Question: performance & Investor return: The VFF case VFF (Very First Fund) is a fund launched in Jan 1999 which managed to raise 320 million $

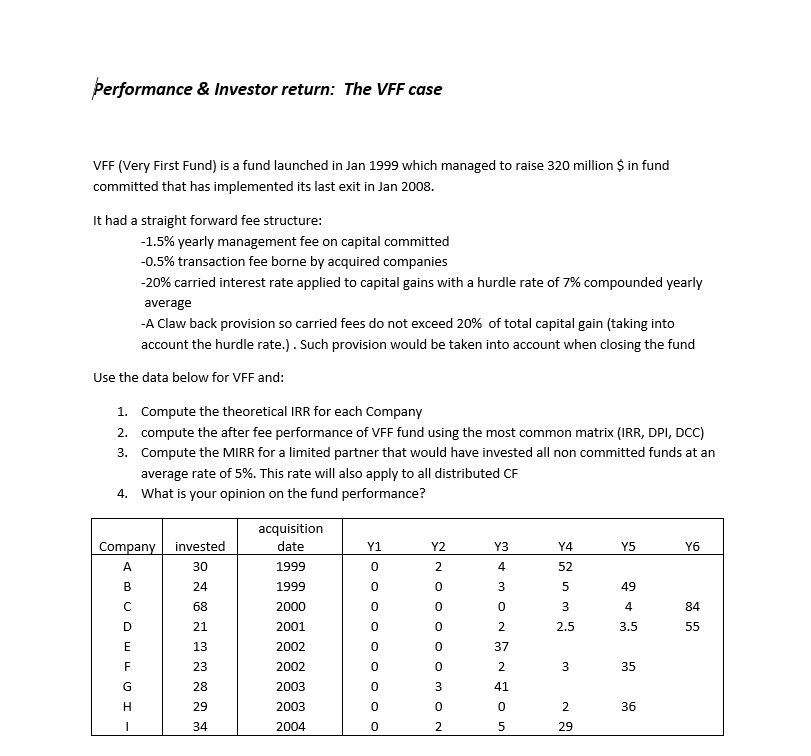

performance & Investor return: The VFF case VFF (Very First Fund) is a fund launched in Jan 1999 which managed to raise 320 million $ in fund committed that has implemented its last exit in Jan 2008. It had a straight forward fee structure: -1.5% yearly management fee on capital committed -0.5% transaction fee borne by acquired companies -20% carried interest rate applied to capital gains with a hurdle rate of 7% compounded yearly average -A Claw back provision so carried fees do not exceed 20% of total capital gain (taking into account the hurdle rate.). Such provision would be taken into account when closing the fund Use the data below for VFF and: 1. Compute the theoretical IRR for each company 2. compute the after fee performance of VFF fund using the most common matrix (IRR, DPI, DCC) 3. Compute the MIRR for a limited partner that would have invested all non committed funds at an average rate of 5%. This rate will also apply to all distributed CF 4. What is your opinion on the fund performance? Y1 Y3 Y4 Y5 6 Company A invested 30 0 4 52 O O NR 24 0 3 5 49 68 acquisition date 1999 1999 2000 2001 2002 2002 2003 0 0 3 4 84 - 21 0 0 2 2.5 3.5 55 13 0 0 37 23 0 2 3 35 28 0 41 U I 3 0 29 0 0 2 36 2003 2004 34 0 2 5 29 performance & Investor return: The VFF case VFF (Very First Fund) is a fund launched in Jan 1999 which managed to raise 320 million $ in fund committed that has implemented its last exit in Jan 2008. It had a straight forward fee structure: -1.5% yearly management fee on capital committed -0.5% transaction fee borne by acquired companies -20% carried interest rate applied to capital gains with a hurdle rate of 7% compounded yearly average -A Claw back provision so carried fees do not exceed 20% of total capital gain (taking into account the hurdle rate.). Such provision would be taken into account when closing the fund Use the data below for VFF and: 1. Compute the theoretical IRR for each company 2. compute the after fee performance of VFF fund using the most common matrix (IRR, DPI, DCC) 3. Compute the MIRR for a limited partner that would have invested all non committed funds at an average rate of 5%. This rate will also apply to all distributed CF 4. What is your opinion on the fund performance? Y1 Y3 Y4 Y5 6 Company A invested 30 0 4 52 O O NR 24 0 3 5 49 68 acquisition date 1999 1999 2000 2001 2002 2002 2003 0 0 3 4 84 - 21 0 0 2 2.5 3.5 55 13 0 0 37 23 0 2 3 35 28 0 41 U I 3 0 29 0 0 2 36 2003 2004 34 0 2 5 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts