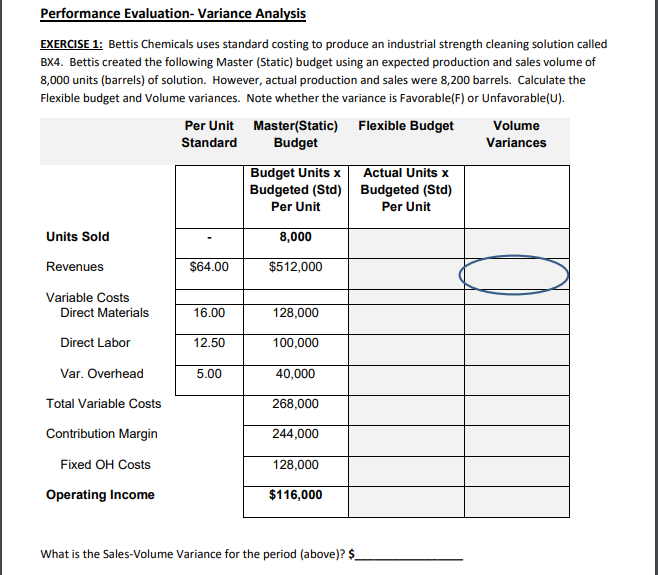

Question: Performance Evaluation- Variance Analysis EXERCISE 1: Bettis Chemicals uses standard costing to produce an industrial strength cleaning solution called BX4. Bettis created the following Master

Performance Evaluation- Variance Analysis EXERCISE 1: Bettis Chemicals uses standard costing to produce an industrial strength cleaning solution called BX4. Bettis created the following Master (Static) budget using an expected production and sales volume of 8,000 units (barrels) of solution. However, actual production and sales were 8,200 barrels. Calculate the Flexible budget and Volume variances. Note whether the variance is Favorable(F) or Unfavorable (U). Master(Static) Flexible Budget Budget Per Unit Volume Standard Variances Budget Units x Budgeted (Std) Actual Units x Budgeted (Std) Per Unit Per Unit Units Sold 8,000 Revenues $64.00 $512,000 Variable Costs Direct Materials 16.00 128,000 100,000 Direct Labor 12.50 Var. Overhead 5.00 40,000 Total Variable Costs 268,000 Contribution Margin 244,000 Fixed OH Costs 128,000 $116,000 Operating Income What is the Sales-Volume Variance for the period (above)? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts