Question: Persimmon Inc. issues a bond with a $100,000 face value. The bond matures in three (3) years. The stated interest rate is 9% and the

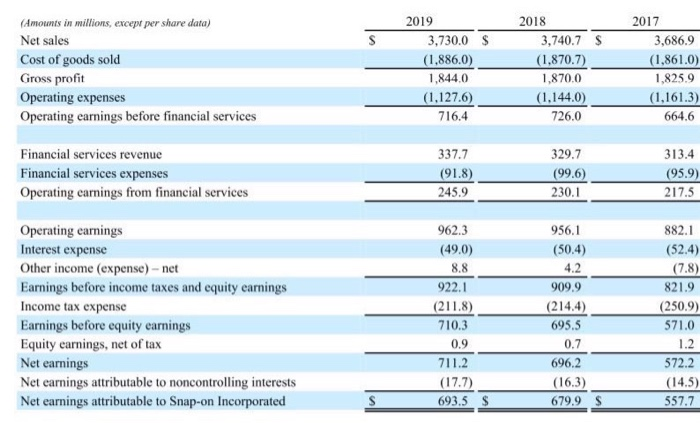

S S $ (Amounts in millions, except per share data) Net sales Cost of goods sold Gross profit Operating expenses Operating earnings before financial services 2019 3,730.0 (1.886.0) 1,844.0 (1.127.6) 716.4 2018 3,740.7 (1.870.7) 1,870.0 (1.144.0) 726.0 2017 3,686.9 (1,861.0) 1,825.9 (1,161.3) 664.6 Financial services revenue Financial services expenses Operating earnings from financial services 337.7 (91.8) 245.9 329.7 (99.6) 230.1 313.4 (95.9) 217.5 Operating earnings Interest expense Other income (expense) - net Earnings before income taxes and equity earnings Income tax expense Earnings before equity earnings Equity earnings, net of tax Net earnings Net earnings attributable to noncontrolling interests Net earnings attributable to Snap-on Incorporated 962.3 (49.0) 8.8 922.1 (211.8) 710.3 956.1 (50.4) 4.2 909.9 (214.4) 695.5 0.7 696,2 (16.3) 679.9 882.1 (52.4) (7.8) 821.9 (250.9) 571.0 1.2 572.2 0.9 711.2 (17.7) 693.5 (14.5) 557.7 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts