Question: PERSONAL FINANCIAL PLANNING 1. The main difference between a credit card and debit card is A. credit card holder is protected under PIDM. B. debit

PERSONAL FINANCIAL PLANNING

PERSONAL FINANCIAL PLANNING

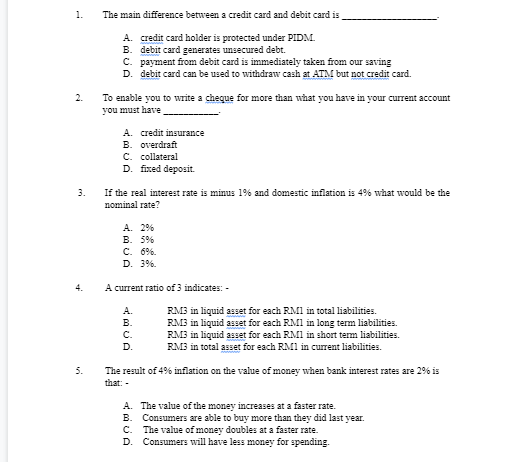

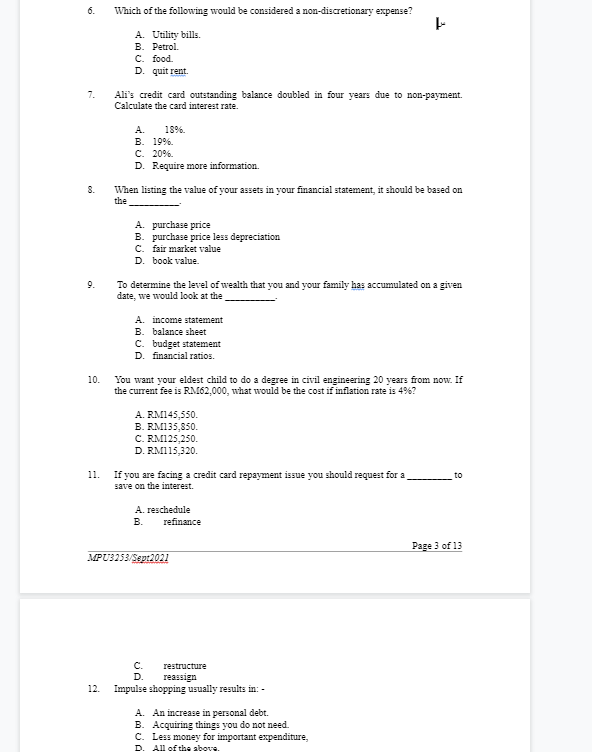

1. The main difference between a credit card and debit card is A. credit card holder is protected under PIDM. B. debit card generates unsecured debt. C. payment from debit card is immediately taken from our saving D. debit card can be used to withdraw cash at ATM but not credit card. To enable you to write a chegue for more than what you have in your current account you must have 2. A. credit insurance B. overdraft C. collateral D. fixed deposit. If the real interest rate is minus 1% and domestic inflation is 4% what would be the nominal rate? 3. A. 2% B. 5% C. 6%. D. 39. 4. A A current ratio of 3 indicates: - RM3 in liquid asset for each RM1 in total liabilities. B. RM3 in liquid asset for each RM1 in long term liabilities. C. RM3 in liquid asset for each RM1 in short term liabilities. D. RM3 in total asset for each RM1 in current liabilities. The result of 4% inflation on the value of money when bank interest rates are 2% is 5. that: - A. The value of the money increases at a faster rate. B. Consumers are able to buy more than they did last year. C. The value of money doubles at a faster rate. D. Consumers will have less money for spending. 5 6. Which of the following would be considered a non-discretionary expense? A. Utility bills. B. Petrol C. food. D. quit rent. 7. Ali's credit card outstanding balance doubled in four years due to non-payment. Calculate the card interest rate. A 18%. B. 19% C. 20%. D. Require more information. 8. When listing the value of your assets in your financial statement, it should be based on the A. purchase price B. purchase price less depreciation C. fair market value D. book value 9. To determine the level of wealth that you and your family has accumulated on a given date, we would look at the A. income statement B. balance sheet C. budget statement D. financial ratios. 10. You want your eldest child to do a degree in civil engineering 20 years from now. If the current fee is RM62,000, what would be the cost if inflation rate is 4%? A. RM145,550. B. RM135,850. C. RM125,250. D. RM115,320 to 11. If you are facing a credit card repayment issue you should request for a save on the interest. A. reschedule B. refinance Page 3 of 13 MPU 3253/Sep 2021 C. restructure D. reassign Impulse shopping usually results in: - 12. A. An increase in personal debt. B. Acquiring things you do not need. C. Less money for important expenditure, D. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts