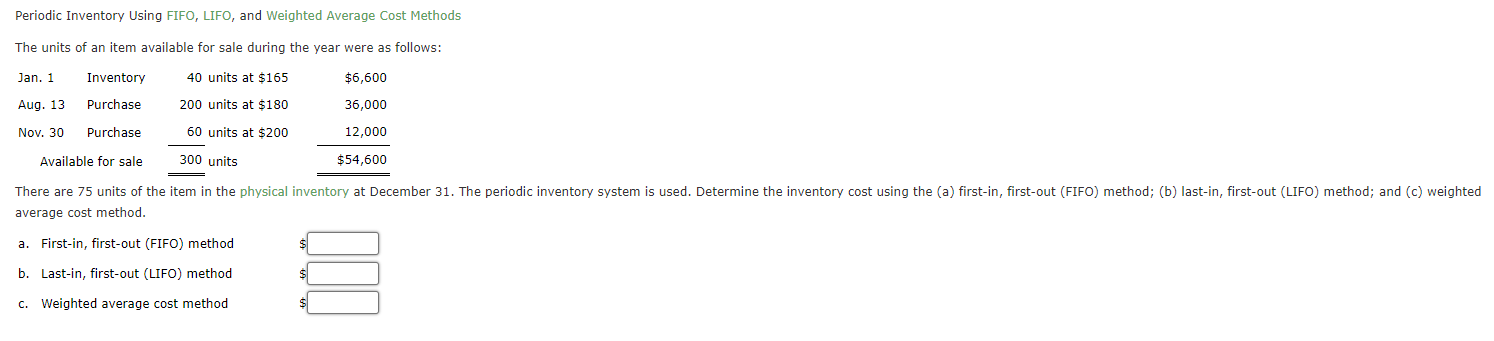

Question: Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan.

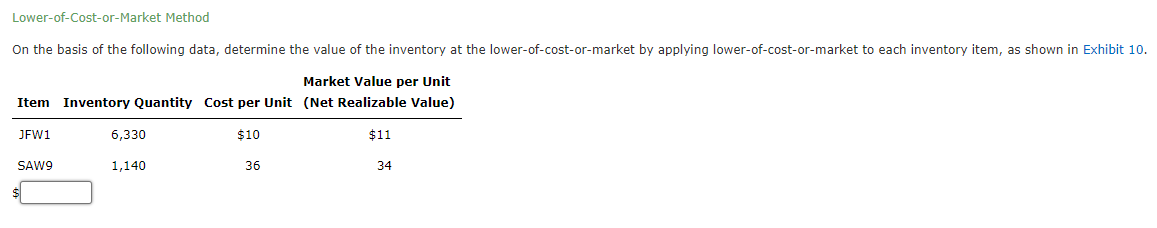

Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 40 units at $165 $6,600 Aug. 13 Purchase 200 units at $180 36,000 Nov. 30 Purchase 60 units at $200 12,000 Available for sale 300 units $54,600 There are 75 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using the (a) first-in, first-out (FIFO) method; (b) last-in, first-out (LIFO) method; and (c) weighted average cost method. a. First-in, first-out (FIFO) method b. Last-in, first-out (LIFO) method III C. Weighted average cost method Lower-of-Cost-or-Market Method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Market Value per Unit Item Inventory Quantity Cost per Unit (Net Realizable Value) JFW1 6,330 $10 $11 SAW9 1,140 36 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts