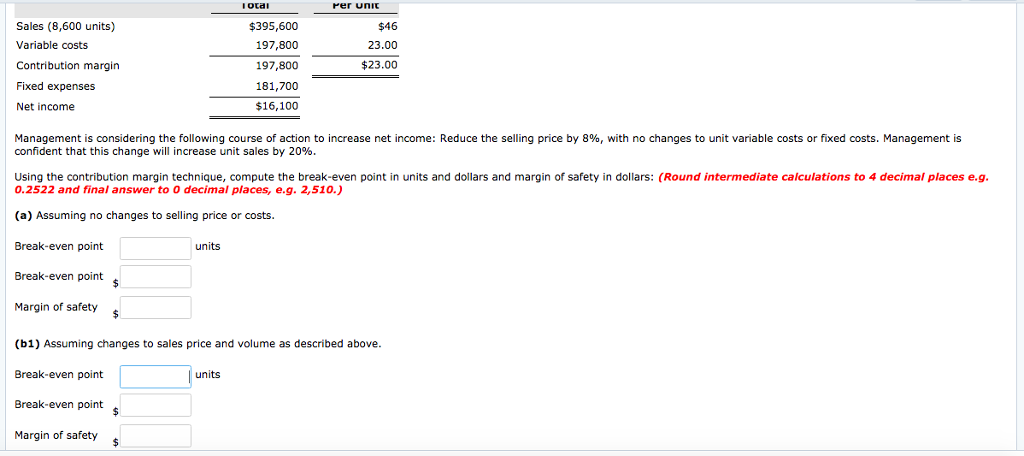

Question: Per unic Sales (8,600 units) Variable costs Contribution margin Fixed expenses Net income $395,600 197,800 197,800 181,700 $16,100 $46 23.00 $23.00 Management is considering the

Per unic Sales (8,600 units) Variable costs Contribution margin Fixed expenses Net income $395,600 197,800 197,800 181,700 $16,100 $46 23.00 $23.00 Management is considering the following course of action to increase net income: Reduce the selling price by 89 , with no changes to unit variable costs or fixed costs. Management is confident that this change will increase unit sales by 20% Using the contribution margin technique, compute the break-even point in units and dollars and margin of safety in dollars: (Round intermediate calculations to 4 decimal places e.g. 0.2522 and final answer to O decimal places, e.g. 2,510.) (a) Assuming no changes to selling price or costs Break-even point Break-even point Margin of safety units (b1) Assuming changes to sales price and volume as described above Break-even point Break-even point Margin of safety units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts