Question: Perfectly correlation assets will most likely have correlation coefficients: a) O -1.0 and +10 b) OF 0 and +1.0. c) Between 0 and +1.0 d)

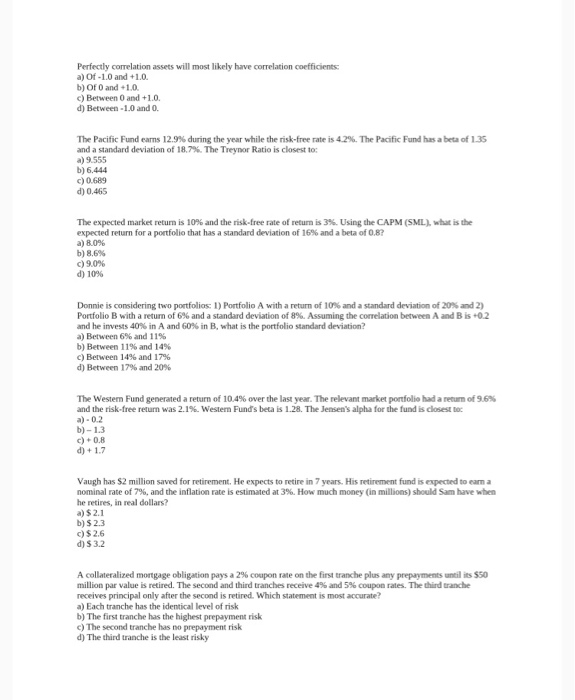

Perfectly correlation assets will most likely have correlation coefficients: a) O -1.0 and +10 b) OF 0 and +1.0. c) Between 0 and +1.0 d) Between - 1.0 and 0. The Pacific Fund earns 12.9% during the year while the risk-free rate is 4.2%. The Pacific Fund has a beta of 1.35 and a standard deviation of 18,7%. The Trevor Ratio is closest to: a) 9.555 b) 6.444 c) 0.689 d) 0,465 The expected market retum is 10% and the risk-free rate of retum is 3%. Using the CAPM (SML). what is the expected return for a portfolio that has a standard deviation of 16% and a beta of 0.8? a) 809 b) 8.6% c) 9.0% d) 10% Donnie is considering two portfolios: 1) Portfolio A with a return of 10% and a standard deviation of 20% and 2) Portfolio B with a return of 6% and a standard deviation of 8% Assuming the correlation between A and B is +02 and he invests 40% in A and 60% in B, what is the portfolio standard deviation? a) Between 6% and 11% b) Between 11% and 14% c) Between 14% and 17% d) Between 17% and 20% The Westem Fund generated a return of 10.4% over the last year. The relevant market portfolio had a return of 9.6% and the risk-free return was 2.1% Western Fund's beta is 1.28. The Jensen's alpha for the fund is closest to a)-0.2 b)-13 c) + 0.8 d) + 1.7 Vaugh has $2 million saved for retirement. He expects to retire in 7 years. His retirement fund is expected to earn a nominal rate of 7%, and the inflation rate is estimated at 3%. How much money (in millions) should Sam have when he retires, in real dollars? a) $ 2.1 b) $23 c) $ 2.6 d) 3.2 A collateralized mortgage obligation pays a 2% coupon rate on the first tranche plus any prepayments until its $50 million par value is retired. The second and third tranches receive 4% and 5% coupon rates. The third tranche receives principal only after the second is retired. Which statement is most accurate? a) Each tranche has the identical level of risk b) The first tranche has the highest prepayment risk c) The second tranche has no prepayment risk d) The third tranche is the least risky

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts