Question: Perform a sensitivity analysis on the projects data, varying the unit price and the demand from their expected value by 10%, 20%, and 30%. Summarize

Perform a sensitivity analysis on the projects data, varying the unit price and the demand from their expected value by 10%, 20%, and 30%. Summarize your results in a table and a sensitivity graph. Which of the two is the NPW more sensitive to changes in?

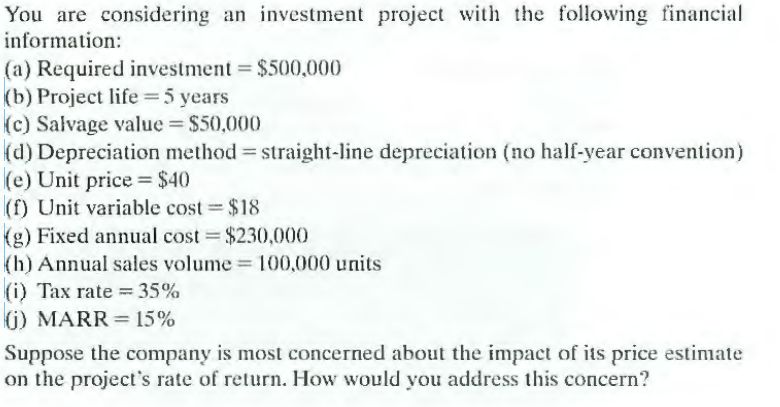

You are considering an investment project with the following financial information: (a) Required investment = $500,000 (b) Project life = 5 years (c) Salvage value = $50,000 (d) Depreciation method = straight-line depreciation (no half-year convention) (e) Unit price = $40 (1) Unit variable cost = $18 (g) Fixed annual cost = $230,000 (h) Annual sales volume = 100.000 units (i) Tax rate = 35% 6) MARR= 15% Suppose the company is most concerned about the impact of its price estimate on the project's rate of relurn. How would you address this concern

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts