Question: Personal Finance Problem P1-3 Cash flows It is typical for Jane to plan, monitor, and assess her financial position using cash flows over a

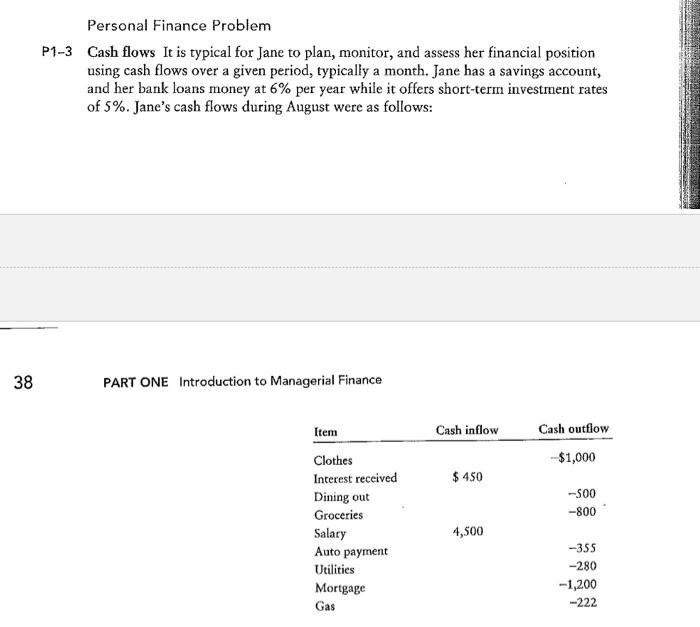

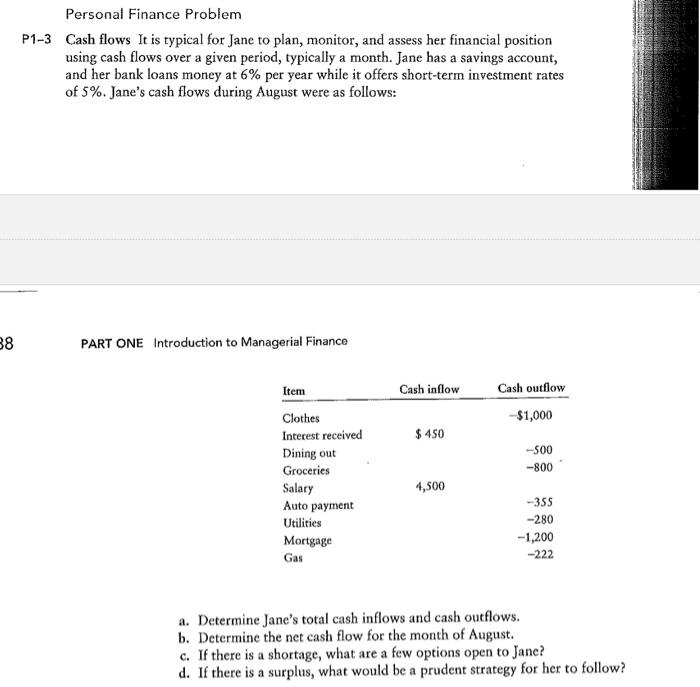

Personal Finance Problem P1-3 Cash flows It is typical for Jane to plan, monitor, and assess her financial position using cash flows over a given period, typically a month. Jane has a savings account, and her bank loans money at 6% per year while it offers short-term investment rates of 5%. Jane's cash flows during August were as follows: 38 38 PART ONE Introduction to Managerial Finance Item Cash inflow Cash outflow Clothes -$1,000 Interest received $ 450 Dining out -500 Groceries -800 Salary 4,500 Auto payment -355 Utilities -280 Mortgage -1,200 Gas -222 Personal Finance Problem P1-3 Cash flows It is typical for Jane to plan, monitor, and assess her financial position using cash flows over a given period, typically a month. Jane has a savings account, and her bank loans money at 6% per year while it offers short-term investment rates of 5%. Jane's cash flows during August were as follows: 38 PART ONE Introduction to Managerial Finance Item Cash inflow Cash outflow Clothes Interest received $ 450 -$1,000 Dining out -500 Groceries -800 Salary 4,500 Auto payment -355 Utilities -280 Mortgage -1,200 Gas -222 a. Determine Jane's total cash inflows and cash outflows. b. Determine the net cash flow for the month of August. c. If there is a shortage, what are a few options open to Jane? d. If there is a surplus, what would be a prudent strategy for her to follow?

Step by Step Solution

There are 3 Steps involved in it

To solve the personal finance problem lets calculate Janes total cash inflows and cash outflows determine the net cash flow for the month of August explore options in case of a shortage and discuss a ... View full answer

Get step-by-step solutions from verified subject matter experts