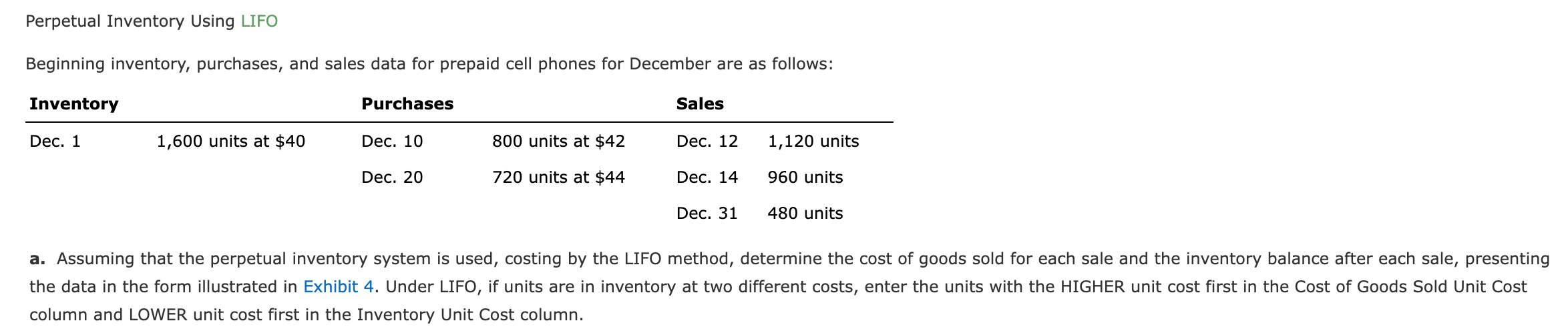

Question: Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: Inventory Purchases Sales Dec. 1 1,600

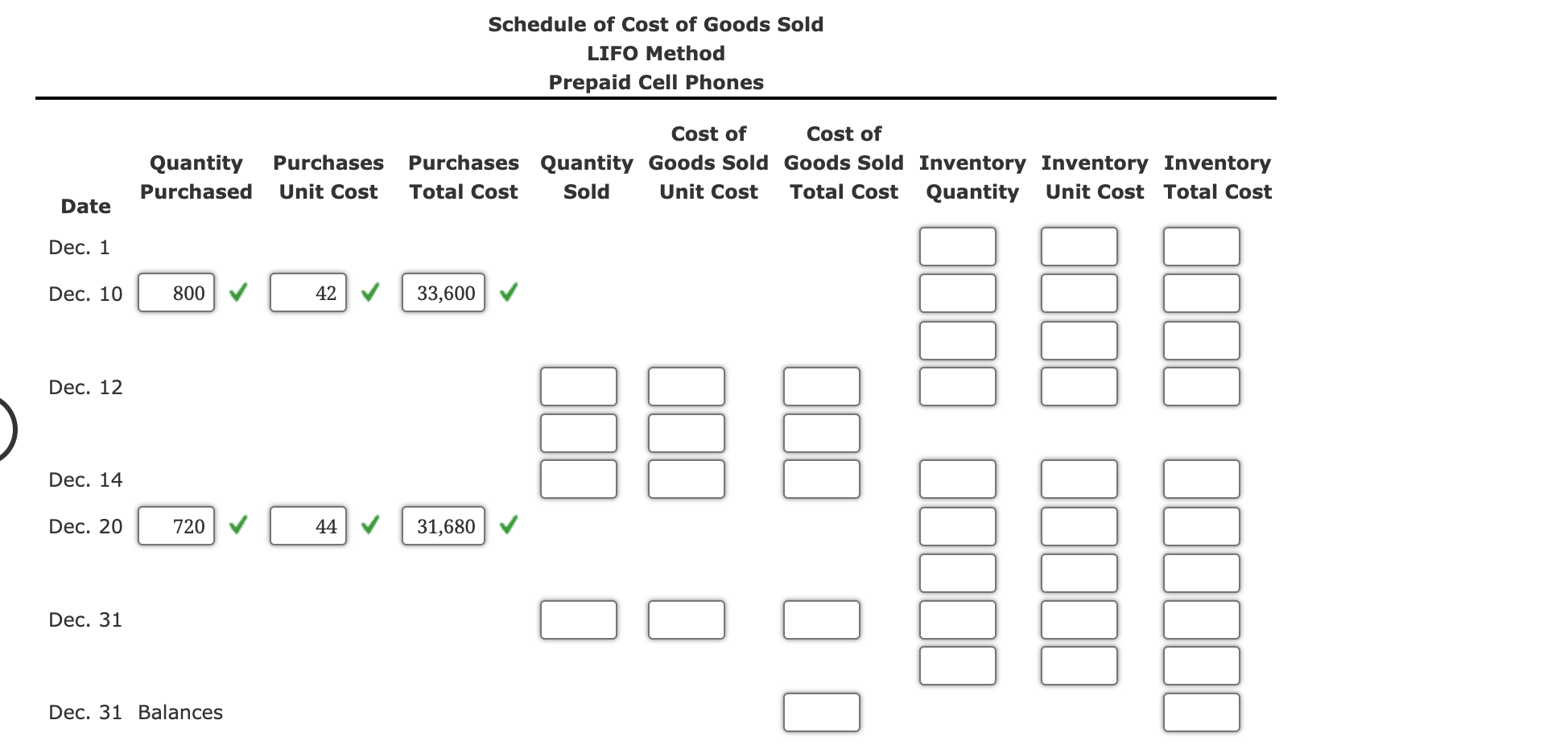

Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: Inventory Purchases Sales Dec. 1 1,600 units at $40 Dec. 10 Dec. 20 800 units at $42 720 units at $44 Dec. 12 1,120 units Dec. 14 960 units Dec. 31 480 units a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method Prepaid Cell Phones Cost of Cost of Quantity Purchased Purchases Purchases Quantity Goods Sold Unit Cost Total Cost Sold Unit Cost Goods Sold Inventory Inventory Inventory Total Cost Quantity Unit Cost Total Cost Date Dec. 1 Dec. 10 800 42 33,600 Dec. 12 Dec. 14 Dec. 20 720 44 31,680 Dec. 31 Dec. 31 Balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts