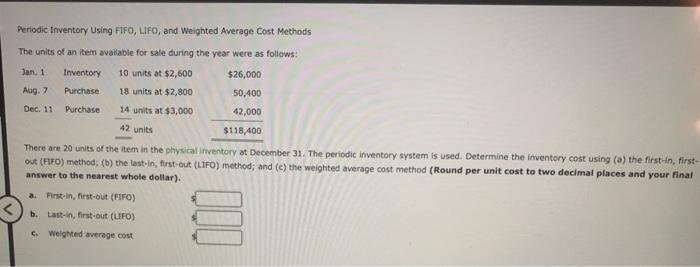

Question: Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan.

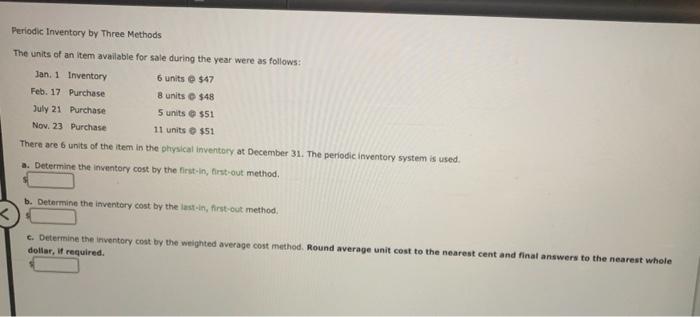

Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory Purchase 10 units at $2,600 18 units at $2,800 Aug. 7 $26,000 50,400 42,000 Dec. 11 Purchase 14 units at $3,000 42 units $118,400 There are 20 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first in, first- out (FFO) method: (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method (Round per unit cost to two decimal places and your final answer to the nearest whole dollar). a. First in, first-out (FIFO) b. Last-in, first-out (LIFO) Weighted average cost Periodic Inventory by Three Methods The units of an Item available for sale during the year were as follows: Jan. 1 Inventory 6 units $47 Feb. 17 Purchase 8 units $48 July 21 Purchase 5 units @ $51 Nov. 23 Purchase 11 units $51 There are 6 units of the item in the physical inventory at December 31. The periodic inventory system is used Determine the inventory cost by the first in, first-out method. b. Determine the inventory cost by the last-in, first-out method t. Determine the inventory cost by the weighted average cost method. Round average unit cost to the nearest cent and final answers to the nearest whole dollar, required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts