Question: a. Peter is 28 years old and is considering full-time study for a Master of Science (MSc) degree. Tuition and other direct costs will

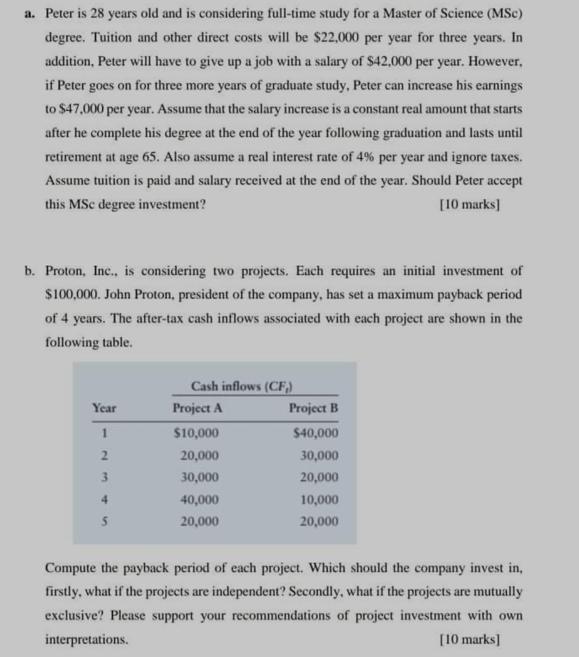

a. Peter is 28 years old and is considering full-time study for a Master of Science (MSc) degree. Tuition and other direct costs will be $22,000 per year for three years. In addition, Peter will have to give up a job with a salary of $42,000 per year. However, if Peter goes on for three more years of graduate study, Peter can increase his earnings to $47,000 per year. Assume that the salary increase is a constant real amount that starts after he complete his degree at the end of the year following graduation and lasts until retirement at age 65. Also assume a real interest rate of 4% per year and ignore taxes. Assume tuition is paid and salary received at the end of the year. Should Peter accept this MSc degree investment? [10 marks] b. Proton, Inc., is considering two projects. Each requires an initial investment of $100,000. John Proton, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table. Year 1 2 3 4 5 Cash inflows (CF) Project A $10,000 20,000 30,000 40,000 20,000 Project B $40,000 30,000 20,000 10,000 20,000 Compute the payback period of each project. Which should the company invest in, firstly, what if the projects are independent? Secondly, what if the projects are mutually exclusive? Please support your recommendations of project investment with own interpretations. [10 marks]

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts