Question: Perform a financial analysis. Please show step by step so I can better understand. Thank you! 7800 27000 52400 5200 31000 67250 7100 35500 98720

Perform a financial analysis. Please show step by step so I can better understand. Thank you!

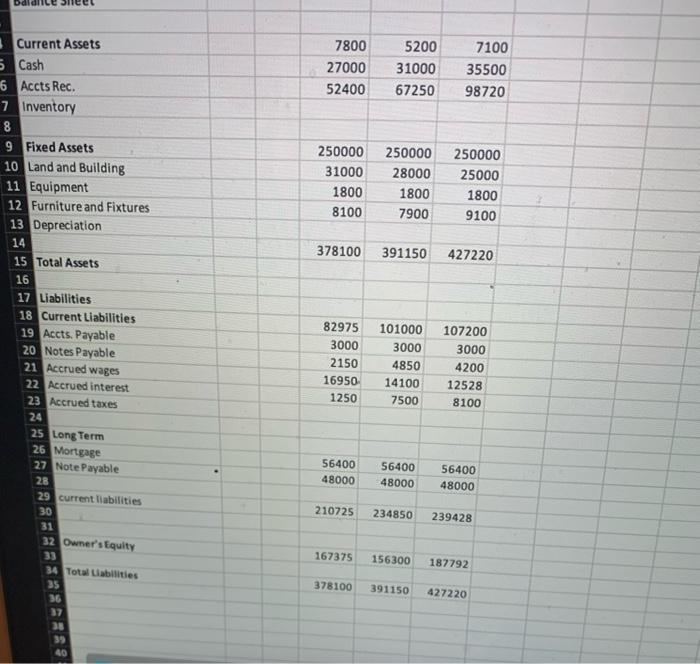

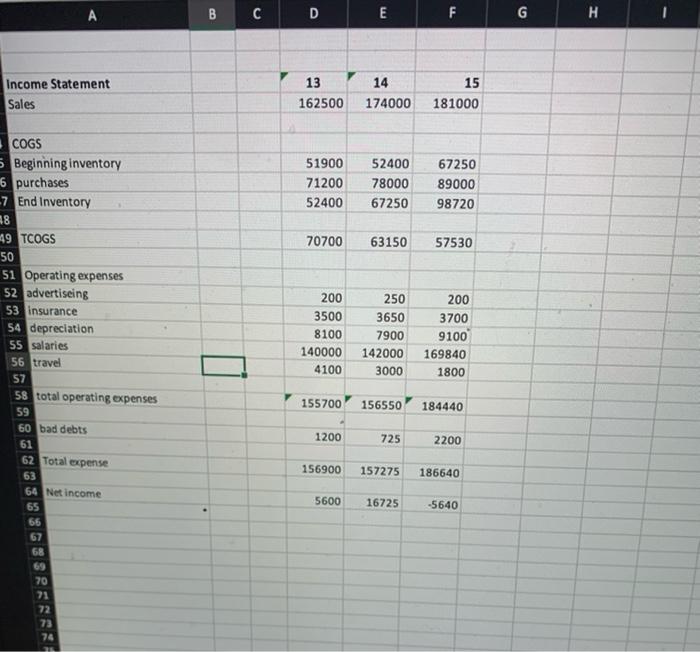

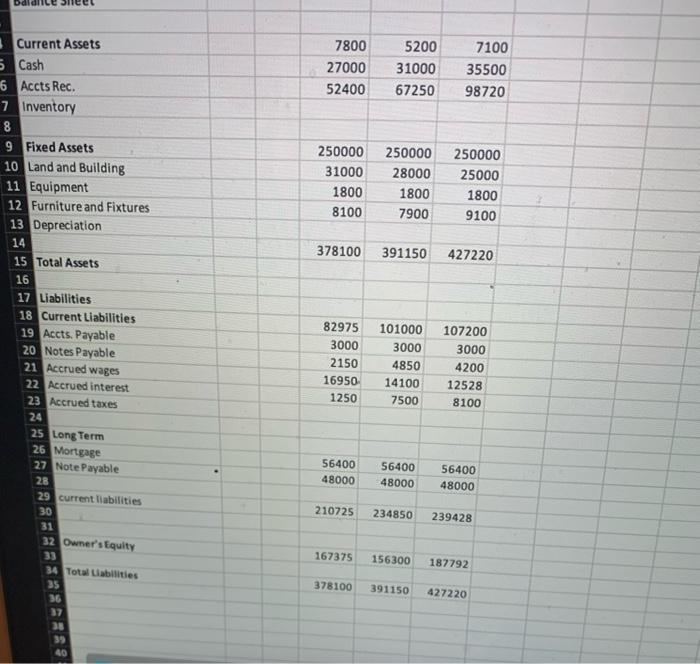

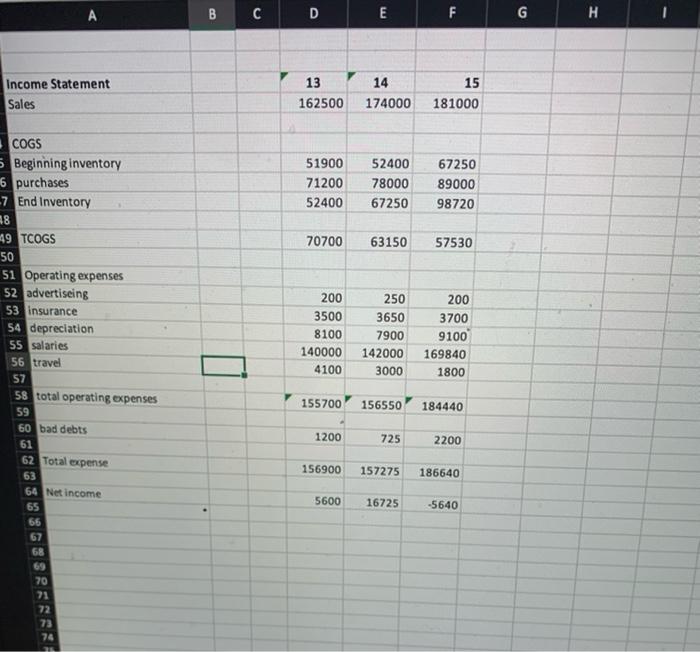

7800 27000 52400 5200 31000 67250 7100 35500 98720 250000 31000 1800 8100 250000 28000 1800 7900 250000 25000 1800 9100 378100 391150 427220 Current Assets 5 Cash 16 Accts Rec. 7 Inventory 8 9 Fixed Assets 10 Land and Building 11 Equipment 12 Furniture and Fixtures 13 Depreciation 14 15 Total Assets 16 17 Liabilities 18 Current Liabilities 19 Accts. Payable 20 Notes Payable 21 Accrued wages 22 Accrued interest 23 Accrued taxes 24 25 Long Term 26 Mortgage 27 Note Payable 28 29 current liabilities 30 31 32 Owner's Equity 82975 3000 2150 16950 1250 101000 3000 4850 14100 7500 107200 3000 4200 12528 8100 56400 48000 56400 48000 56400 48000 210725 234850 239428 167375 156300 187792 34 Total abilities 378100 391150 427220 35 36 37 38 39 40 A B C D E F G H Income Statement Sales 13 162500 14 174000 15 181000 51900 71200 52400 52400 78000 67250 67250 89000 98720 70700 63150 57530 COGS 5 Beginning inventory 6 purchases -7 End Inventory 18 49 TCOGS 50 51 Operating expenses 52 advertiseing 53 insurance 54 depreciation 55 salaries 56 travel 57 58 total operating expenses 59 60 bad debts 200 3500 8100 140000 4100 250 3650 7900 142000 3000 200 3700 9100 169840 1800 155700 156550 184440 1200 725 2200 61 62 Total expense 156900 157275 186640 63 64 Net income 65 66 5600 16725 -5640 68 70 71 72 73 74

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock