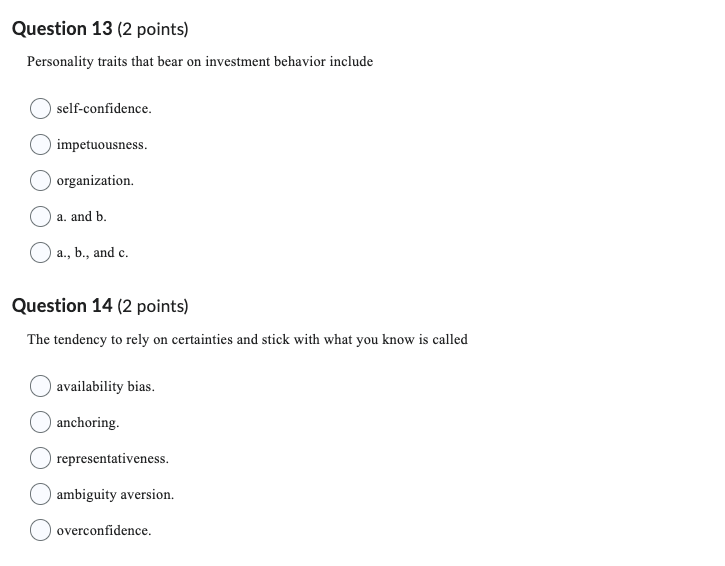

Question: Personality traits that bear on investment behavior include self-confidence. impetuousness. organization. a. and b. a., b., and c. Question 14 (2 points) The tendency to

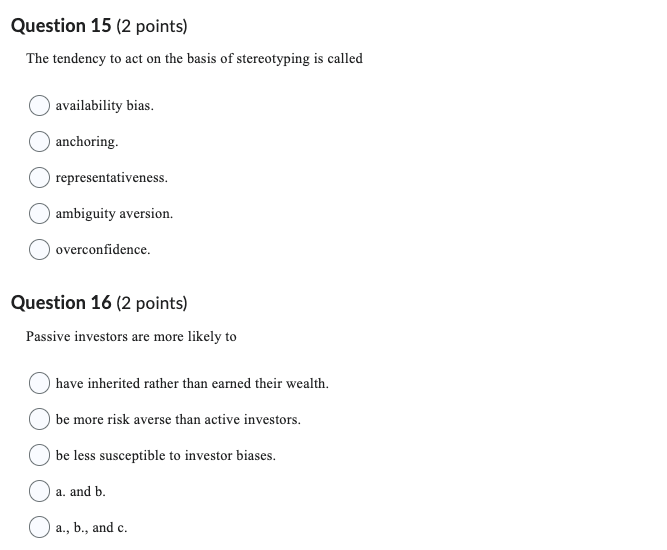

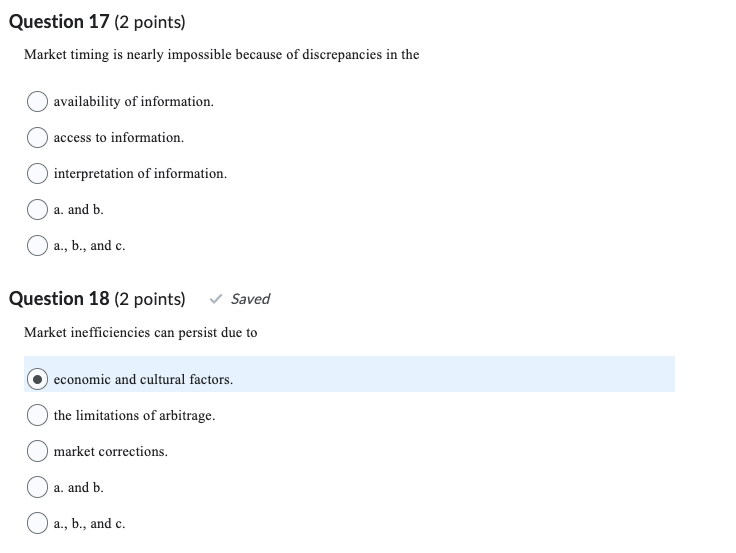

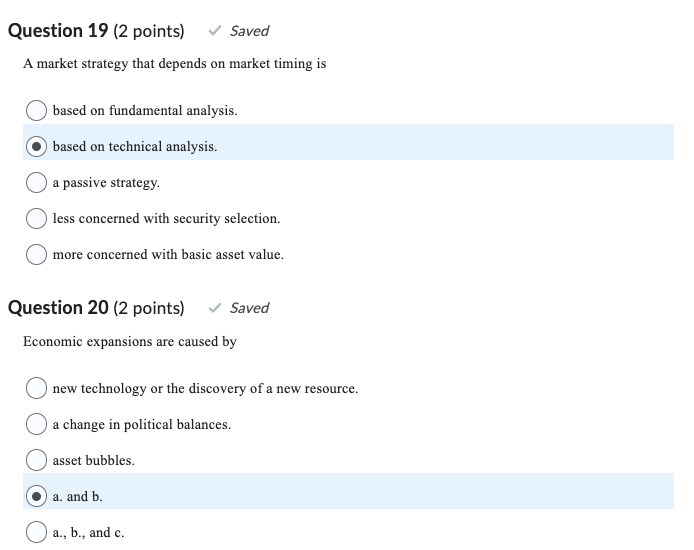

Personality traits that bear on investment behavior include self-confidence. impetuousness. organization. a. and b. a., b., and c. Question 14 (2 points) The tendency to rely on certainties and stick with what you know is called availability bias. anchoring. representativeness. ambiguity aversion. overconfidence. The tendency to act on the basis of stereotyping is called availability bias. anchoring. representativeness. ambiguity aversion. overconfidence. Question 16 ( 2 points) Passive investors are more likely to have inherited rather than earned their wealth. be more risk averse than active investors. be less susceptible to investor biases. a. and b. a., b., and c. Market timing is nearly impossible because of discrepancies in the availability of information. access to information. interpretation of information. a. and b. a., b., and c. Question 18 (2 points) Saved Market inefficiencies can persist due to economic and cultural factors. the limitations of arbitrage. market corrections. a. and b. a., b., and c. A market strategy that depends on market timing is based on fundamental analysis. based on technical analysis. a passive strategy. less concerned with security selection. more concerned with basic asset value. Question 20 ( 2 points) Saved Economic expansions are caused by new technology or the discovery of a new resource. a change in political balances. asset bubbles. a. and b. a., b., and c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts