Question: PERFORMANCE TASK NO. 1 Pina Cute, a lawyer, decided to open a law firm named Cute Law Firm. The chart of accounts listed below will

PERFORMANCE TASK NO. 1

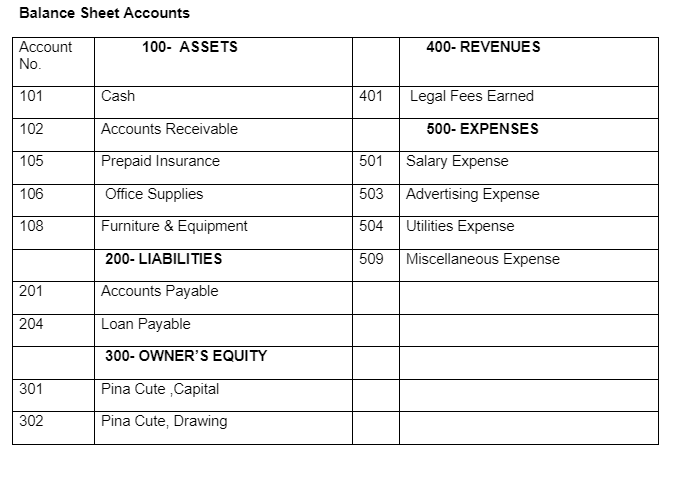

Pina Cute, a lawyer, decided to open a law firm named Cute Law Firm. The chart of accounts listed below will be used for recording purposes.

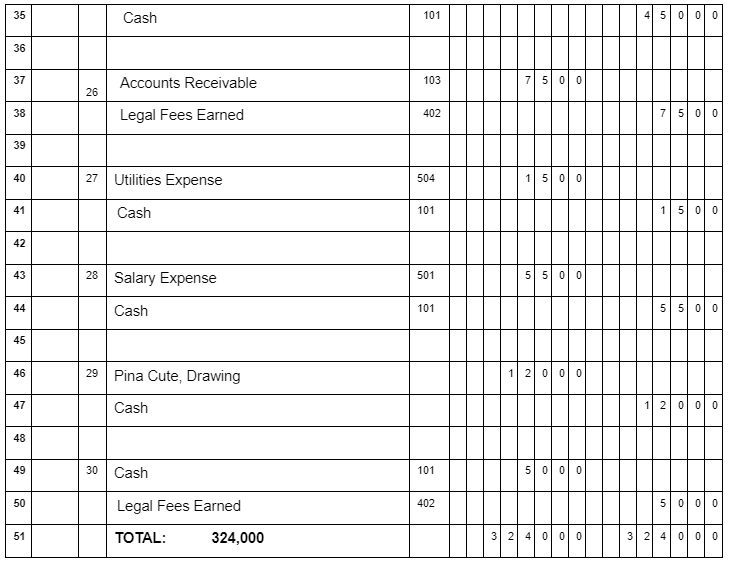

NOTE: The whole thing may need to be reviewed since it will not balance

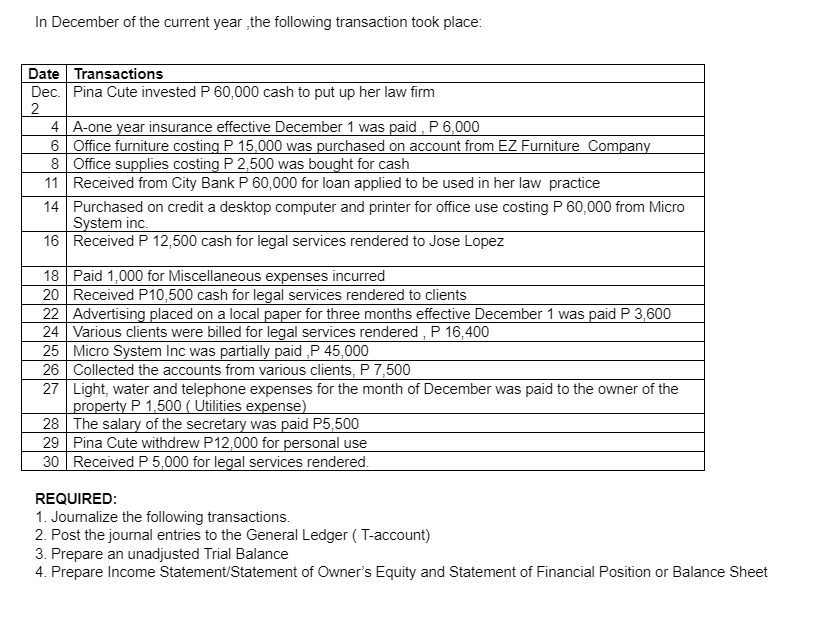

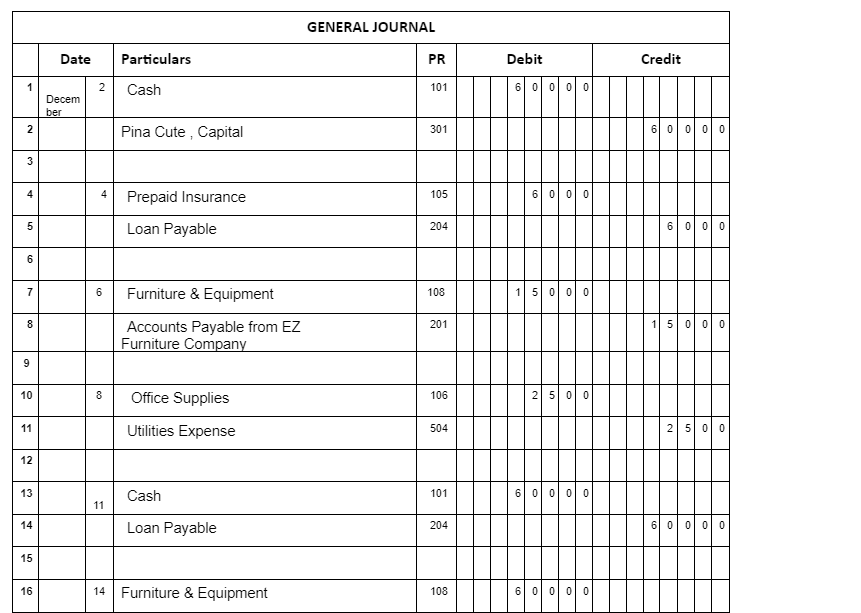

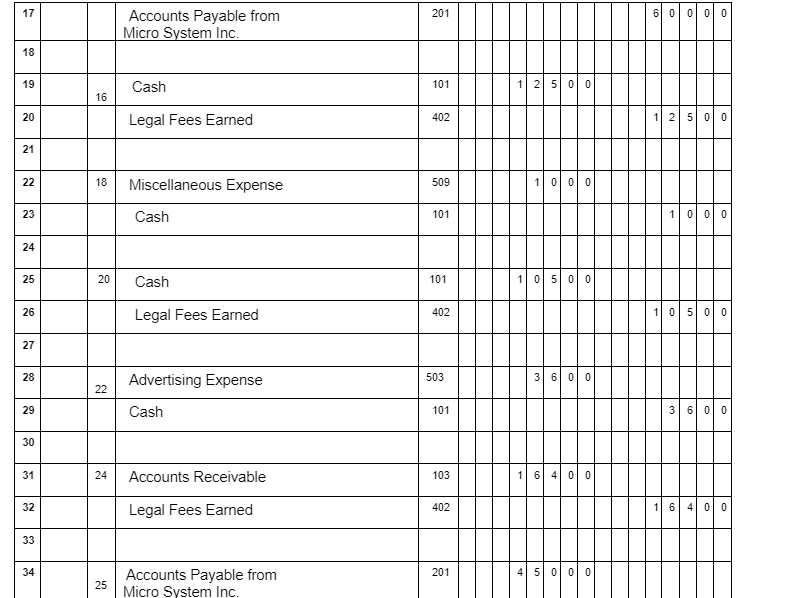

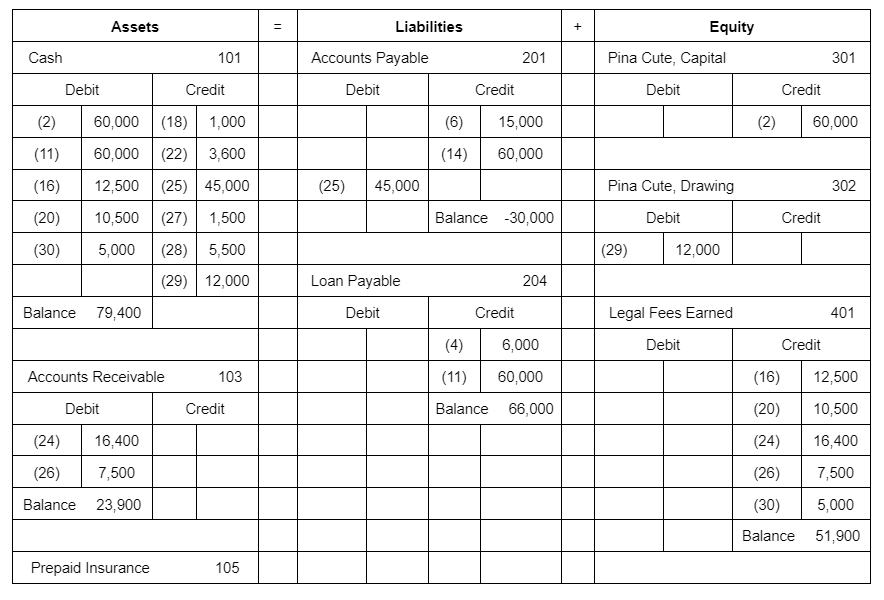

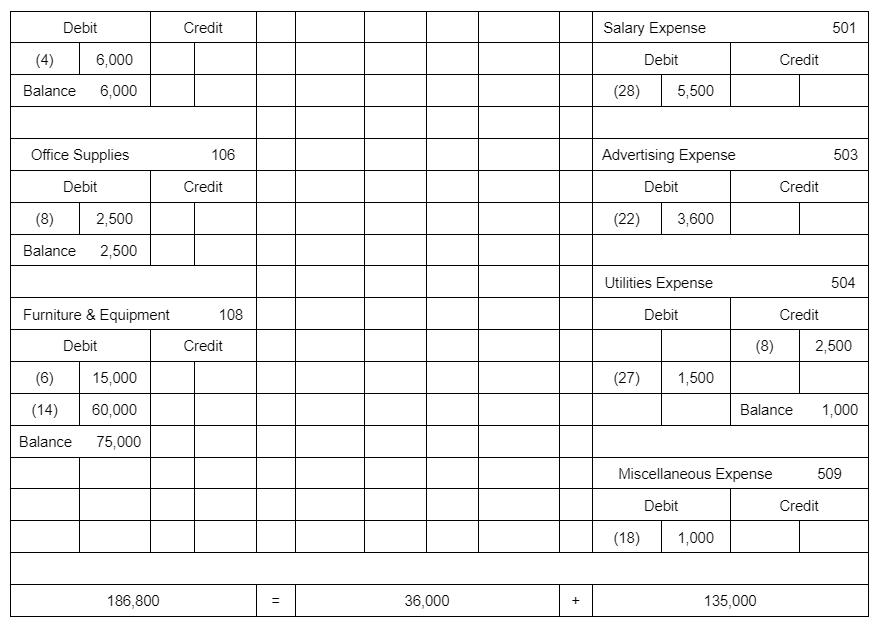

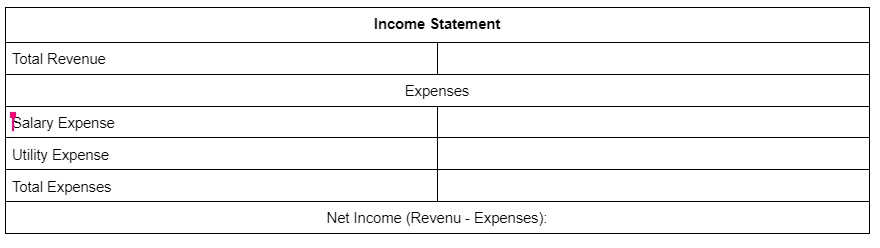

Balance Sheet Accounts Account 100- ASSETS 400- REVENUES No. 101 Cash 401 Legal Fees Earned 102 Accounts Receivable 500-EXPENSES 105 Prepaid Insurance 501 Salary Expense 106 Office Supplies 503 Advertising Expense 108 Furniture & Equipment 504 Utilities Expense 200- LIABILITIES 509 Miscellaneous Expense 201 Accounts Payable 204 Loan Payable 300- OWNER'S EQUITY 301 Pina Cute Capital Pina Cute, Drawing 302 In December of the current year the following transaction took place: Date Transactions Dec. Pina Cute invested P 60,000 cash to put up her law firm 2 4 A-one year insurance effective December 1 was paid , P 6,000 6 Office furniture costing P 15,000 was purchased on account from EZ Furniture Company 8 Office supplies costing P 2,500 was bought for cash 11 Received from City Bank P 60,000 for loan applied to be used in her law practice 14 Purchased on credit a desktop computer and printer for office use costing P60,000 from Micro System inc. 16 Received P 12,500 cash for legal services rendered to Jose Lopez 18 Paid 1,000 for Miscellaneous expenses incurred 20 Received P10,500 cash for legal services rendered to clients 22 Advertising placed on a local paper for three months effective December 1 was paid P 3,600 24 Various clients were billed for legal services rendered, P 16,400 25 Micro System Inc was partially paid ,P 45,000 26 Collected the accounts from various clients, P 7,500 27 Light, water and telephone expenses for the month of December was paid to the owner of the property P 1,500 ( Utilities expense) 28 The salary of the secretary was paid P5,500 29 Pina Cute withdrew P12,000 for personal use 30 Received P5,000 for legal services rendered. REQUIRED: 1. Journalize the following transactions. 2. Post the journal entries to the General Ledger (T-account) 3. Prepare an unadjusted Trial Balance 4. Prepare Income Statement/Statement of Owner's Equity and Statement of Financial Position or Balance Sheet GENERAL JOURNAL Date Particulars PR Debit Credit 1 2 Cash 101 6 0 0 0 0 Decem ber N 2 Pina Cute , Capital 301 3 4 105 Prepaid Insurance 61 01010 5 Loan Payable 204 6 0 0 0 6 7 6 108 1 5 0 0 0 Furniture & Equipment Accounts Payable from EZ Furniture Company 8 201 1 5 0 0 0 9 10 8 Office Supplies 106 2 500 11 Utilities Expense 504 2 500 12 . 13 Cash 101 6 0 0 0 0 11 14 Loan Payable 204 15 16 14 Furniture & Equipment 108 17 201 61 0 0 0 0 Accounts Payable from Micro System Inc. 18 19 Cash 101 2 500 16 20 Legal Fees Earned 402 1 2 5 0 0 21 22 18 Miscellaneous Expense 509 1 0 0 0 23 Cash 101 1 0 0 0 24 25 20 Cash 101 1 0 5 0 0 26 Legal Fees Earned 402 1 0 5 0 0 27 28 503 Advertising Expense 3 6 0 0 22 29 Cash 101 3600 30 31 24 Accounts Receivable 103 1 6400 32 Legal Fees Earned 402 1 6 4 0 0 33 34 201 5 0 0 0 25 Accounts Payable from Micro System Inc. 35 Cash 101 45|0|0|0 36 37 Accounts Receivable 103 5 00 26 38 Legal Fees Earned 402 7 5 0 0 39 40 27 Utilities Expense 504 5 0 0 41 Cash 101 15 00 42 43 28 Salary Expense 501 5 5 0 0 44 Cash 101 5 5 0 0 45 46 29 Pina Cute, Drawing 1 47 Cash 1 2 0 0 0 48 49 30 Cash 101 5 0 0 0 50 402 Legal Fees Earned 5 000 51 TOTAL: 324,000 3 2 4 000 31 21 4 0 0 0 Assets Liabilities + Equity Cash 101 Accounts Payable 201 Pina Cute, Capital 301 Debit Credit Debit Credit Debit Credit (2) (6) 15,000 (2) 60,000 (11) (14) 60,000 (16) (25) 45,000 Pina Cute, Drawing 302 60,000 (18) 1,000 60,000 (22) 3,600 12,500 (25) 45,000 10,500 (27) 1,500 5,000 (28) 5,500 (29) 12,000 Balance -30,000 Debit Credit (20) (30) (29) 12,000 Loan Payable 204 Balance 79,400 Debit Credit Legal Fees Earned 401 (4) 6,000 Debit Credit Accounts Receivable 103 (11) 60,000 (16) (20) 12,500 10,500 Debit Credit Balance 66,000 (24) 16,400 (24) 16,400 (26) 7,500 (26) 7,500 Balance 23,900 (30) 5,000 Balance 51,900 Prepaid Insurance 105 Debit Credit Salary Expense 501 (4) 6,000 Debit Credit Balance 6,000 (28) 5,500 Office Supplies 106 Advertising Expense 503 Debit Credit Debit Credit (8) 2,500 (22) 3,600 Balance 2,500 Utilities Expense 504 Furniture & Equipment 108 Debit Credit Debit Credit (8) 2,500 (6) 15,000 (27) 1,500 (14) 60,000 Balance 1,000 Balance 75,000 Miscellaneous Expense 509 Debit Credit (18) 1,000 186,800 11 36,000 + 135,000 Income Statement Total Revenue Expenses Salary Expense Utility Expense Total Expenses Net Income (Revenu - Expenses)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts