Question: Peter operates a sole proprietorship using the cash method. Peter made the following expenditures: $480 to Truist Bank for 12 months of interest accruing

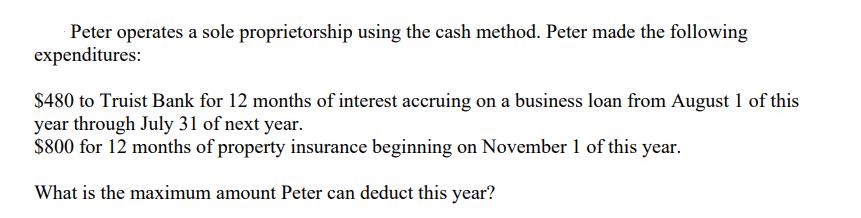

Peter operates a sole proprietorship using the cash method. Peter made the following expenditures: $480 to Truist Bank for 12 months of interest accruing on a business loan from August 1 of this year through July 31 of next year. $800 for 12 months of property insurance beginning on November 1 of this year. What is the maximum amount Peter can deduct this year?

Step by Step Solution

There are 3 Steps involved in it

Deduction Calculation 1 Interest Accruing on Business Loan Peter can only de... View full answer

Get step-by-step solutions from verified subject matter experts