Question: PERIODIC METHOD please help Question 27 (1 point) Account titles available for use: Cash Purchases Purchase Returns Accounts Receivable Purchase Allowances Sales Revenue Freight Expense

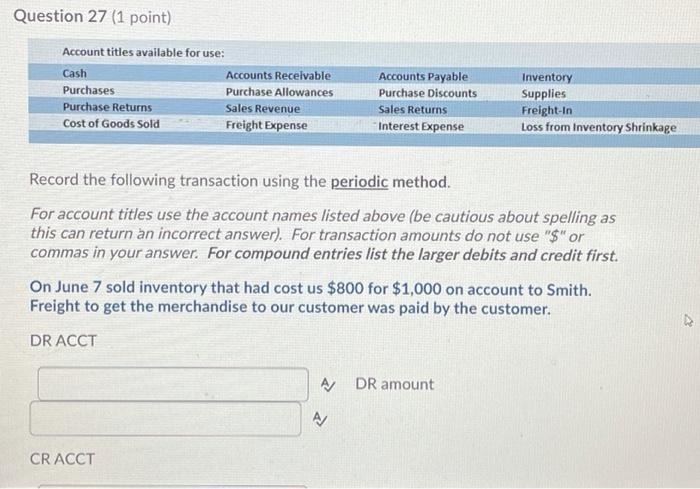

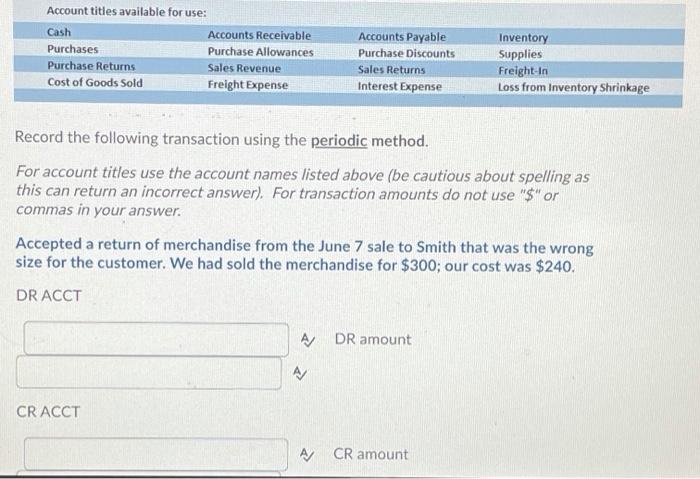

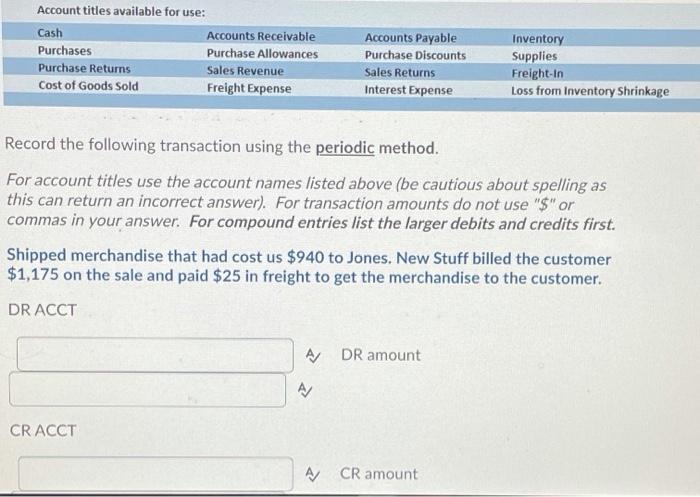

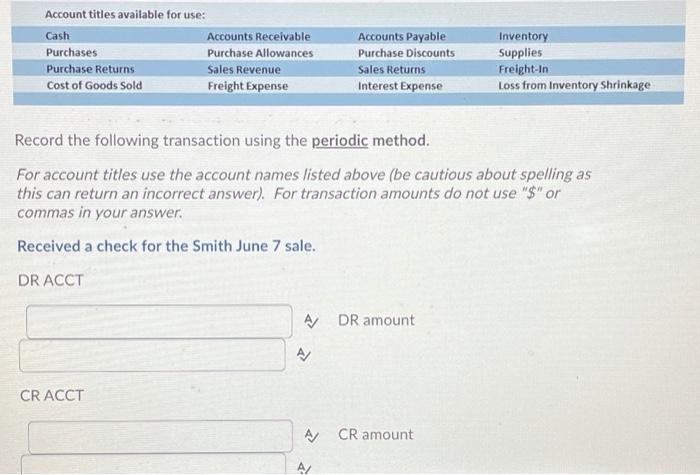

Question 27 (1 point) Account titles available for use: Cash Purchases Purchase Returns Accounts Receivable Purchase Allowances Sales Revenue Freight Expense Accounts Payable Purchase Discounts Sales Returns Interest Expense Inventory Supplies Freight-In Loss from Inventory Shrinkage Cost of Goods Sold Record the following transaction using the periodic method. For account titles use the account names listed above (be cautious about spelling as this can return an incorrect answer). For transaction amounts do not use "$" or commas in your answer. For compound entries list the larger debits and credit first. On June 7 sold inventory that had cost us $800 for $1,000 on account to Smith. Freight to get the merchandise to our customer was paid by the customer. DR ACCT A/ DR amount CR ACCT Account titles available for use: Accounts Receivable Accounts Payable Purchase Discounts Cash Purchases Purchase Returns Cost of Goods Sold Purchase Allowances Sales Revenue Inventory Supplies Freight-in Loss from Inventory Shrinkage Sales Returns Freight Expense Interest Expense Record the following transaction using the periodic method. For account titles use the account names listed above (be cautious about spelling as this can return an incorrect answer). For transaction amounts do not use "$" or commas in your answer. Accepted a return of merchandise from the June 7 sale to Smith that was the wrong size for the customer. We had sold the merchandise for $300; our cost was $240. DR ACCT A DR amount 4 CR ACCT A CR amount Account titles available for use: Cash Accounts Receivable Accounts Payable Purchase Discounts Purchases Purchase Allowances Sales Revenue Purchase Returns Sales Returns Inventory Supplies Freight-in Loss from Inventory Shrinkage Cost of Goods Sold Freight Expense Interest Expense Record the following transaction using the periodic method. For account titles use the account names listed above (be cautious about spelling as this can return an incorrect answer). For transaction amounts do not use "$" or commas in your answer. For compound entries list the larger debits and credits first. Shipped merchandise that had cost us $940 to Jones, New Stuff billed the customer $1,175 on the sale and paid $25 in freight to get the merchandise to the customer. DR ACCT A DR amount A/ CRACCT ACR amount Account titles available for use: Accounts Receivable Purchase Allowances Cash Purchases Purchase Returns Cost of Goods Sold Accounts Payable Purchase Discounts Sales Returns Inventory Supplies Freight-in Loss from Inventory Shrinkage Sales Revenue Freight Expense Interest Expense Record the following transaction using the periodic method. For account titles use the account names listed above (be cautious about spelling as this can return an incorrect answer). For transaction amounts do not use "$" or commas in your answer. Received a check for the Smith June 7 sale. DR ACCT ADR amount A CR ACCT A/ CR amount AL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts