash inflows NPV of project D The project will be Probilom 10.7 + 550 : x x AB F . CFS CF6 1 2 3 CF1 $ $ $ $ $ $ E 16,000 15,000 14,000 13,000 12,000 11,000 CF, CF, CF 10 55 56 > 58 PV of cash inflows NPV of project C The project will be Project D 60 61 62 63 Discount rate Number of years CF CF 14% 8 950,000 230,000 -$ s 65 66 PV of cash inflows NPV of project D The project will be 68 69 70 71 Project E Discount rate 14% 80,000 CF. 72 -$ $ S CF: 74 75 CF 20,000 30,000 77 CF CF CF . CF PV of cash inflows NPV of project E The project will be 5 $ $ S $ $ 50,000 60,000 70,000 Problem 10-7 + O.Av Styles Styles Pane Dietate Sc Step Instructions Possible 1 Start Excel. Download and open the workbook named: Zutter_Problem_10-7_Start. 2 1 4 1 5 6 1 7 In cell E26, by using coll references to the given data and the function PV, calculate the present value of the cash inflows for project A. Note: The result of your calculation is expected as a positive answer in cell E27, by using coll references to the given data, calculate the net present value for project A In celi E26, type elther accepted or rejected based on your calculation of the project's NPV. In cell E39, by using cail references to the given data and the function NPV, calculate the present value of the cash inflows for project B. In cel E40, by using cell references to the glven data, calculate the nat present value for project B In cell E41, type alther accepted or rejected based on your calculation of the project's NPV. In cell ES6, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project c. in cell ES7, by using cell references to the given data, calculate the net present value for project In cell E58, type either accepted or rejected based on your calculation of the project's NPV. In cell E65, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project D. Note: The result of your calculation is expected as a positive answer In cell E86, by using cell referenons to the given data, calculate the net present value for project in cell E87, type other accepted or rejected based on your calculation of the project's NPV In caill EDS, by using cell references to the gen data and the function NPV, calculate the value cash E in cell E82 by using cell references to the given data, calculate the net prosent value for Focus 8 + 9 1 10 11 12 13 16 dtv . MacBook At

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts