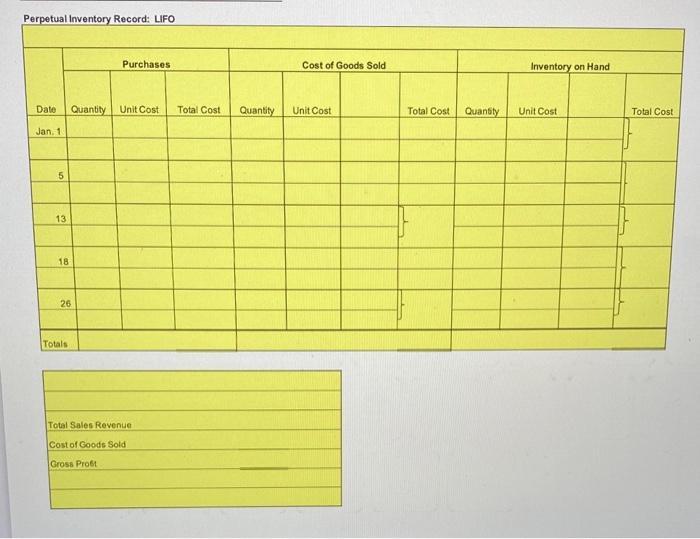

Question: Perpetual Inventory Record: FIFO Date Quantity Unit Cost Jan. 1 5 13 18 Purchases Totals Total Sales Revenue Cost of Goods Sold Gross Profit

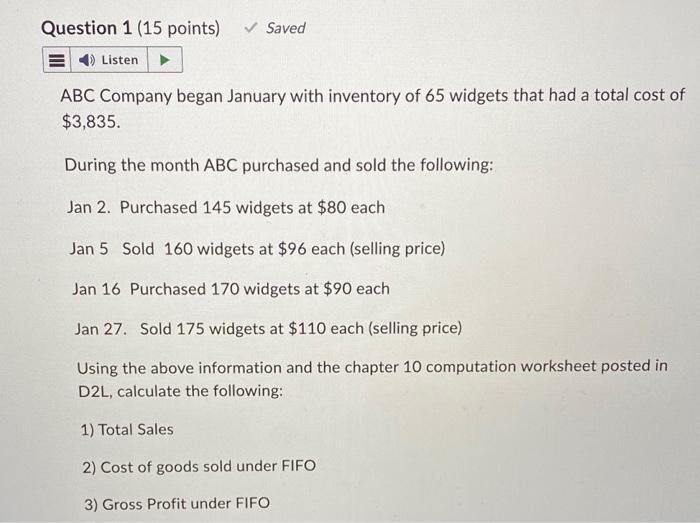

Perpetual Inventory Record: FIFO Date Quantity Unit Cost Jan. 1 5 13 18 Purchases Totals Total Sales Revenue Cost of Goods Sold Gross Profit Total Cost Quantity Cost of Goods Sold Unit Cost Total Cost Quantity Inventory on Hand Unit Cost Total Cost Perpetual Inventory Record: LIFO Date Quantity Unit Cost Jan. 1 5 13 18 26 Purchases Totals Total Sales Revenue Cost of Goods Sold Gross Proft Total Cost Quantity Cost of Goods Sold Unit Cost Total Cost Quantity Inventory on Hand Unit Cost Total Cost Question 1 (15 points) Listen Saved ABC Company began January with inventory of 65 widgets that had a total cost of $3,835. During the month ABC purchased and sold the following: Jan 2. Purchased 145 widgets at $80 each Jan 5 Sold 160 widgets at $96 each (selling price) Jan 16 Purchased 170 widgets at $90 each Jan 27. Sold 175 widgets at $110 each (selling price) Using the above information and the chapter 10 computation worksheet posted in D2L, calculate the following: 1) Total Sales 2) Cost of goods sold under FIFO 3) Gross Profit under FIFO 4) Ending inventory under FIFO 5) Cost of goods sold under LIFO 6) Gross Profit under LIFO 7) Ending inventory under LIFO

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts