Question: Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 37 units @ $19 Oct. 7

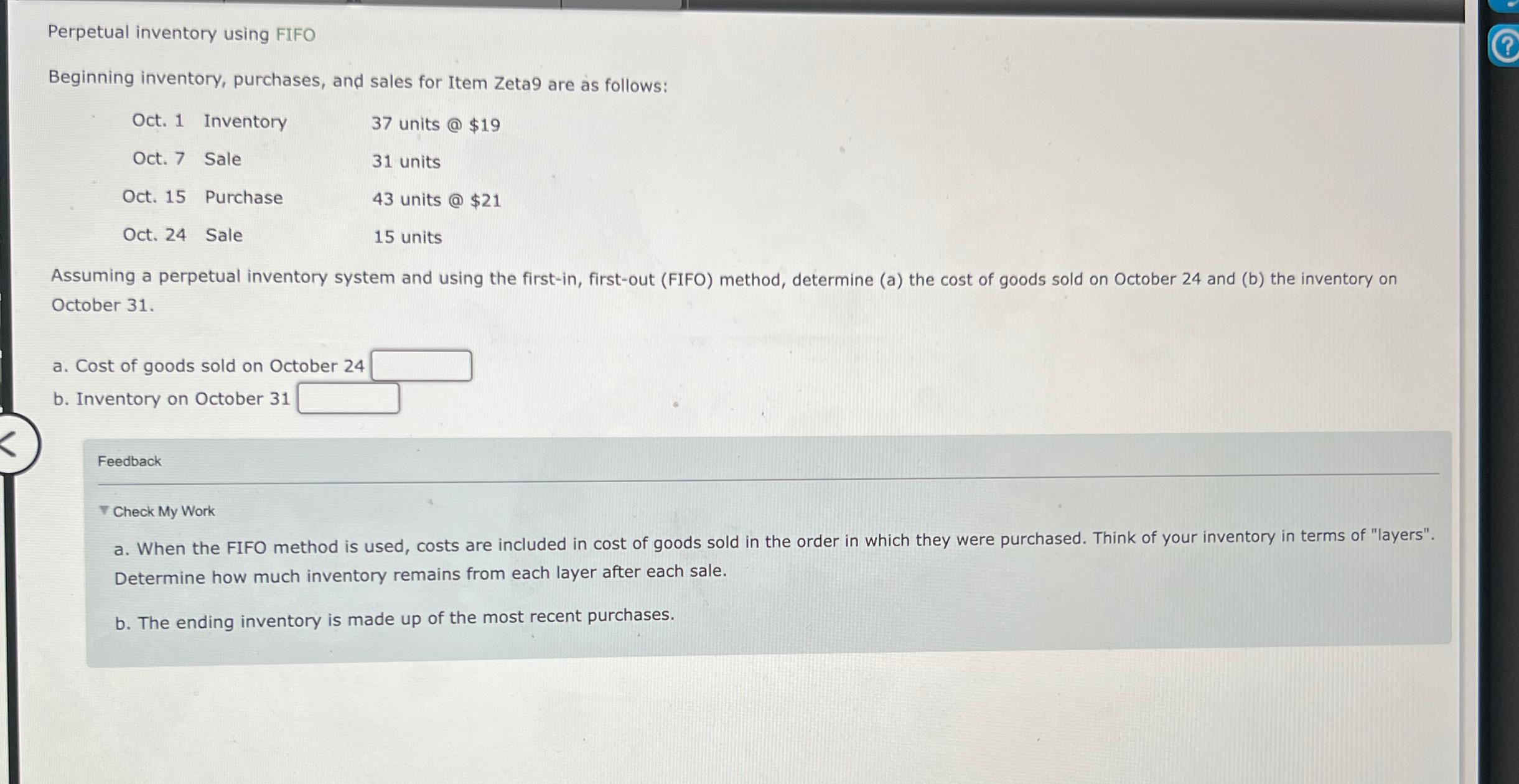

Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 37 units @ $19 Oct. 7 Sale Oct. 15 Purchase Oct. 24 Sale Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 b. Inventory on October 31 Feedback 31 units 43 units @ $21 15 units Check My Work a. When the FIFO method is used, costs are included in cost of ods sold in the order in which they were purchased. Think of your inventory in terms of "layers". Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases. ?

Step by Step Solution

There are 3 Steps involved in it

The question refers to accounting practices and specifically the FIFO FirstIn FirstOut inventory val... View full answer

Get step-by-step solutions from verified subject matter experts