Question: Perform vertical analysis by applying formulas and give interpretation Consolidated Statement of Profit and Loss Notes 32 Year ended March 31, 2019 299.190.59 2.747.81 301,938.40

Perform vertical analysis by applying formulas and give interpretation

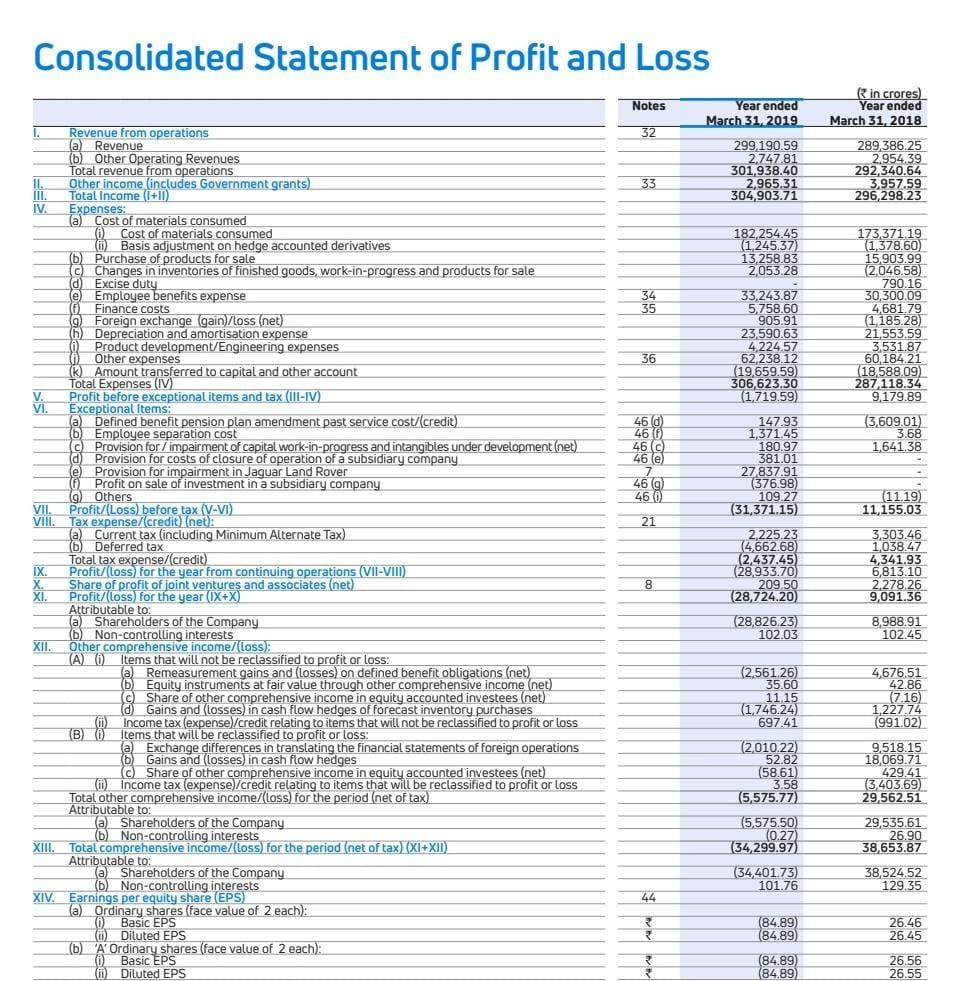

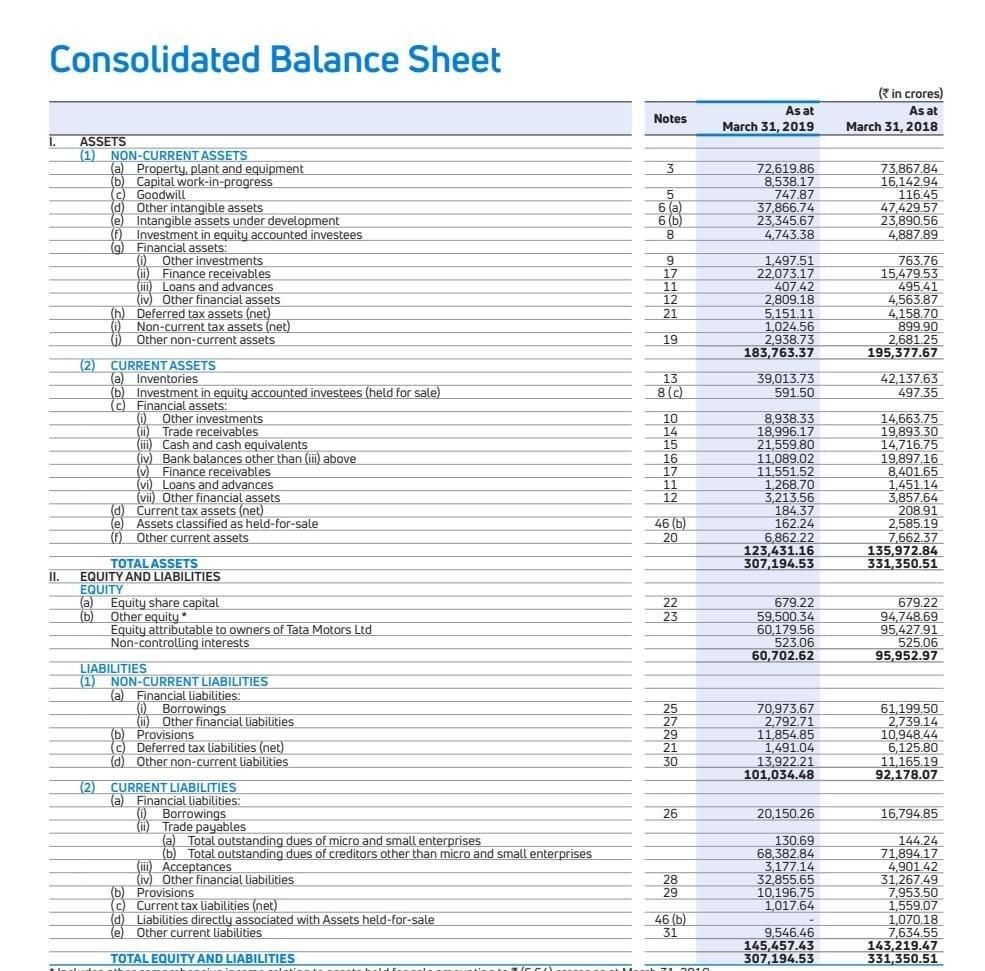

Consolidated Statement of Profit and Loss Notes 32 Year ended March 31, 2019 299.190.59 2.747.81 301,938.40 2.965.31 304,903.71 in crores) Year ended March 31, 2018 289,386.25 2.954,39 292,340.64 3957.59 296 298.23 33 34 173,37119 (1,378.60) 15,903.99 2.046.58) 790.16 30,300.09 4.681.79 (1185.28) 21.553.59 3,531.87 60,184.21 (18,588.09) 287,118.34 9,179.89 0 36 46 182,254.45 (1.245.37) 13,258.83 2053.28 33,243.87 5.758,60 905.91 23,590.63 4.224.57 62.238.12 (19,659.59) 306,623.30 (1.719.59 147.93 1,37145 180.97 381.01 27837.91 (376.98) 109.27 (31,371.15) 2.225.23 14.662.68) (2,437.45) (28,933.70 209.50 (28,724.20) (28,826.23) 102.03 13,609,062 46 46 (e) 1.641.38 46 (a) 460) Revenue from operations (a) Revenue (6) Other Operating Revenues Total revenue from operations Other income (includes Government grants) III. Total Income (i+11) IV Expenses: (a) Cost of materials consumed 0 Cost of materials consumed ) Basis adjustment on hedge accounted derivatives (b) Purchase of products for sale C) Changes in inventories of finished goods, work-in-progress and products for sale d) Excise duty e Employee benefits expense () Finance costs 9) Foreign exchange (gain)/Loss (net) (h) Depreciation and amortisation expense Product development/Engineering expenses 0 Other expenses (k) Amount transferred to capital and other account Total Expenses (IV) V. Profit before exceptional items and tax (III-IV) Exceptional Items: (a) Defined benefit pension plan amendment past service cost/(credit) 6 Employee separation cost C) Provision for / impairment of capital work-in-progress and intangibles under development (net) d Provision for costs of closure of operation of a subsidiary company e Provision for impairment in Jaguar Land Rover 0 Profit on sale of investment in a subsidiary company (9) Others VII. Profit/(Loss) before tax (V-VI) VIII. Tax expense/(credit) (net): (a) Current tax (including Minimum Alternate Tax) (b) Deferred tax Total tax expense/(credit) Profit/(loss for the year from continuing operations (VII-VIII) X. Share of profit of joint ventures and associates (net) XI. Profit/(loss) for the year (IX+X) Attributable to: a Shareholders of the Company (b) Non-controlling interests XII. Other comprehensive income/loss): (A) 0 Items that will not be reclassified to profit or loss: (a) Remeasurement gains and (losses) on defined benefit obligations (net) 6 Equity instruments at fair value through other comprehensive income (net) Share of other comprehensive income in equity accounted investees (net) Income tax (expense)/credit relating to items that will not be reclassified to profit or loss B0 Items that will be reclassified to profit or loss: a) Exchange differences in translating the financial statements of foreign operations (0) Gains and losses in cash flow hedges (C) Share of other comprehensive income in equity accounted investees (net) () Income tax (expense)/credit relating to items that will be reclassified to profit or loss Total other comprehensive income/(Loss) for the period (net of tax) Attributable to: a) Shareholders of the Company (b) Non-controlling interests XIII. Total comprehensive income/loss) for the period (net of tax) (XI+XII) Attributable to: a Shareholders of the Company (6) Non-controlling interests XIV. Earnings per equity share (EPS) a) Ordinary shares (face value of 2 each): 10) Basic EPS (0) Diluted EPS (b) A' Ordinary shares (face value of 2 each): Basic EPS (1) Diluted EPS 21 IX (1119) 11,155.03 3,303.46 1.038,47 4,341.93 6,813.10 2.278.26 9,091.36 8,988.91 102.45 8 (2,561.26) 35.60 11.15 (1.746.24 697.41 (2.010.22) 52.82 (58.61) 3.58 (5,575.77) 15,575,50) (34,299.97) (34,401.73) 101.76 4,676.51 42.86 (7.16) 1,227.74 (991.02) 9,518.15 18,069.71 429.41 (3.403.69 29,562.51 29,535.61 26.90 38,653.87 38,524.52 129.35 0.27 44 (84.89) (84.89 26.46 26.45 26.56 26.55 (84.89 (84.89 Consolidated Balance Sheet in crores) As at March 31, 2018 As at March 31, 2019 Notes 5 6a) 60 8 72,619.86 8,538.17 747.87 37,866.74 23,345.67 4.743.38 73,867.84 16.142.94 116.45 47,429.57 23,890.56 4,887.89 9 17 11 12 21 cos 1,497.51 22,073.17 407.42 2,809.18 5151.11 1,024.56 2.938.73 183,763.37 763.76 15,479.53 495.41 4,563.87 4158.70 899.90 2.681.25 195,377.67 42,137.63 497.35 19 13 8 (c) 39,013.73 591.50 10 14 15 16 17 11 12 ASSETS (1) NON-CURRENT ASSETS (a) Property, plant and equipment (b) Capital work-in-progress (C) Goodwill d) Other intangible assets e) Intangible assets under development (6) Investment in equity accounted investees (9) Financial assets. (0) Other investments ) Finance receivables (ii) Loans and advances (iv) Other financial assets (h) Deferred tax assets (net) Non-current tax assets (net) Other non-current assets (2) CURRENT ASSETS (a) Inventories (b) Investment in equity accounted investees (held for sale) (c) Financial assets: (0) Other investments ) Trade receivables (ii) Cash and cash equivalents (iv) Bank balances other than (ii) above (v) Finance receivables (vi) Loans and advances (vii) Other financial assets d) Current tax assets (net) (e) Assets classified as held-for-sale (f) Other current assets TOTAL ASSETS EQUITY AND LIABILITIES EQUITY (a) Equity share capital (b) Other equity Equity attributable to owners of Tata Motors Ltd Non-controlling interests LIABILITIES (1) NON-CURRENT LIABILITIES (a) Financial liabilities: Borrowings Other Financial liabilities (b) Provisions c) Deferred tax liabilities (net) d) Other non-current liabilities (2) CURRENT LIABILITIES (a) Financial liabilities: 0_Borrowings (b) Trade payables (a) Total outstanding dues of micro and small enterprises (b) Total outstanding dues of creditors other than micro and small enterprises (iii) Acceptances (iv) Other financial liabilities (6) Provisions (C) Current tax liabilities (net) d) Liabilities directly associated with Assets held-for-sale le) Other current liabilities TOTAL EQUITY AND LIABILITIES 8.938.33 18,996.17 21,559.80 11.089.02 11.551.52 1,268.70 3,213.56 184.37 162.24 6,862.22 123,431.16 307,194.53 14,663.75 19,893.30 14,716.75 19,897.16 8.401.65 1.451.14 3,857.64 208.91 2,585.19 7,662.37 135,972.84 331,350.51 46 (b) 20 II. 22 679.22 59,500.34 60.179.56 523.06 60,702.62 679.22 94.748.69 95,427,91 525.06 95,952.97 29 21 30 70,973.67 2,792.71 11,854.85 1,491.04 13.922.21 101,034.48 61.199.50 2,739.14 10,948.44 6,125.80 11.165.19 92.178.07 26 20,150.26 16,794.85 28 130.69 68,38284 3.177.14 32,855.65 10.196.75 1,017.64 144.24 71.894 17 4.901.42 31,267.49 7,953.50 1,559.07 1.070.18 7,634.55 143,219.47 331,350.51 46 (b) 9,546.46 145,457.43 307,194.53 niny 1101 Consolidated Statement of Profit and Loss Notes 32 Year ended March 31, 2019 299.190.59 2.747.81 301,938.40 2.965.31 304,903.71 in crores) Year ended March 31, 2018 289,386.25 2.954,39 292,340.64 3957.59 296 298.23 33 34 173,37119 (1,378.60) 15,903.99 2.046.58) 790.16 30,300.09 4.681.79 (1185.28) 21.553.59 3,531.87 60,184.21 (18,588.09) 287,118.34 9,179.89 0 36 46 182,254.45 (1.245.37) 13,258.83 2053.28 33,243.87 5.758,60 905.91 23,590.63 4.224.57 62.238.12 (19,659.59) 306,623.30 (1.719.59 147.93 1,37145 180.97 381.01 27837.91 (376.98) 109.27 (31,371.15) 2.225.23 14.662.68) (2,437.45) (28,933.70 209.50 (28,724.20) (28,826.23) 102.03 13,609,062 46 46 (e) 1.641.38 46 (a) 460) Revenue from operations (a) Revenue (6) Other Operating Revenues Total revenue from operations Other income (includes Government grants) III. Total Income (i+11) IV Expenses: (a) Cost of materials consumed 0 Cost of materials consumed ) Basis adjustment on hedge accounted derivatives (b) Purchase of products for sale C) Changes in inventories of finished goods, work-in-progress and products for sale d) Excise duty e Employee benefits expense () Finance costs 9) Foreign exchange (gain)/Loss (net) (h) Depreciation and amortisation expense Product development/Engineering expenses 0 Other expenses (k) Amount transferred to capital and other account Total Expenses (IV) V. Profit before exceptional items and tax (III-IV) Exceptional Items: (a) Defined benefit pension plan amendment past service cost/(credit) 6 Employee separation cost C) Provision for / impairment of capital work-in-progress and intangibles under development (net) d Provision for costs of closure of operation of a subsidiary company e Provision for impairment in Jaguar Land Rover 0 Profit on sale of investment in a subsidiary company (9) Others VII. Profit/(Loss) before tax (V-VI) VIII. Tax expense/(credit) (net): (a) Current tax (including Minimum Alternate Tax) (b) Deferred tax Total tax expense/(credit) Profit/(loss for the year from continuing operations (VII-VIII) X. Share of profit of joint ventures and associates (net) XI. Profit/(loss) for the year (IX+X) Attributable to: a Shareholders of the Company (b) Non-controlling interests XII. Other comprehensive income/loss): (A) 0 Items that will not be reclassified to profit or loss: (a) Remeasurement gains and (losses) on defined benefit obligations (net) 6 Equity instruments at fair value through other comprehensive income (net) Share of other comprehensive income in equity accounted investees (net) Income tax (expense)/credit relating to items that will not be reclassified to profit or loss B0 Items that will be reclassified to profit or loss: a) Exchange differences in translating the financial statements of foreign operations (0) Gains and losses in cash flow hedges (C) Share of other comprehensive income in equity accounted investees (net) () Income tax (expense)/credit relating to items that will be reclassified to profit or loss Total other comprehensive income/(Loss) for the period (net of tax) Attributable to: a) Shareholders of the Company (b) Non-controlling interests XIII. Total comprehensive income/loss) for the period (net of tax) (XI+XII) Attributable to: a Shareholders of the Company (6) Non-controlling interests XIV. Earnings per equity share (EPS) a) Ordinary shares (face value of 2 each): 10) Basic EPS (0) Diluted EPS (b) A' Ordinary shares (face value of 2 each): Basic EPS (1) Diluted EPS 21 IX (1119) 11,155.03 3,303.46 1.038,47 4,341.93 6,813.10 2.278.26 9,091.36 8,988.91 102.45 8 (2,561.26) 35.60 11.15 (1.746.24 697.41 (2.010.22) 52.82 (58.61) 3.58 (5,575.77) 15,575,50) (34,299.97) (34,401.73) 101.76 4,676.51 42.86 (7.16) 1,227.74 (991.02) 9,518.15 18,069.71 429.41 (3.403.69 29,562.51 29,535.61 26.90 38,653.87 38,524.52 129.35 0.27 44 (84.89) (84.89 26.46 26.45 26.56 26.55 (84.89 (84.89 Consolidated Balance Sheet in crores) As at March 31, 2018 As at March 31, 2019 Notes 5 6a) 60 8 72,619.86 8,538.17 747.87 37,866.74 23,345.67 4.743.38 73,867.84 16.142.94 116.45 47,429.57 23,890.56 4,887.89 9 17 11 12 21 cos 1,497.51 22,073.17 407.42 2,809.18 5151.11 1,024.56 2.938.73 183,763.37 763.76 15,479.53 495.41 4,563.87 4158.70 899.90 2.681.25 195,377.67 42,137.63 497.35 19 13 8 (c) 39,013.73 591.50 10 14 15 16 17 11 12 ASSETS (1) NON-CURRENT ASSETS (a) Property, plant and equipment (b) Capital work-in-progress (C) Goodwill d) Other intangible assets e) Intangible assets under development (6) Investment in equity accounted investees (9) Financial assets. (0) Other investments ) Finance receivables (ii) Loans and advances (iv) Other financial assets (h) Deferred tax assets (net) Non-current tax assets (net) Other non-current assets (2) CURRENT ASSETS (a) Inventories (b) Investment in equity accounted investees (held for sale) (c) Financial assets: (0) Other investments ) Trade receivables (ii) Cash and cash equivalents (iv) Bank balances other than (ii) above (v) Finance receivables (vi) Loans and advances (vii) Other financial assets d) Current tax assets (net) (e) Assets classified as held-for-sale (f) Other current assets TOTAL ASSETS EQUITY AND LIABILITIES EQUITY (a) Equity share capital (b) Other equity Equity attributable to owners of Tata Motors Ltd Non-controlling interests LIABILITIES (1) NON-CURRENT LIABILITIES (a) Financial liabilities: Borrowings Other Financial liabilities (b) Provisions c) Deferred tax liabilities (net) d) Other non-current liabilities (2) CURRENT LIABILITIES (a) Financial liabilities: 0_Borrowings (b) Trade payables (a) Total outstanding dues of micro and small enterprises (b) Total outstanding dues of creditors other than micro and small enterprises (iii) Acceptances (iv) Other financial liabilities (6) Provisions (C) Current tax liabilities (net) d) Liabilities directly associated with Assets held-for-sale le) Other current liabilities TOTAL EQUITY AND LIABILITIES 8.938.33 18,996.17 21,559.80 11.089.02 11.551.52 1,268.70 3,213.56 184.37 162.24 6,862.22 123,431.16 307,194.53 14,663.75 19,893.30 14,716.75 19,897.16 8.401.65 1.451.14 3,857.64 208.91 2,585.19 7,662.37 135,972.84 331,350.51 46 (b) 20 II. 22 679.22 59,500.34 60.179.56 523.06 60,702.62 679.22 94.748.69 95,427,91 525.06 95,952.97 29 21 30 70,973.67 2,792.71 11,854.85 1,491.04 13.922.21 101,034.48 61.199.50 2,739.14 10,948.44 6,125.80 11.165.19 92.178.07 26 20,150.26 16,794.85 28 130.69 68,38284 3.177.14 32,855.65 10.196.75 1,017.64 144.24 71.894 17 4.901.42 31,267.49 7,953.50 1,559.07 1.070.18 7,634.55 143,219.47 331,350.51 46 (b) 9,546.46 145,457.43 307,194.53 niny 1101

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts