Question: perfo Solving Problems 1. A retailers current assets are $7.4 million Presently, his current ratio is .5.) The retailer wants to borrow money to fund

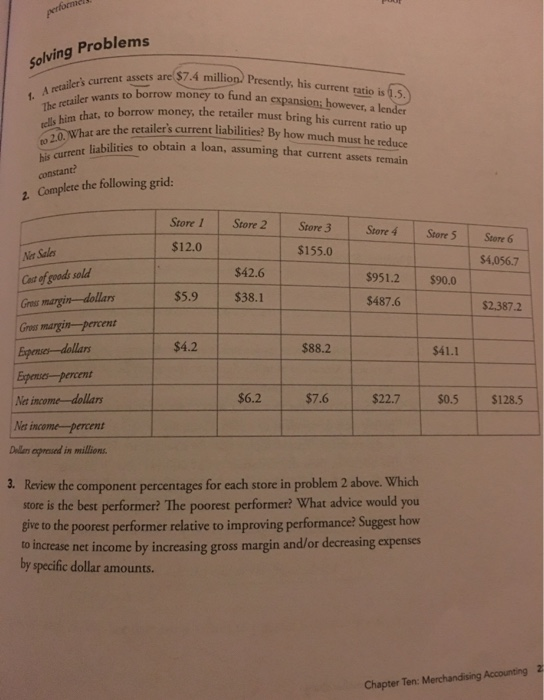

perfo Solving Problems 1. A retailers current assets are $7.4 million Presently, his current ratio is .5.) The retailer wants to borrow money to fund an expansion; however, a lender tells him that, to borrow money, the retailer must bring his current ratio up to 2.0. What are the retailer's current liabilities? By how much must he reduce his current liabilities to obtain a loan, assuming that current assets remain constant? 2 Complete the following grid: Store 1 Store 2 Store 3 Store 4 Store 5 Store 6 $12.0 $155.0 Ner Sale $4,056.7 $42.6 Cast of goods sold $951.2 $90.0 $5.9 $38.1 $487.6 Grea margin-dollars $2.387.2 Greas margin-percent Expenses dollars Expernses percent $4.2 $88.2 $41.1 $6.2 $7.6 $22.7 Net imcome-dollars $0.5 $128.5 Net income percent Deler axpresed in millions 3. Review the component percentages for each store in problem 2 above. Which store is the best performer? The poorest performer? What advice would you give to the poorest performer relative to improving performance? Suggest how to increase net income by increasing gross margin and/or decreasing expenses by specific dollar amounts. Chapter Ten: Merchandising Accounting 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts