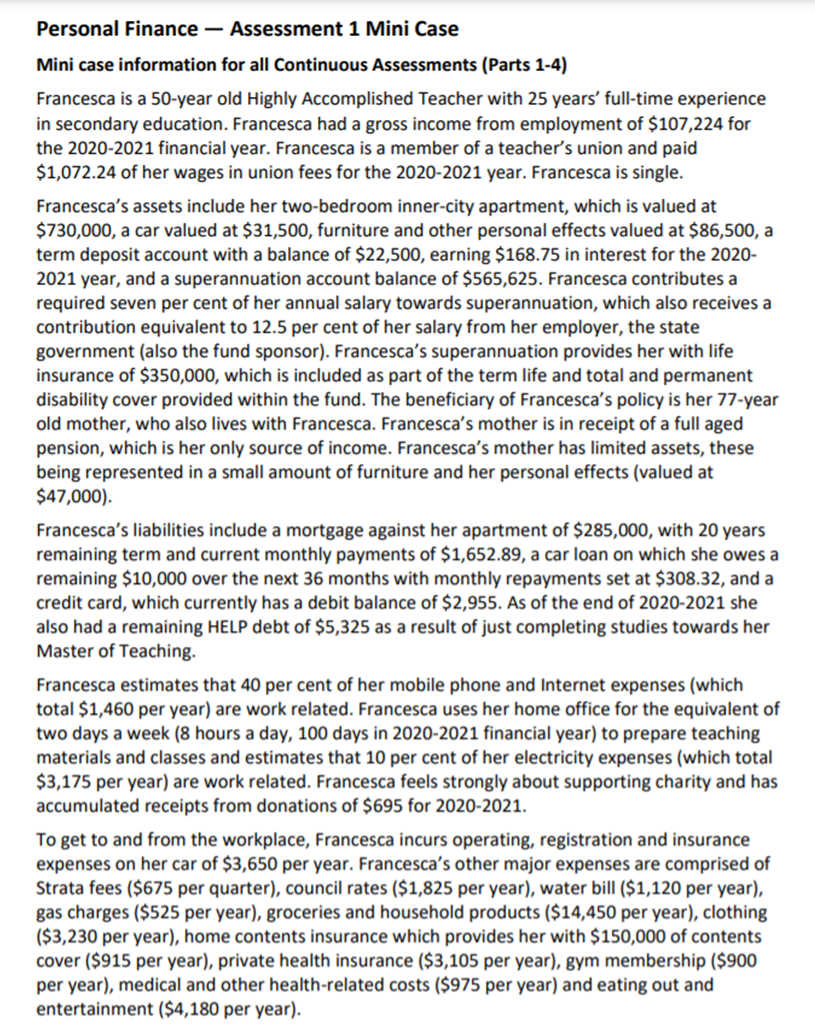

Question: Personal Finance Assessment 1 Mini Case Mini case information for all Continuous Assessments {Parts 1-4) Francesca is a 50-year old Highly Accomplished Teacher with 25

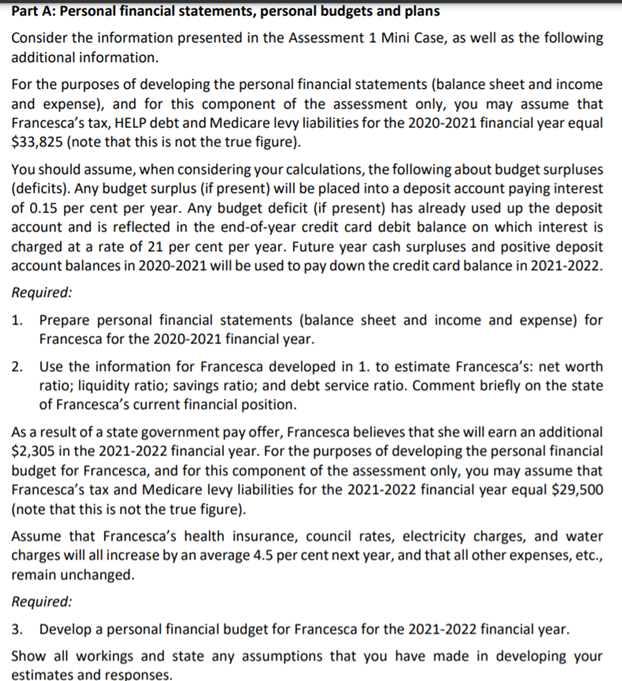

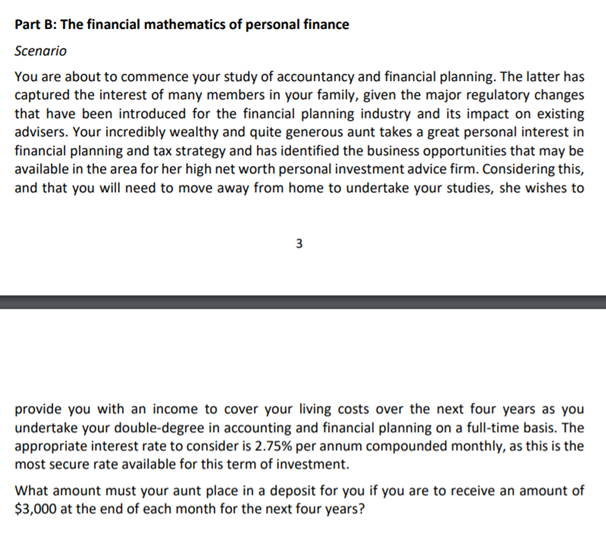

Personal Finance Assessment 1 Mini Case Mini case information for all Continuous Assessments {Parts 1-4) Francesca is a 50-year old Highly Accomplished Teacher with 25 years\" full-time experience in secondary education. Francesca had a gross income from employment of $102,224 for the 20204021 financial year. Francesca is a member of a teacher's union and paid $1,072.24 of her wages in union fees for the 2020-2021 year. Francesca is single. Francesca's assets include her two-bedroom inner-city apartment, which is valued at $230,000, a car valued at $31,500, furniture and other personal effects valued at $36,500, a term deposit account with a balance of $22,500, earning $168.75 in interest for the 2020- 2021 year, and a superannuation account balance of $565,625. Francesca contributes a required seven per cent of her annual salary towards superannuation, which also receives a contribution equivalent to 12.5 per cent of her salary from her employer, the state government (also the fund sponsor]. Francesca's superannuation provides her with life insurance of $350,000, which is included as part of the term life and total and permanent disability cover provided within the lund. The beneciary of Francesca's policy is her 72-year old mother, who also lives with Francesca. Francesca's mother is in receipt of a full aged pension, which is her only source of income. Francesca's mother has limited assets, these being represented In a small amount of furniture and her personal effects (valued at $47,000). Francesca's liabilities include a mortgage against her apartment of $235,000, with 20 years remaining term and current monthly payments of $1,652.89, a car loan on which she owes a remaining $10,000 over the next 36 months with monthly repayments set at $303.32, and a credit card, which currently has a debit balance of 52,955. As of the end of 2020-2021 she also had a remaining HELP debt of 55,325 as a result of just completing studies towards her Master of Teaching. Francesca estimates that 40 per cent of her mobile phone and Internet expenses (which total $1,460 per year) are work related. Francesca uses her home office for the equivalent of two days a week (8 hours a day, 100 days in 2020-2021 nancial year] to prepare teaching materials and classes and estimates that 10 per cent of her electricity expenses {which total $3,125 per year) are work related. Francesca feels strongly about supporting charity and has accumulated receipts from donations of $695 for 2020-2021. To get to and from the workplace, Francesca incurs operating, registration and insurance expenses on her car of $3,050 per year. Francesca's other major expenses are comprised of Strata fees {$525 per quarter), council rates [$1,825 per year), water bill [$1,120 per year), gas charges {$525 per year), groceries and household products ($14,450 per year), clothing ($3,230 per year), home contents insurance which provides her with $150,000 of contents cover [5915 per year), private health insurance [$3,105 per year), gym membership ($900 per year), medical and other health-related costs ($975 per year) and eating out and entertainment (54, 180 per year). Part A: Personal financial statements, personal budgets and plans Consider the information presented in the Assessment 1 Mini Case, as well as the following additional information. For the purposes of developing the personal financial statements (balance sheet and income and expense), and for this component of the assessment only, you may assume that Francesca's tax, HELP debt and Medicare levy liabilities for the 2020-2021 financial year equal $33,825 (note that this is not the true figure). You should assume, when considering your calculations, the following about budget surpluses (deficits). Any budget surplus (if present) will be placed into a deposit account paying interest of 0.15 per cent per year. Any budget deficit (if present) has already used up the deposit account and is reflected in the end-of-year credit card debit balance on which interest is charged at a rate of 21 per cent per year. Future year cash surpluses and positive deposit account balances in 2020-2021 will be used to pay down the credit card balance in 2021-2022. Required: 1. Prepare personal financial statements (balance sheet and income and expense) for Francesca for the 2020-2021 financial year. 2. Use the information for Francesca developed in 1. to estimate Francesca's: net worth ratio; liquidity ratio; savings ratio; and debt service ratio. Comment briefly on the state of Francesca's current financial position. As a result of a state government pay offer, Francesca believes that she will earn an additional $2,305 in the 2021-2022 financial year. For the purposes of developing the personal financial budget for Francesca, and for this component of the assessment only, you may assume that Francesca's tax and Medicare levy liabilities for the 2021-2022 financial year equal $29,500 (note that this is not the true figure). Assume that Francesca's health insurance, council rates, electricity charges, and water charges will all increase by an average 4.5 per cent next year, and that all other expenses, etc., remain unchanged. Required: 3. Develop a personal financial budget for Francesca for the 2021-2022 financial year. Show all workings and state any assumptions that you have made in developing your estimates and responses.Part B: The financial mathematics of personal finance Scenario You are about to commence your study of accountancy and financial planning. The latter has captured the interest of many members in your family, given the major regulatory changes that have been introduced for the financial planning industry and its impact on existing advisers. Your incredibly wealthy and quite generous aunt takes a great personal interest in financial planning and tax strategy and has identified the business opportunities that may be available in the area for her high net worth personal investment advice firm. Considering this, and that you will need to move away from home to undertake your studies, she wishes to 3 provide you with an income to cover your living costs over the next four years as you undertake your double-degree in accounting and financial planning on a full-time basis. The appropriate interest rate to consider is 2.75% per annum compounded monthly, as this is the most secure rate available for this term of investment. What amount must your aunt place in a deposit for you if you are to receive an amount of $3,000 at the end of each month for the next four years