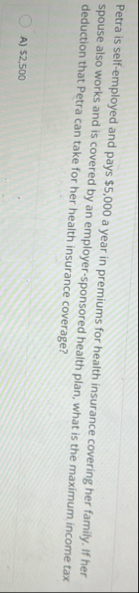

Question: Petra is self - employed and pays $ 5 , 0 0 0 a year in premiums for health insurance covering her family. If her

Petra is selfemployed and pays $ a year in premiums for health insurance covering her family. If her spouse also works and is covered by an employersponsored health plan, what is the maximum income tax deduction that Petra can take for her health insurance coverage?

A $B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock