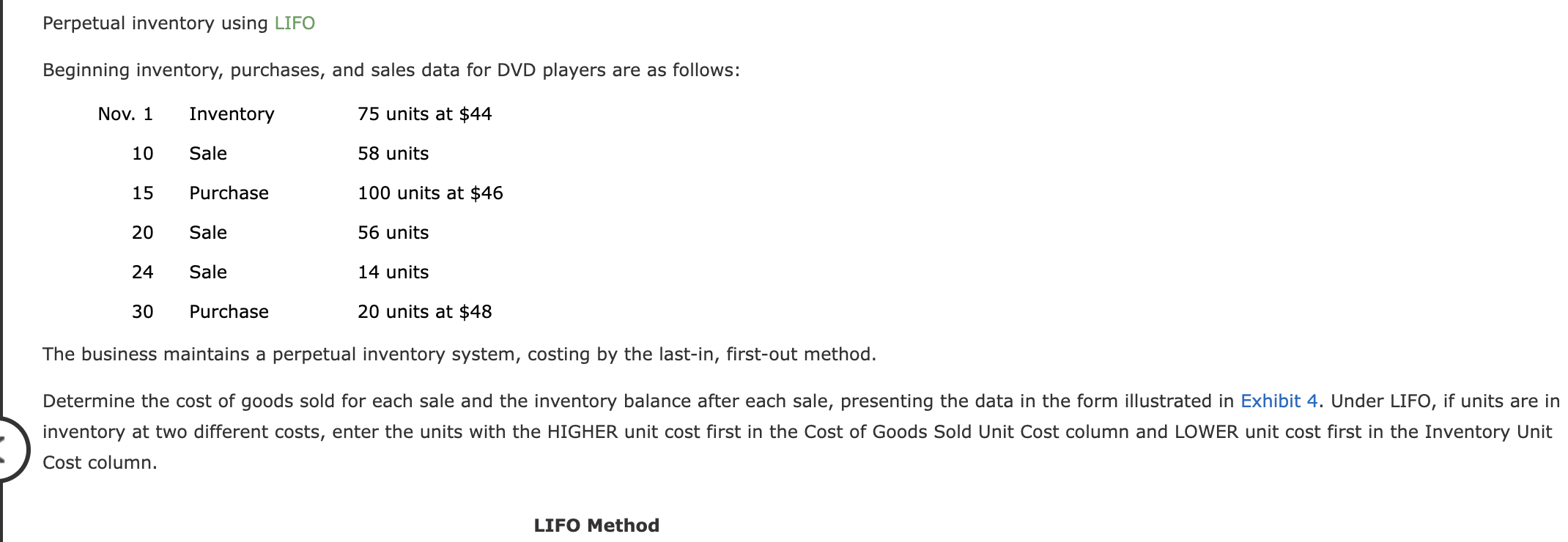

Question: Perpetual inventory using LIFO Beginning inventory, purchases, and sales data for DVD players are as follows: Nov. 1 Inventory 75 units at $44 10 Sale

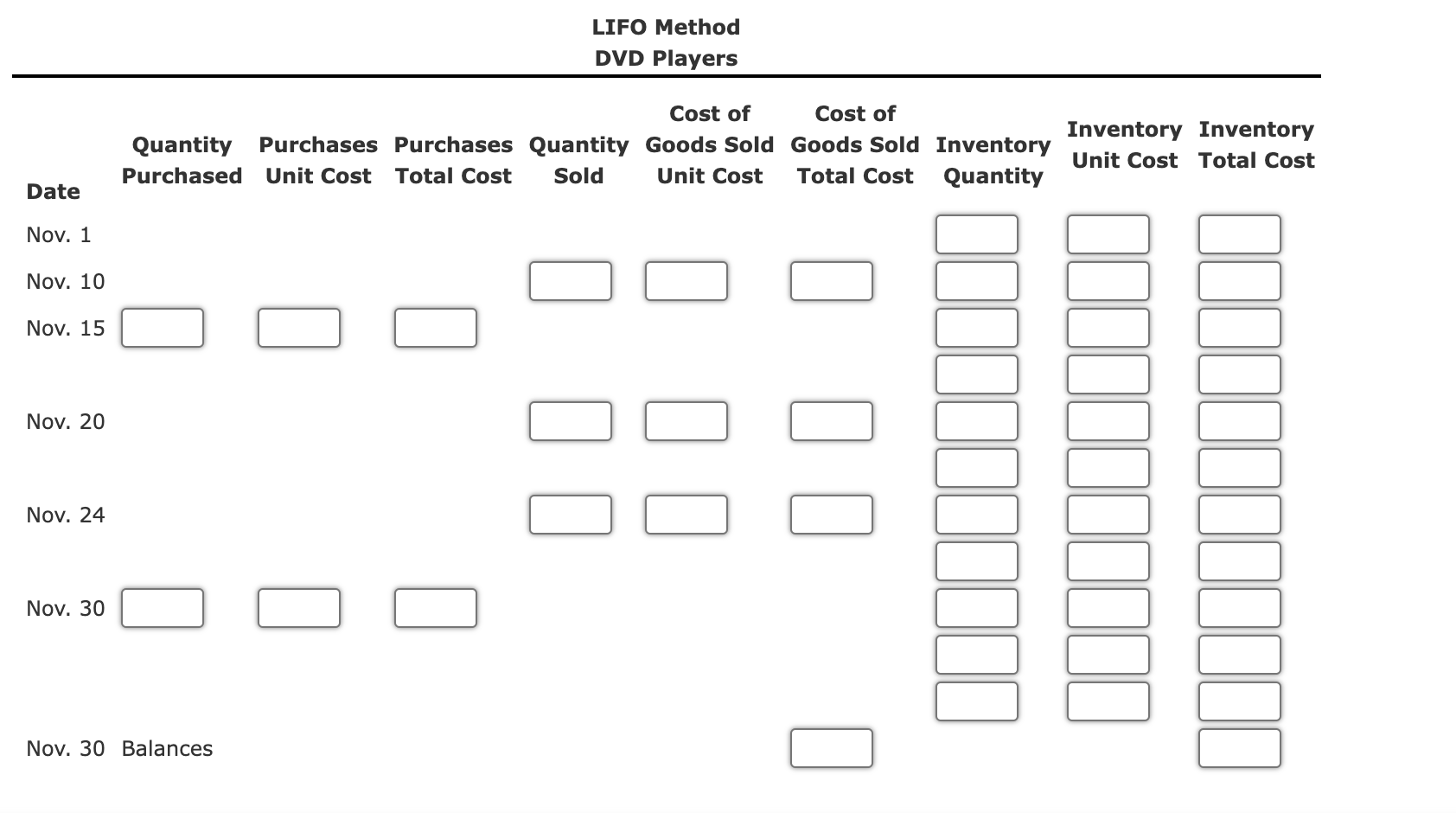

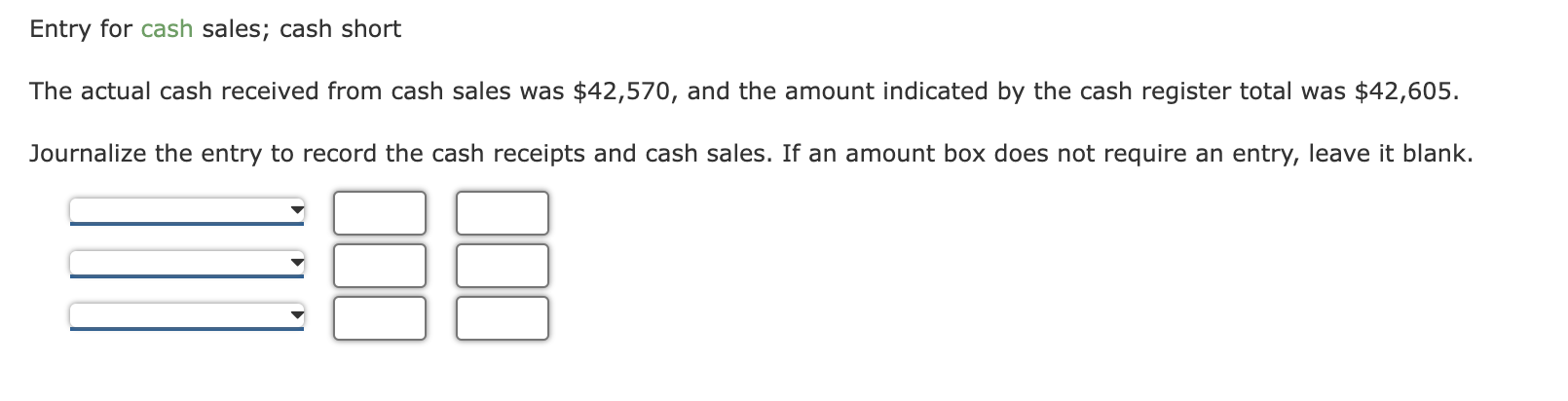

Perpetual inventory using LIFO Beginning inventory, purchases, and sales data for DVD players are as follows: Nov. 1 Inventory 75 units at $44 10 Sale 58 units 15 Purchase 100 units at $46 20 Sale 56 units 24 Sale 14 units 30 Purchase 20 units at $48 The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. LIFO Method LIFO Method DVD Players Cost of Cost of Quantity Purchases Purchases Quantity Goods Sold Goods Sold Inventory Purchased Unit Cost Total Cost Sold Unit Cost Total Cost Quantity Inventory Inventory Unit Cost Total Cost Date Nov. 1 Nov. 10 Nov. 15 Nov. 20 Nov. 24 Nov. 30 Nov. 30 Balances Entry for cash sales; cash short The actual cash received from cash sales was $42,570, and the amount indicated by the cash register total was $42,605. Journalize the entry to record the cash receipts and cash sales. If an amount box does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts