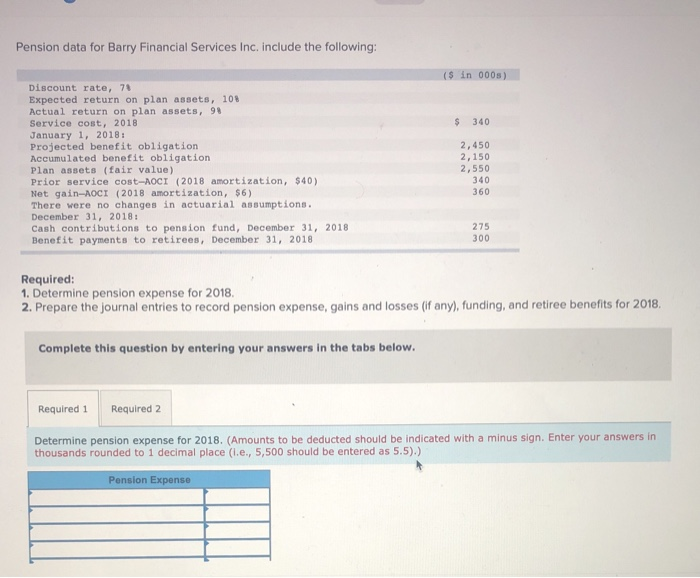

Question: Pension data for Barry Financial Services Inc. include the following: ($ in 000) $ 340 Discount rate, 78 Expected return on plan assets, 10% Actual

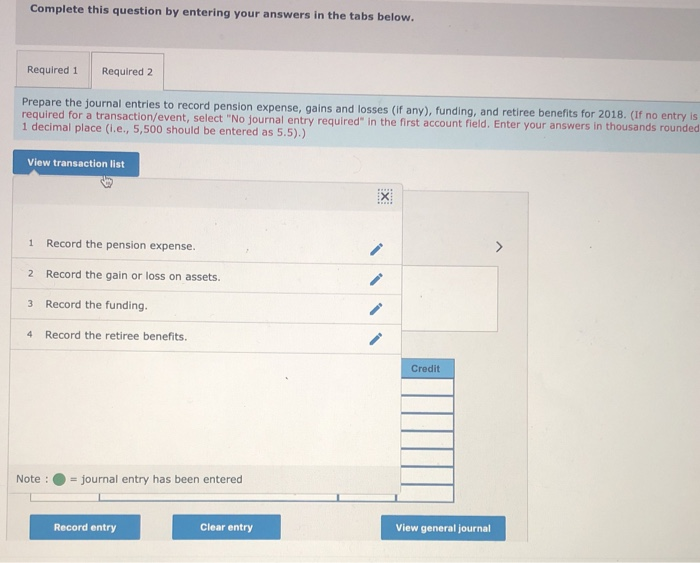

Pension data for Barry Financial Services Inc. include the following: ($ in 000) $ 340 Discount rate, 78 Expected return on plan assets, 10% Actual return on plan assets, 99 Service cost, 2018 January 1, 2018: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value) Prior service cost-AOCI (2018 amortization, $40) Net gain-AOCI (2018 amortization, $6) There were no changes in actuarial assumptions. December 31, 2018: Cash contributions to pension fund, December 31, 2018 Benefit payments to retirees, December 31, 2018 2,450 2,150 2,550 340 360 275 300 Required: 1. Determine pension expense for 2018. 2. Prepare the journal entries to record pension expense, gains and losses (if any), funding, and retiree benefits for 2018. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for 2018. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands rounded to 1 decimal place (l.e., 5,500 should be entered as 5.5).) Pension Expense Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries to record pension expense, gains and losses (if any), funding, and retiree benefits for 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands rounded 1 decimal place (i.e., 5,500 should be entered as 5.5).) View transaction list 1 Record the pension expense. 2 Record the gain or loss on assets. 3 Record the funding. 4 Record the retiree benefits. Credit Note : journal entry has been entered View general journal Record entry Clear entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts