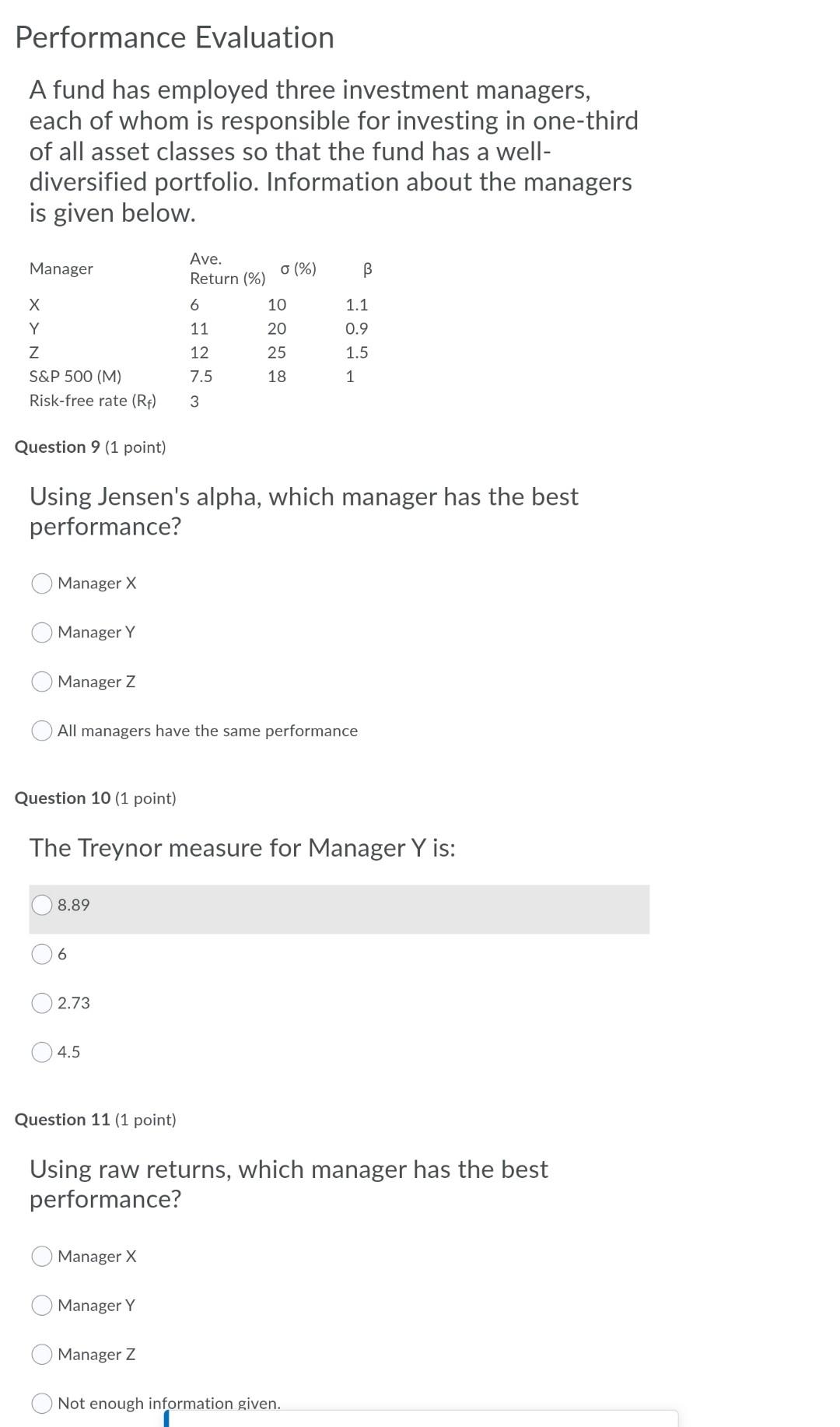

Question: Performance Evaluation A fund has employed three investment managers, each of whom is responsible for investing in one-third of all asset classes so that the

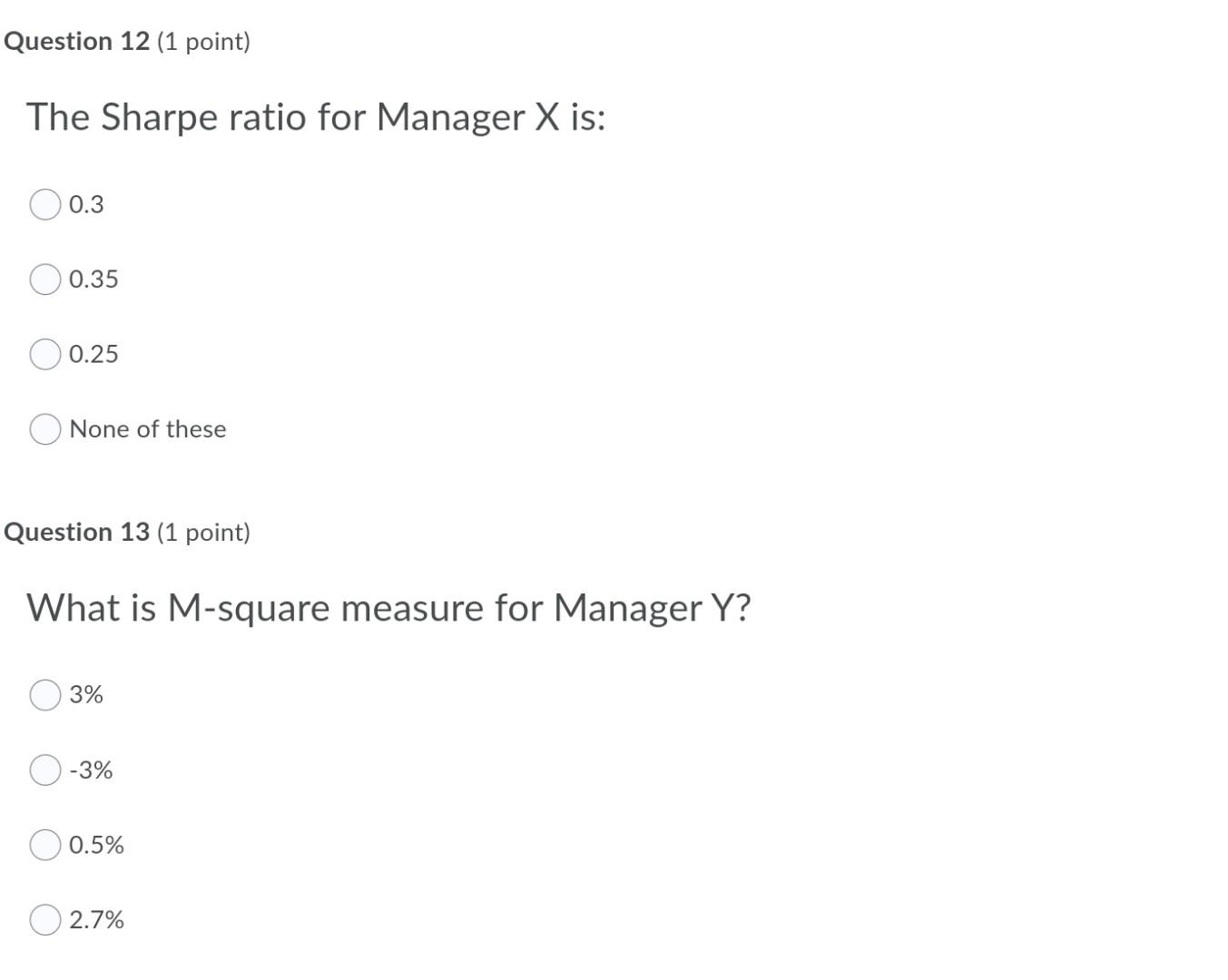

Performance Evaluation A fund has employed three investment managers, each of whom is responsible for investing in one-third of all asset classes so that the fund has a well- diversified portfolio. Information about the managers is given below. Manager Ave. Return (%) 0(%) B X 10 6 11 Y 1.1 0.9 1.5 Z S&P 500 (M) Risk-free rate (RF) 20 25 18 12 7.5 1 3 Question 9 (1 point) Using Jensen's alpha, which manager has the best performance? Manager X Manager Y Manager Z All managers have the same performance Question 10 (1 point) The Treynor measure for Manager Yis: 8.89 6 2.73 4.5 Question 11 (1 point) Using raw returns, which manager has the best performance? Manager X Manager Y Manager Z Not enough information given. Question 12 (1 point) The Sharpe ratio for Manager X is: 0.3 0.35 0.25 None of these Question 13 (1 point) What is M-square measure for Manager Y? 3% -3% 0.5% 02.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts