Question: Personal risk management case study : questions needs to be answered according to the case study thoroughly with explanations and show calculation workings accordingly and

Personal risk management case study : questions needs to be answered according to the case study thoroughly with explanations and show calculation workings accordingly and precisely

Client Background You are a financial planner with a specialty in risk management. You've completed the LLQP and are licensed to sell insurance products. You love your career and have built a successful practice based mainly on referrals from your satisfied clients. Jack, age 49, and Jill, age 48, are one of those referrals. Jack is Vice-President of Marketing at a mid-sized systems firm. His salary is $190,000 + bonus. Last year his bonus was $40,000. Jill is an accountant in private practice. She works from home and typically bills $150,000 a year or $100,000 after expenses. They feel pretty comfortable financially but have asked you to flag any gaps that you can see in their risk management strategy. They also have specific questions that they'd like you to address. Jack and Jill are married with two children who live at home: Tracey, age 22 and Travis, age 17.

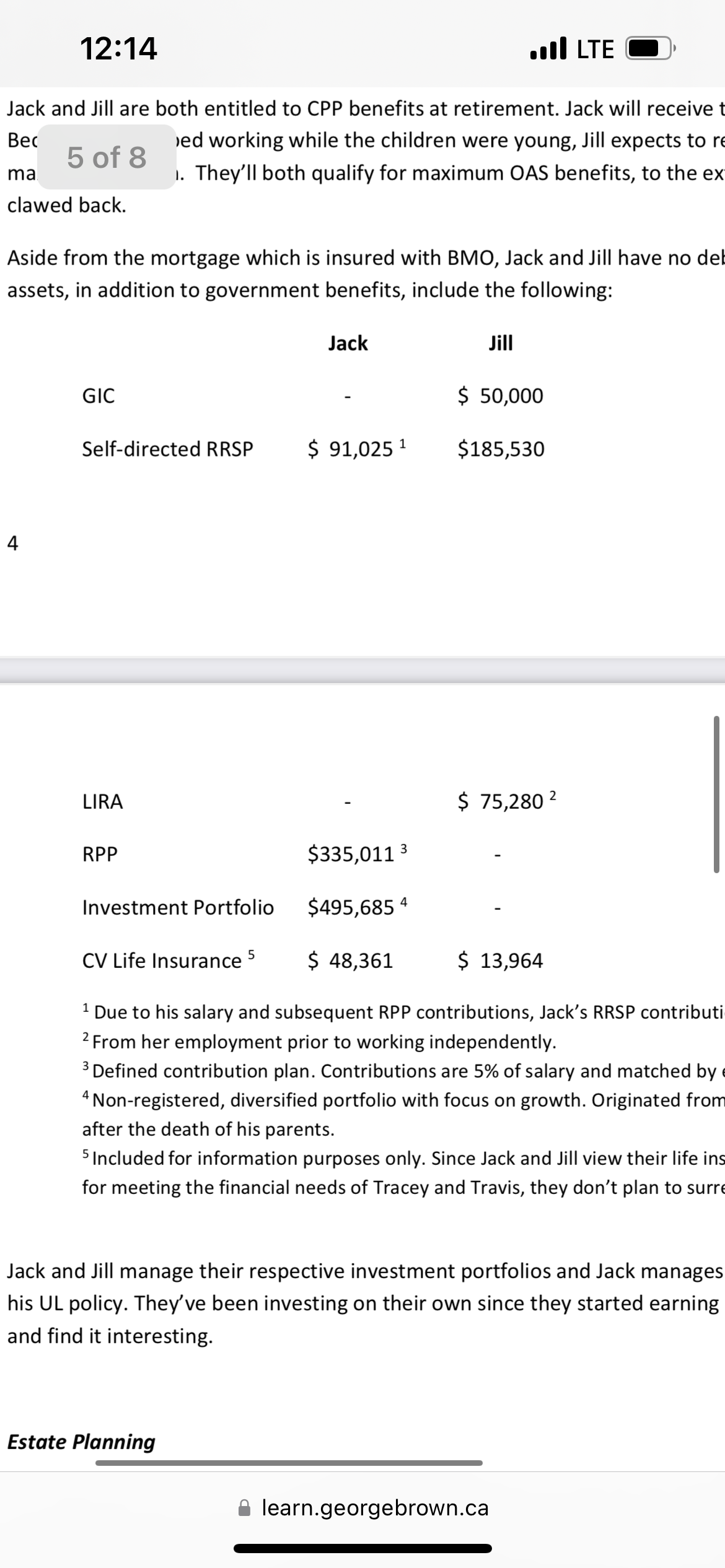

Jill's mother, Lauren age 75, is widowed. Although she is financially independent, she moved in with Jill and her family after the recent death of her husband. She contributes to the family's expenses and is especially devoted to her granddaughter, Tracey. Tracey, a happy and outgoing woman, was born with Down syndrome, a common genetic disorder. Otherwise, Tracey is in good health and could easily live to age 60. Jack and Jill would like to keep Tracey at home as long as possible but they are concerned about her ability to adapt if one or both of them dies unexpectedly. As a result, they're considering moving her into a group home in their city. The group home provides full support to residents. The fee for this year is $58,250. Tracey has seen the place and likes it, in no small part because her boyfriend lives there. Travis will finish high school this year and start university in the fall. He's been accepted into the systems engineering program, considered the top such program in Canada. As the university is in his home town, he'll be able to live at home. On graduation, he hopes to find employment locally so he can continue to live near his sister, with whom he's very close. Jack and Jill have invested the maximum in a RESP for Travis and the FMV is $71,415. Given that they will soon start making withdrawals from the plan, they recently switched the investment portfolio to a mix of cash and GICs. While it's been a struggle for Jack and Jill to manage the diverse needs of both children, they love them both deeply and want to make sure they're set up to be successful in life. This means ensuring enough funds are available to support Tracey in the group home for as long as she lives. In Travis's case, they intend to pay his annual tuition and related expenses for an undergraduate degree and a graduate degree should he decide to pursue one. As Travis will likely continue to live at home during this period, they estimate the cost of his education at $15,000 per year for the next six years. They'd also like Travis to have extra money once he graduates, to buy a home or start a business. The amount they have in mind for that is $1/2 million. Aside from these financial obligations, they plan to retire in 18 years and spend all their hard-earned money having fun! Risk Management Jack's group benefits include: ? Life insurance: two times salary (not including bonus or commission) to a maximum of $200,000 ? Dependant life insurance: $10,000 on the employee's spouse, $5,000 on each dependant child ? Disability insurance of 60% of salary up to a maximum of $4,000 per month, "regular occupation" definition for the first two years defaulting to "any occupation" thereafter, 180-day elimination period, benefit period to age 65 and partial disability benefits. ? Extended health benefits. The plan covers Jack, his spouse and dependants. There are no deductibles and no maximums. Coinsurance is 80%. ? Dental benefits. Jack's plan provides comprehensive coverage. Coinsurance is 80%. The annual maximum for basic restorative is $2,000. In addition to his group benefits, Jack has an individual long-term disability policy that he bought years ago. The benefit is $2,000 per month in the event of his total disability, defined as the worker's "regular" occupation and defaulting to "any occupation" after two years. The elimination period is 60 days and the benefit period is to age 65. There are partial but no residual benefits. He also owns a Manulife universal life insurance policy (see abbreviated copy attached). Jack's beneficiary on his life insurance policies is Jill. Jill has no group benefits; however, she has private coverage for life and LTD insurance. She has a $250,000 of Term 10 policy and a $25,000 participating whole life policy that her parents took out for her when she was a child. The dividend option on the latter policy is "cash". Jack is the beneficiary of both policies. Her LTD coverage will provide a monthly benefit of $3,800 on total disability, defined as "regular occupation". The policy has a rider that extends the regular occ definition of disability to age 65. The elimination period is 60 days. Like Jack's plans, there is partial coverage but not residual. Both Jack and Jill pay the premiums for all their LITD coverage. When Jill's father died six months ago, she received $50,000 from a life insurance policy on his life. She put the funds into a one-year GIC, which she saw as a temporary move until she could figure out how best to invest the money long-term. Both Jack and Jill feel that, with the mortgage paid off, if one of them died the survivor could manage well on his/her continuing income plus the couple's joint savings. Since Jack and Jill plan to spend all their invested assets in retirement, they expect the planned legacies 4 for Travis and Tracey and their final expenses at death will be covered solely by their existing life insurance. They're not sure if their life insurance is sufficient for this, but that's their plan. Jack and Jill estimate the value of their home at $1,675,000. They have a "small" mortgage of $215,000 with BMO. This is their only debt. The mortgage is insured with BMO and the outstanding balance will be repaid should either Jack or Jill die. They recently updated their home and car insurance. They have two cars and, up until last year, they parked both cars outside in the driveway. But last fall, anticipating a particularly cold and wet winter ahead, they added a carport to the side of their house. During this process, they modified and enhanced the entrance to the home and updated the landscaping at the front of the property to give the house more "street appeal". Their general agent pointed out that, because earthquakes have happened in the GTA - twice in past 20 years alone, they might want to consider adding a rider to their property insurance policy to insure their home against earthquake- related damages. But, thinking the odds of this very remote, they decided their existing property insurance was adequate and declined the extra protection. Jill's mother, Lauren, is in good health now but she's thinking about moving into a retirement home and is concerned about the cost should she eventually have to hire additional care. Lauren had a $100,000 whole life policy with a cash value of $35,000. After meeting recently with Agent A, she was persuaded to transfer the $35,000 cash value into a deferred annuity contract. Agent A explained that the annuity would earn a regular, fixed income and she could withdraw the $35,000 anytime without penalty. This would nicely cover any unforeseen expenses in the retirement home. The new contract was issued and, during the 10-day "free look" period, a friend of Lauren's examined it. When she told Lauren that the agent probably misled her about the withdrawals, Lauren immediately cancelled the contract and sued the agent. Lauren found this very upsetting but didn't think she had a choice. Retirement Planning Jack and Jill are both entitled to CPP benefits at retirement. Jack will receive the maximum pension. Because she stopped working while the children were young, Jill expects to receive 70% of the maximum pension. They'll both qualify for maximum OAS benefits, to the extent those benefits are not clawed back. Aside from the mortgage which is insured with BMO, Jack and Jill have no debts. Their "spendable" assets, in addition to government benefits, include the following: Jack Jill GIC - $ 50,000 Self-directed RRSP $ 91,025 1 $185,530 LIRA - $ 75,280 RPP $335,011 - Investment Portfolio $495,685 - CV Life Insurance $ 48,361 $ 13,964 1 Due to his salary and subsequent RPP contributions, Jack's RRSP contributions are now minimal. 2 From her employment prior to working independently. 3 Defined contribution plan. Contributions are 5% of salary and matched by employer. 4 Non-registered, diversified portfolio with focus on growth. Originated from an inheritance Jack received after the death of his parents. 5 Included for information purposes only. Since Jack and Jill view their life insurance policies as essential for meeting the financial needs of Tracey and Travis, they don't plan to surrender them. Jack and Jill manage their respective investment portfolios and Jack manages the accumulation fund in his UL policy. They've been investing on their own since they started earning money. They feel confident and find it interesting. Estate Planning Jack and Jill have mirror wills. Anticipated final expenses include their funerals and the executors' and accountants' fees. They've estimated that $50,000 for each of them should be adequate to cover these expenses. They are each other's beneficiary. After both have died, the net estate proceeds will be divided equally between Travis and a trust for Tracy. They both also have Powers of Attorney for Property and for Personal Care. Tax Planning Other than investing in their RRSPs and a vague awareness of income taxes at death, Jack and Jill haven't thought much about income taxes. They both have an average tax rate of 35%. Since they plan to spend all their money in retirement, they don't foresee any major tax liability on their death. 6 Required Part I (20%) 1. A MAXIMUM one-page cover letter, in business format to the clients that: ? Lists the clients' objectives ? Summarizes your group's major findings and any urgent actions they should take. Notes for the balance of your report: ? Respond with bullet points. ? When you make calculations, show all your work.

please answer all questions thoroughly and show all working calculations precisely according to the case study

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts