Question: Personal Finance Problem P5-25 Value of an annuity versus a single amount Assume that you just won the state lor. tery. Your prize can be

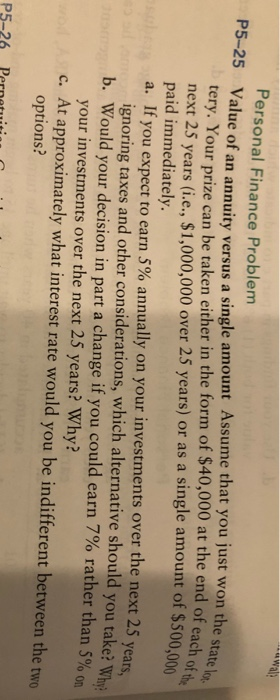

Personal Finance Problem P5-25 Value of an annuity versus a single amount Assume that you just won the state lor. tery. Your prize can be taken either in the form of $40,000 at the end of each of the next 25 years (i.e., $1,000,000 over 25 years) or as a single amount of $500,000 paid immediately. a. If you expect to earn 5% annually on your investments over the next 25 years, ignoring taxes and other considerations, which alternative should you take? Why b. Would your decision in part a change if you could earn 7% rather than 5% on your investments over the next 25 years? Why? c. At approximately what interest rate would you be indifferent between the two options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts