Question: Perform a common size analysis and percent change analysis. What do these analysestell you about Jansen? What actions should be taken to improve its overall

Perform a common size analysis and percent change analysis. What do these analysestell you about Jansen? What actions should be taken to improve its overall financial position?

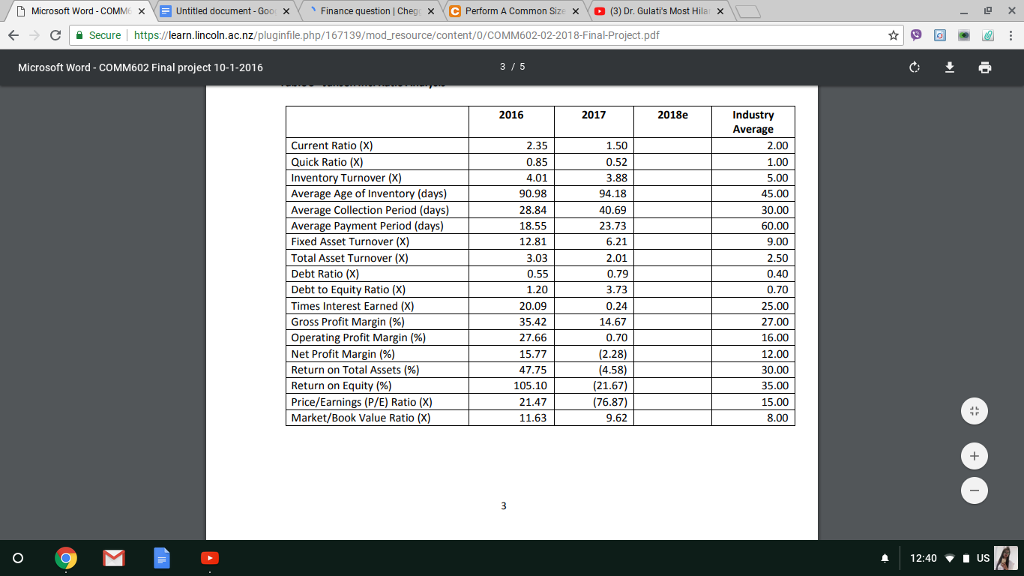

D Microsoft word COMM xE Untitled document Goc Finance question ICheg Perform A Common Szex 0 3 Dr. Gulati s Most Hile secure! https://learn.lincoln.ac.nz/pluginfile.php/1671 39/mod-resource/content/0/COMM602-02-2018-Final-Project.pdf Microsoft Word-COMM602 Final project 10-1-2016 3 5 Industry Average 2016 2017 2018e Current Ratio (X) Quick Ratio (X) Inventory Turnover (X) Average Age of Inventory (days) Average Collection Period (days) Average Payment Period (days) Fixed Asset Turnover (X) Total Asset Turnover (X) Debt Ratio (X) Debt to Equity Ratio (X) Times Interest Earned (X) Gross Profit Margin(%) Operating Profit Margin(%) Net Profit Margin (%) Return on Total Assets (%) Return on Equity (%) Price/Earnings (P/E) Ratio (X) Market/Book Value Ratio (X) 2.35 0.85 4.01 90.98 28.84 18.55 12.81 3.03 0.55 1.20 20.09 35.42 27.66 15.77 47.75 105.10 21.47 11.63 1.50 0.52 3.88 94.18 40.69 23.73 6.21 2.01 0.79 3.73 0.24 14.67 0.70 (2.28) (4.58) (21.67) (76.87) 9.62 2.00 1.00 5.00 45.00 30.00 60.00 9.00 2.50 0.40 0.70 25.00 27.00 16.00 12.00 30.00 35.00 15.00 8.00 412:40US

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts