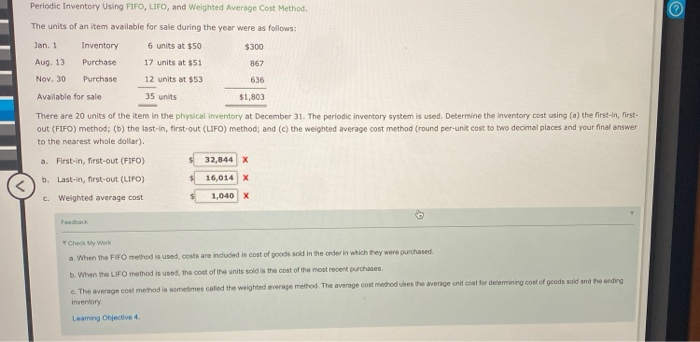

Question: Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Method. The units of an item available for sale during the year were as follows: 35

Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Method. The units of an item available for sale during the year were as follows: 35 units Jan. 1 Inventory 6 units at $50 $300 Aug. 13 Purchase 17 units at $51 867 Nov. 30 Purchase 12 units at $53 Available for sale $1,803 There are 20 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first-in, first- out (FIFO) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method (round per-unit cost to two decimal places and your final answer to the nearest whole dollar). a. First-in, first-out (FIFO) 32,844 X b. Last-in, first-out (LIFO) 16,014 X c. Weighted average cost 1,040 x Check My Work a. When the FIFO method is used, costs are included in cost of goods sold in the order in which they were purchased. b. When the LIFO method is used, the cost of the units sold is the cost of the most recent purchases c. The average cost method is sometimes called the weighted average method. The average cost method uses the average unit cool for determining cost of goods sold and the ending inventory Learning Objective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts