Question: Perhaps more surprising to Mr. Pitkin was a proposal by the VP of Marketing to make a major investment in market share by increasing

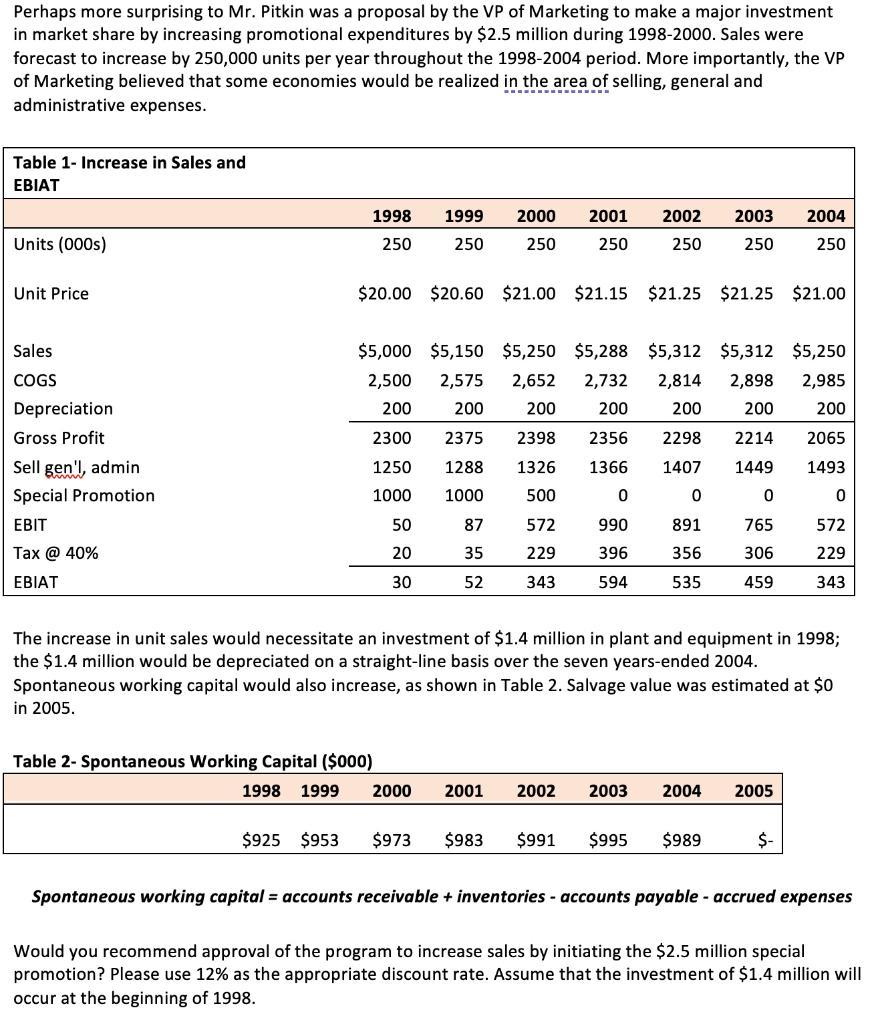

Perhaps more surprising to Mr. Pitkin was a proposal by the VP of Marketing to make a major investment in market share by increasing promotional expenditures by $2.5 million during 1998-2000. Sales were forecast to increase by 250,000 units per year throughout the 1998-2004 period. More importantly, the VP of Marketing believed that some economies would be realized in the area of selling, general and administrative expenses. Table 1- Increase in Sales and EBIAT Units (000s) Unit Price Sales. COGS Depreciation Gross Profit Sell gen'l, admin Special Promotion EBIT Tax @ 40% EBIAT 1998 250 $20.00 $20.60 $21.00 $21.15 $21.25 $21.25 $21.00 2300 1250 1000 $5,000 $5,150 $5,250 $5,288 $5,312 $5,312 $5,250 2,575 2,652 2,732 2,814 2,898 2,985 200 2,500 200 200 200 200 200 200 2375 2398 2356 2298 2214 2065 1288 1326 1366 1407 1449 1493 1000 500 0 0 0 0 572 990 891 765 572 229 396 356 306 229 343 594 535 459 343 1999 2000 2001 2002 2003 2004 250 250 250 250 250 250 50 20 30 Table 2- Spontaneous Working Capital ($000) 87 35 52 The increase in unit sales would necessitate an investment of $1.4 million in plant and equipment in 1998; the $1.4 million would be depreciated on a straight-line basis over the seven years-ended 2004. Spontaneous working capital would also increase, as shown in Table 2. Salvage value was estimated at $0 in 2005. 1998 1999 2000 2001 2002 $925 $953 $973 $983 $991 2003 2004 2005 $995 $989 $- Spontaneous working capital = accounts receivable + inventories- accounts payable - accrued expenses Would you recommend approval of the program to increase sales by initiating the $2.5 million special promotion? Please use 12% as the appropriate discount rate. Assume that the investment of $1.4 million will occur at the beginning of 1998.

Step by Step Solution

There are 3 Steps involved in it

To determine whether the investment in the special promotion should be approved we need to calculate the net present value NPV of the project NPV is calculated by discounting the cash flows associated ... View full answer

Get step-by-step solutions from verified subject matter experts