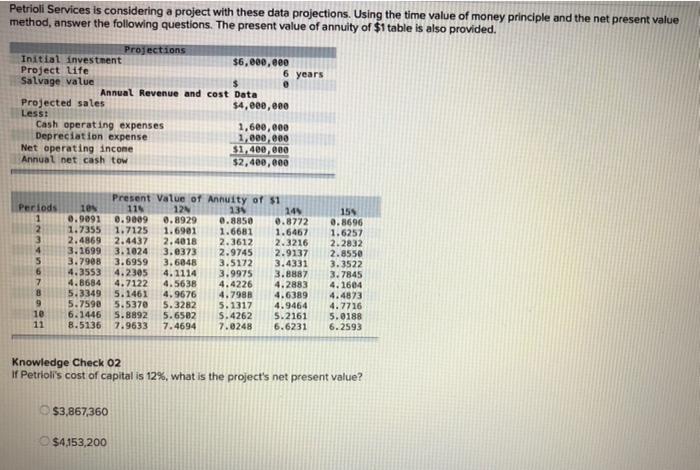

Question: Petrioli Services is considering a project with these data projections. Using the time value of money principle and the net present value method, answer

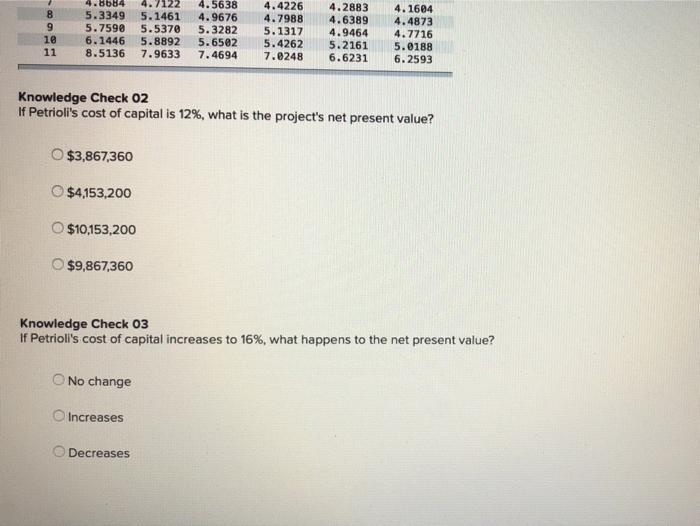

Petrioli Services is considering a project with these data projections. Using the time value of money principle and the net present value method, answer the following questions. The present value of annuity of $1 table is also provided. Initial investment Project Life Salvage value Periods 1 2 3 4 Projected sales Less: Cash operating expenses Depreciation expense Net operating income Annual net cash tow 5 6 7 8 9 10 11 Projections $ Annual Revenue and cost Data $6,000,000 $3,867,360 $4,153,200 $4,000,000 6 years 1,600,000 1,000,000 $1,400,000 $2,400,000 Present Value of Annuity of $1 10% 11 12N 0.9091 0.9009 0.8929 1.7355 1.7125 1.6901 2.4869 2.4437 2.4018 3.1699 3.1024 3.0373 3.7908 3.6959 3.6048 4.3553 4.2305 4.1114 4.8684 4.7122 4.5638 5.3349 5.1461 4.9676 5.7598 5.5370 5.3282 5.1317 4.9464 6.1446 5.8892 5.6582 5.4262 5.2161 5.0188 8.5136 7.9633 7.4694 7.0248 6.6231 6.2593 4.4873 4.7716 139 24% 0.8850 0.8772 1.6467 1.6681 2.3612 2.9745 3.5172 2.3216 2.9137 3.4331 3.8887 4.2883 4.7988 4.6389 3.9975 4.4226 15% 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 Knowledge Check 02 If Petrioli's cost of capital is 12%, what is the project's net present value? 7888 9 10 11 4.8684 4.7122 4.5638 5.3349 5.1461 4.4226 4.9676 4.7988 5.7590 5.5370 5.3282 5.1317 6.1446 5.8892 5.6502 5.4262 8.5136 7.9633 7.4694 7.0248 O$3,867,360 $4,153,200 Knowledge Check 02 If Petrioli's cost of capital is 12%, what is the project's net present value? $10,153,200 $9,867,360 O No change 4.2883 4.1604 4.6389 4.4873 Knowledge Check 03 If Petrioli's cost of capital increases to 16 %, what happens to the net present value? Increases 4.9464 4.7716 5.2161 5.0188 6.6231 6.2593 Decreases

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Answer The correct option is as follows Table Value NET PRESENT VALUE Yea... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635d92fc8f141_176892.pdf

180 KBs PDF File

635d92fc8f141_176892.docx

120 KBs Word File