Question: Per chegg guidlines please answer #5 Cell Styles 69 B PRICE Operating Cash Flow 0 f. What are the free cash flows of the project

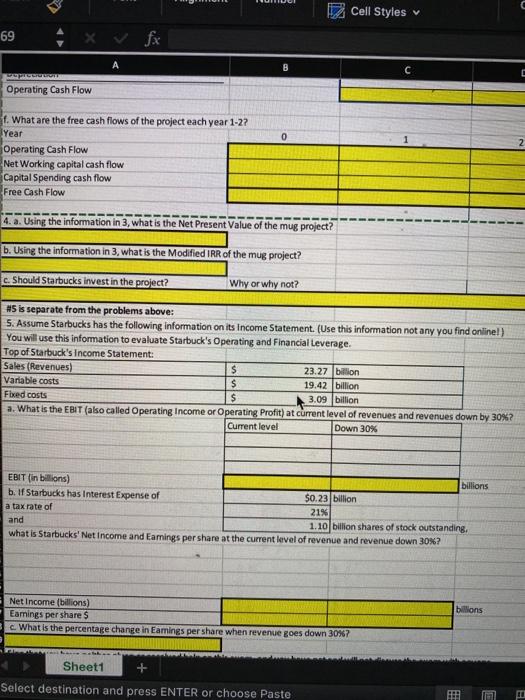

Cell Styles 69 B PRICE Operating Cash Flow 0 f. What are the free cash flows of the project each year 1-2? Year Operating Cash Flow Net Working capital cash flow Capital Spending cash flow Free Cash Flow 4. a. Using the information in 3, what is the Net Present Value of the mug project? b. Using the information in 3, what is the Modified IRR of the mug project? c. Should Starbucks invest in the project? Why or why not? #5 is separate from the problems above: 5. Assume Starbucks has the following information on its Income Statement. (Use this information not any you find onlinel) You will use this information to evaluate Starbuck's Operating and Financial Leverage. Top of Starbuck's Income Statement: Sales (Revenues) $ 23.27 billion Variable costs $ 19.42 billion Fixed costs $ 3.09 billion a. What is the EBIT (also called Operating Income or Operating Profit) at current level of revenues and revenues down by 30%? Current level Down 30% EBIT (in billions) billions b. If Starbucks has Interest Expense of $0.23 billion a tax rate of 21% and 1.10 billion shares of stock outstanding. what is Starbucks' Net Income and Earings per share at the current level of revenue and revenue down 30%? billions Net Income (billions) Eamings per shares What is the percentage change in Eamings per share when revenue goes down 30%? Sheet1 Select destination and press ENTER or choose Paste

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts