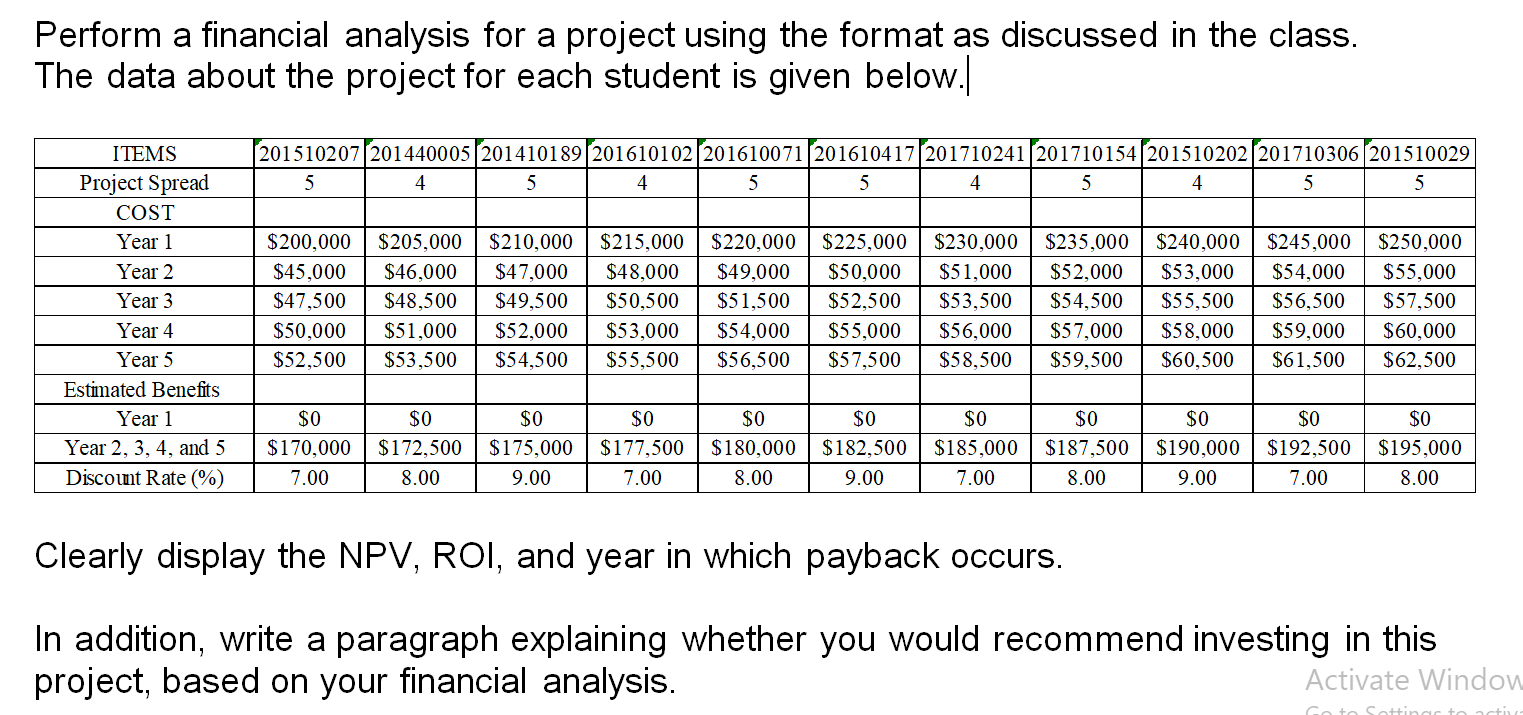

Question: Perform a financial analysis for a project using the format as discussed in the class. The data about the project for each student is given

Perform a financial analysis for a project using the format as discussed in the class. The data about the project for each student is given below. (201510207201440005/201410189 201610102201610071/201610417201710241 201710154/201510202 (201710306201510029 5 4 5 4 5 5 4 5 4 / 5 5 ITEMS Project Spread COST Year 1 Year 2 Year 3 Year 4 Year 5 Estimated Benefits Year 1 Year 2, 3, 4, and 5 Discount Rate (%) $200,000 $45,000 $47,500 $50,000 $52,500 $205,000 $46,000 $48,500 $51,000 $53,500 $210,000 $47,000 $49,500 $52,000 $54,500 $215,000 $48,000 $50,500 $53,000 $55,500 $220,000 $49,000 $51,500 $54,000 $56,500 $225,000 $50,000 $52,500 $55,000 $57,500 $230,000 $51,000 $53,500 $56,000 $58,500 $235,000 $52,000 $54,500 $57,000 $59,500 $240,000 $53,000 $55,500 $58,000 $60,500 $245,000 $54,000 $56,500 $59,000 $61,500 $250,000 $55,000 $57,500 $60,000 $62,500 co $0 $170,000 7.00 $0 $0 $172,500 | $175,000 8.00 9.00 $0 $0 $177,500 | $180,000 7.00 8.00 $0 $182,500 9.00 $0 $185,000 7.00 $0 $187,500 8.00 $0 $190,000 9.00 $0 $192,500 7.00 $0 $195.000 8.00 Clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Activate Window Coto Sottina toti Perform a financial analysis for a project using the format as discussed in the class. The data about the project for each student is given below. (201510207201440005/201410189 201610102201610071/201610417201710241 201710154/201510202 (201710306201510029 5 4 5 4 5 5 4 5 4 / 5 5 ITEMS Project Spread COST Year 1 Year 2 Year 3 Year 4 Year 5 Estimated Benefits Year 1 Year 2, 3, 4, and 5 Discount Rate (%) $200,000 $45,000 $47,500 $50,000 $52,500 $205,000 $46,000 $48,500 $51,000 $53,500 $210,000 $47,000 $49,500 $52,000 $54,500 $215,000 $48,000 $50,500 $53,000 $55,500 $220,000 $49,000 $51,500 $54,000 $56,500 $225,000 $50,000 $52,500 $55,000 $57,500 $230,000 $51,000 $53,500 $56,000 $58,500 $235,000 $52,000 $54,500 $57,000 $59,500 $240,000 $53,000 $55,500 $58,000 $60,500 $245,000 $54,000 $56,500 $59,000 $61,500 $250,000 $55,000 $57,500 $60,000 $62,500 co $0 $170,000 7.00 $0 $0 $172,500 | $175,000 8.00 9.00 $0 $0 $177,500 | $180,000 7.00 8.00 $0 $182,500 9.00 $0 $185,000 7.00 $0 $187,500 8.00 $0 $190,000 9.00 $0 $192,500 7.00 $0 $195.000 8.00 Clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Activate Window Coto Sottina toti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts