Question: Pensky Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive and equally risky. Calculate the MIRR

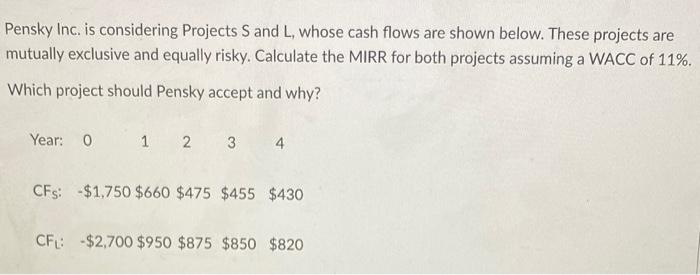

Pensky Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive and equally risky. Calculate the MIRR for both projects assuming a WACC of 11%. Which project should Pensky accept and why? Year: 0 1 2 3 4 CFS: $1,750 $660 $475 $455 $430 CF: $2,700 $950 $875 $850 $820

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock