Question: Periodic Inventory System and Inventory Costing Methods P2. The inventory of Wood4Fun and data on purchases and sales for a two-month period follow. The company

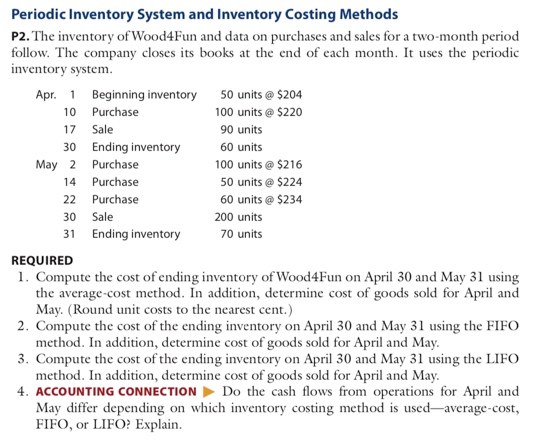

Periodic Inventory System and Inventory Costing Methods P2. The inventory of Wood4Fun and data on purchases and sales for a two-month period follow. The company closes its books at the end of each month. It uses the periodic inventory system. Apr.1 Beginning inventory 50 units @ $204 10 Purchase 100 units @ $220 17 Sale 90 units 30 Ending inventory 60 units May 2 Purchase 100 units @ $216 14 Purchase 50 units @ $224 22 Purchase 60 units @ $234 30 Sale 200 units 31 Ending inventory 70 units REQUIRED 1. Compute the cost of ending inventory of Wood4Fun on April 30 and May 31 using the average cost method. In addition, determine cost of goods sold for April and May. (Round unit costs to the nearest cent.) 2. Compute the cost of the ending inventory on April 30 and May 31 using the FIFO method. In addition, determine cost of goods sold for April and May. 3. Compute the cost of the ending inventory on April 30 and May 31 using the LIFO method. In addition, determine cost of goods sold for April and May. 4. ACCOUNTING CONNECTION Do the cash flows from operations for April and May differ depending on which inventory costing method is used average cost, FIFO, or LIFO? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts