Question: Persistence Robert Meers was still contemplating The Question project when Janet McCutchins, the Vice President of New Products Development, came into Meers' office anxious to

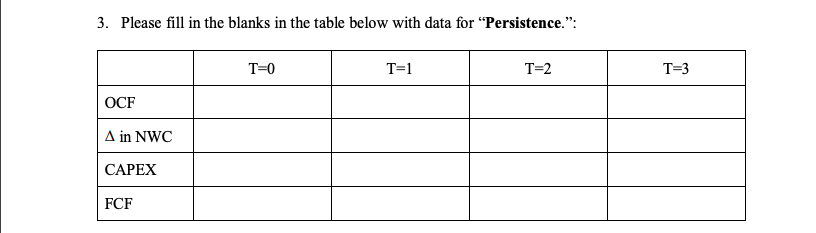

"Persistence" Robert Meers was still contemplating "The Question" project when Janet McCutchins, the Vice President of New Products Development, came into Meers' office anxious to meet with him. McCutchins was excited about a proposal she had developed for a new Reebok hiking shoe. The hiking shoe would be named "Persistence". The hiking sector is one of the fastest growing areas of the footwear industry -- and one that Reebok had not yet entered. Furthermore, Reebok's strategic plans were to enter into new areas of the athletic shoe industry with high anticipated growth, such as hiking and walking shoes. McCutchins was confident that hiking shoes would be the largest footwear trend in the next decade and suggested that, at the project's end, Reebok follow-up with another hiking shoe. In fact, she urged Reebok to investigate introducing an entire hiking shoe product line in the future. The target market for this shoe would be men and women in the 25 to 40 year old age category. McCutchins needs to produce a projected capital budgeting cash flow statement for "Persistence," and after some preliminary analysis, decides on the following: 1. The life of the project would be only 3 years, given the steep technological learning curve for this new product line. * Research Alert, 9/6/96, v.14, n.17, p.5 www.reebok.com/company/student.html. The "hiking and walking" category was the third largest in the athletic footwear industry (9%), as well as the fastest growing category. Source: Research Alert, 9/6/96, v.14, n.17, p.5. 2. The manufacturer's selling price of the shoe will be $90.00 3. This segment of the athletic shoe market is projected to reach $350 million during Year 1 and is growing at a rate of 15% per year. The segment market share projections for "Persistence" are: Year 1, 10%; Year 2, 16%, and Year 3, 19%. 4. Reebok will be able to use an idle section of one of its factories to produce the hiking shoe. A cost accountant has estimated that, according to the square footage in the factory, this section's overhead allocation would amount to $1.8 million per year. Note that Reebok would still incur these costs if the product is not undertaken. In addition, this section would remain idle for the life of the project if the "Persistence" project is not undertaken. 5. Reebok must purchase manufacturing equipment costing $10 million. The equipment falls into the five year MACRS depreciation category. As such, the depreciation percentages for the first three years, respectively, are: 20%, 32%, and 19%. The cash outlay will be today. at year 0, and depreciation will start in year 1. Reebok analysts estimate that the equipment can be sold for book value at the end of the project's life. Inventory and accounts receivable accounts will increase by $25 million at year 0 and will be recovered at the end of the project (year 3). The firm's accounts payable balance is projected to increase by $10 million at year 0 and will also be recovered at the end of the project. 7. Because Reebok has not yet entered the hiking shoe market, the introduction of this product is not expected to have an impact on sales of Reebok's other shoe lines. 8. Variable costs of producing the shoe are expected to be 17% of the shoe's sales. 9. General and Administrative Expenses for "Persistence" will be 20% of revenues per year. 10. The product will not have a celebrity endorser, but advertising and promotion costs are expected to be $3 million per year, beginning in year 1. 11. The company's federal plus state marginal tax rate is 40%. 12. In order to begin immediate production of "Persistence", the design technology and manufacturing specifications for a simple hiking shoe will be purchased from an outside source for $50 million before taxes. It is assumed this outlay takes place immediately and will be expensed immediately for tax purposes. 3. Please fill in the blanks in the table below with data for "Persistence.": T= "=1 T=2 T=3 OCF A in NWC CAPEX FCF "Persistence" Robert Meers was still contemplating "The Question" project when Janet McCutchins, the Vice President of New Products Development, came into Meers' office anxious to meet with him. McCutchins was excited about a proposal she had developed for a new Reebok hiking shoe. The hiking shoe would be named "Persistence". The hiking sector is one of the fastest growing areas of the footwear industry -- and one that Reebok had not yet entered. Furthermore, Reebok's strategic plans were to enter into new areas of the athletic shoe industry with high anticipated growth, such as hiking and walking shoes. McCutchins was confident that hiking shoes would be the largest footwear trend in the next decade and suggested that, at the project's end, Reebok follow-up with another hiking shoe. In fact, she urged Reebok to investigate introducing an entire hiking shoe product line in the future. The target market for this shoe would be men and women in the 25 to 40 year old age category. McCutchins needs to produce a projected capital budgeting cash flow statement for "Persistence," and after some preliminary analysis, decides on the following: 1. The life of the project would be only 3 years, given the steep technological learning curve for this new product line. * Research Alert, 9/6/96, v.14, n.17, p.5 www.reebok.com/company/student.html. The "hiking and walking" category was the third largest in the athletic footwear industry (9%), as well as the fastest growing category. Source: Research Alert, 9/6/96, v.14, n.17, p.5. 2. The manufacturer's selling price of the shoe will be $90.00 3. This segment of the athletic shoe market is projected to reach $350 million during Year 1 and is growing at a rate of 15% per year. The segment market share projections for "Persistence" are: Year 1, 10%; Year 2, 16%, and Year 3, 19%. 4. Reebok will be able to use an idle section of one of its factories to produce the hiking shoe. A cost accountant has estimated that, according to the square footage in the factory, this section's overhead allocation would amount to $1.8 million per year. Note that Reebok would still incur these costs if the product is not undertaken. In addition, this section would remain idle for the life of the project if the "Persistence" project is not undertaken. 5. Reebok must purchase manufacturing equipment costing $10 million. The equipment falls into the five year MACRS depreciation category. As such, the depreciation percentages for the first three years, respectively, are: 20%, 32%, and 19%. The cash outlay will be today. at year 0, and depreciation will start in year 1. Reebok analysts estimate that the equipment can be sold for book value at the end of the project's life. Inventory and accounts receivable accounts will increase by $25 million at year 0 and will be recovered at the end of the project (year 3). The firm's accounts payable balance is projected to increase by $10 million at year 0 and will also be recovered at the end of the project. 7. Because Reebok has not yet entered the hiking shoe market, the introduction of this product is not expected to have an impact on sales of Reebok's other shoe lines. 8. Variable costs of producing the shoe are expected to be 17% of the shoe's sales. 9. General and Administrative Expenses for "Persistence" will be 20% of revenues per year. 10. The product will not have a celebrity endorser, but advertising and promotion costs are expected to be $3 million per year, beginning in year 1. 11. The company's federal plus state marginal tax rate is 40%. 12. In order to begin immediate production of "Persistence", the design technology and manufacturing specifications for a simple hiking shoe will be purchased from an outside source for $50 million before taxes. It is assumed this outlay takes place immediately and will be expensed immediately for tax purposes. 3. Please fill in the blanks in the table below with data for "Persistence.": T= "=1 T=2 T=3 OCF A in NWC CAPEX FCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts